There will be only one crypto winner and there are questions as to whether litecoin can out-muscle its larger rival. Raising the question, is this the time to sell litecoin? This article will cover the following:

- What is litecoin?

- How has litecoin traded since 2011?

- What are the challenges facing litecoin?

- Tips for trading litecoin

- Final thoughts

What is litecoin?

Like bitcoin, litecoin was created to provide a decentralised peer-to-peer transaction system using blockchain technology. This means individuals can make payments on transactions from anywhere in the world.

The approach of using a shared ledger means there is a degree of transparency not typical of traditional accounts. This provides users of the system with a degree of security.

One major selling point of litecoin is that transactions fees are low. Sending litecoin costs less than $0.05 compared to the $0.56 charge for sending bitcoin (prices as of Sep 2018), which adds up to litecoin being a preferred method for sending crypto to and from exchanges.

Like bitcoin, it went through a halving in May 2020. Unlike bitcoin, litecoin has a market capitalisation of ‘only’ $3.9bn. This is not an insignificant number, but the scale of the challenge facing LTC is that on the same date, the market capitalisation of BTC was $199.6bn.

How Has litecoin traded?

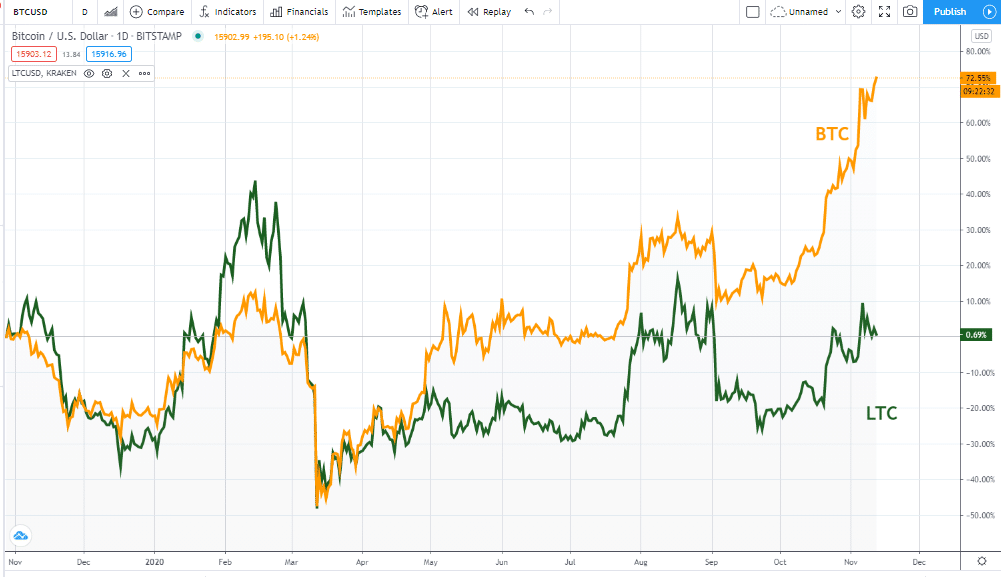

Litecoin is often referred to as ‘the silver to bitcoin’s gold’. Its price chart shows that over the long-term, it’s more closely correlated to the price of BTC than some other altcoins.

For traders, this can be a positive, in that taking positions in LTC after BTC makes a move can be a profitable strategy. It does raise the question of how is LTC going to get past its bigger and more established rival.

