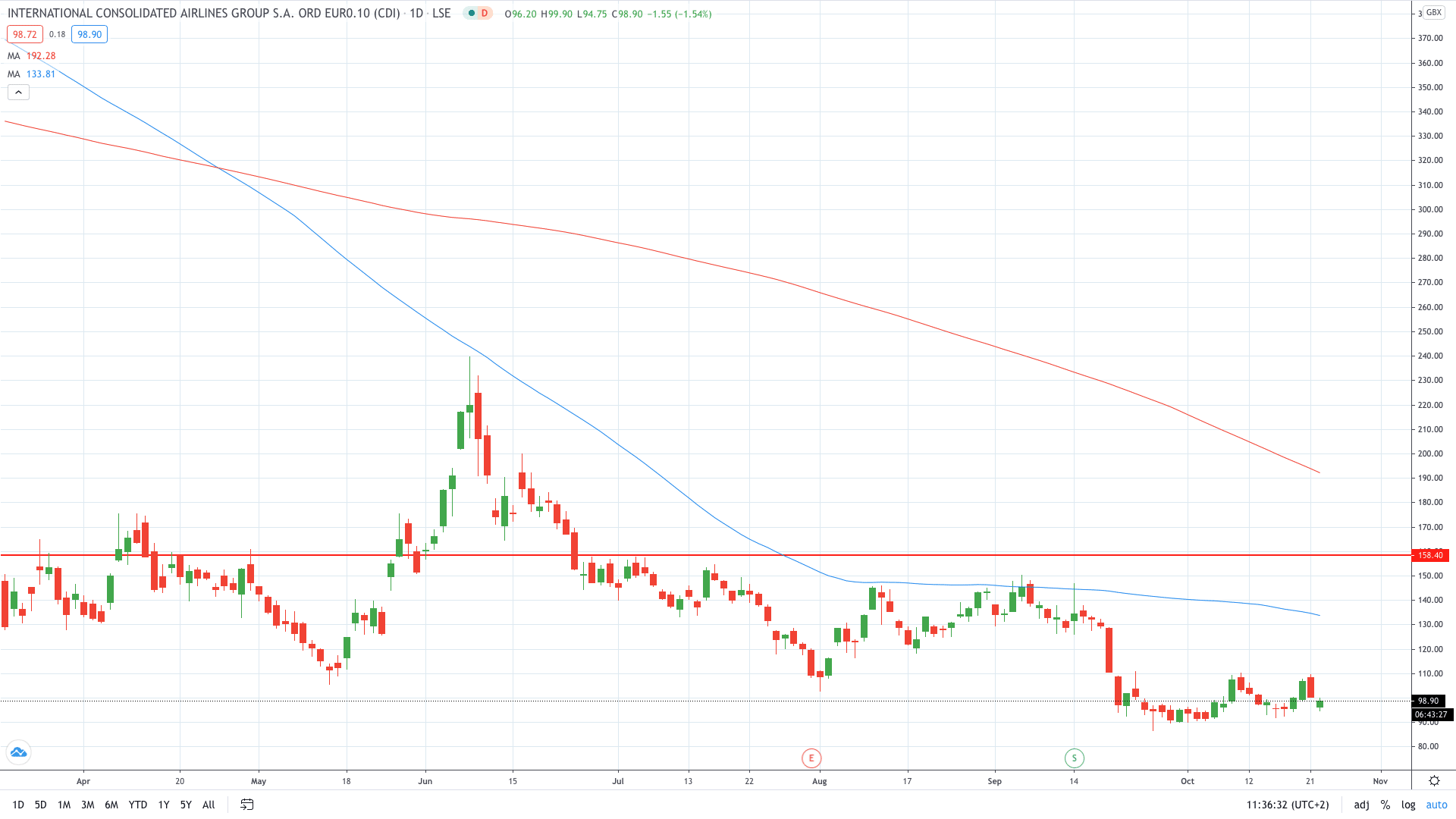

Shares of International Consolidated Airlines Group PLC (LON: IAG) fell about 5% today after the owner of British Airways posted a €1.3 billion operating loss in the third quarter.

This represents an enormous swing as the company recorded a €1.4 billion profit last year. Last quarter, IAG reported a €1.4 billion loss followed with losses of €535 million in the first quarter of the year. All in all, losses amount to over €3.2 billion since this year has started.

IAG’s revenue plunged 83% to €1.2 billion from €7.3 billion in 2019. The company’s current liquidity sits at €9.3 billion, with cash holdings at nearly €8 billion, boosted by last month’s €2.74 billion rights issue.

“Recent overall bookings have not developed as previously expected due to additional measures implemented by many European governments in response to a second wave of COVID-19 infections, including an increase in local lockdowns and extension of quarantine requirements to travellers from an increasing number of countries,” IAG said in its statement.

IAG plans to fly in the fourth quarter no more than 30% of last year’s capacity. As a result, the owner of British Airways and Iberia no longer expects to break even when it comes to net cash flows from operating activities during this quarter.

IAG share price gapped over 4% this morning before erasing a portion of losses to trade at 98.75p, or 1.69% in the red.

PEOPLE WHO READ THIS ALSO VIEWED:

- Here’s Why Just Eat Takeaway Share Price Just Soared to Fresh Record Highs

- Experience stock trading with a reliable demo account

- Implement Divergence Trading strategy in your daily trading plan