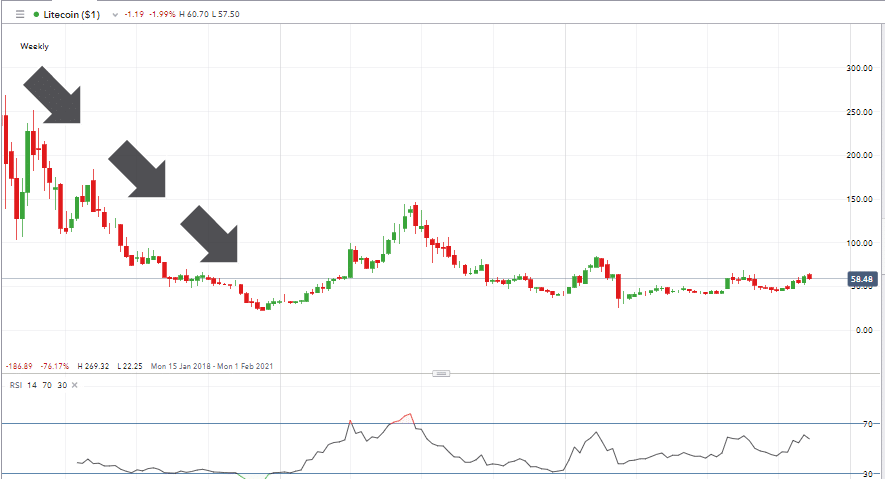

Source: IG

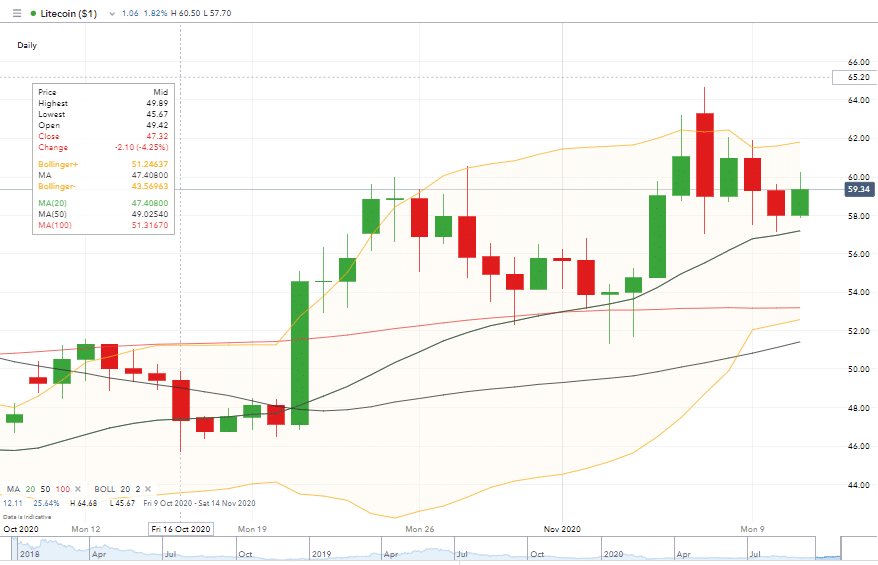

Litecoin’s trading history shows it has experienced three main bull markets. Each one followed by a sharp sell-off. It’s not the only altcoin to come down as well as go up in price. It does though appear a candidate for short-selling.

- In 2013 – the most extreme price hike saw LTC prices increase by a multiple of x10 in the space of a several days.

- March 2017 – Litecoin entered its second bull market. The price of LTC moved from $3 to $50 in the space of four months. It then went on to touch $80 in September 2017. By 10th December 2018, the price had fallen back to $22.26.

- In 2019, litecoin started a third bull run. This time price climbed as high as $145 (June 2019) before falling back to $50 as the year-end approached. Since then it has traded in a relatively tight range between $25–$84.

Some of the price falls, such as the one in the first half of 2019, were part of a sector-wide phenomenon. Interest for short-sellers, however, comes from LTC failing to rebound as quickly as other coins, particularly bitcoin.

Being a long-established crypto is generally an advantage as it helps get over one of the main barriers to adoption – stigma. Unfortunately, litecoin was embroiled in the ‘wild west’ style fiasco involving the Tokyo-based Mt Gox exchange.

In 2014 Mt Gox reported a loss of 744,408 of its account holders’ crypto coins and 100,000 of its own. This was bad for the sector as a whole. Decentralised accounting was shown to not, at that time at least, be the cure-all it claimed.

It has though been harder for litecoin to shift the stain. Bitcoin’s brand strength, particularly as a store of wealth held up far better since Mt Gox.

What are the challenges facing litecoin?

The main advantage litecoin has over bitcoin is the speed of processing times. With every subsequent advance in blockchain technology, it is the new entrants who appear more likely to challenge bitcoin.

There are now more than 5,000 cryptocurrencies in the market. All of these altcoins take on the challenge of beating bitcoin to the title of the world’s most wanted crypto.

Some take a left-field approach and use modern technology to try to gain an edge. Litecoin, by contrast, is caught somewhere in the middle. It’s very much like bitcoin but not different enough to get a competitive edge over BTC.

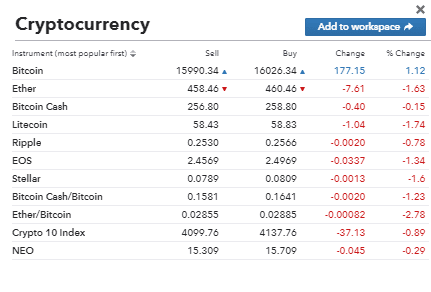

Source: IG

Realistically, there can be only one winner. Even then, that crypto will have to take on resistance from the establishment. Central banks, investment banks and other financial institutions have a lot to lose by rolling over and letting crypto do their job for them.

If you are looking to take a position in any market, then timing is everything. Developing a clear strategy with entry and exit points is strongly recommended. To help with that, most brokers offer free research on litecoin and the crypto markets.

It comes in different formats and you can choose whether to build your knowledge using video, webinar or written reports.

Trading strategies for selling litecoin

The article found here considers some of the long-term price predictions for litecoin. If you are looking to sell litecoin, then the below strategies offer an insight into why and how to do that.

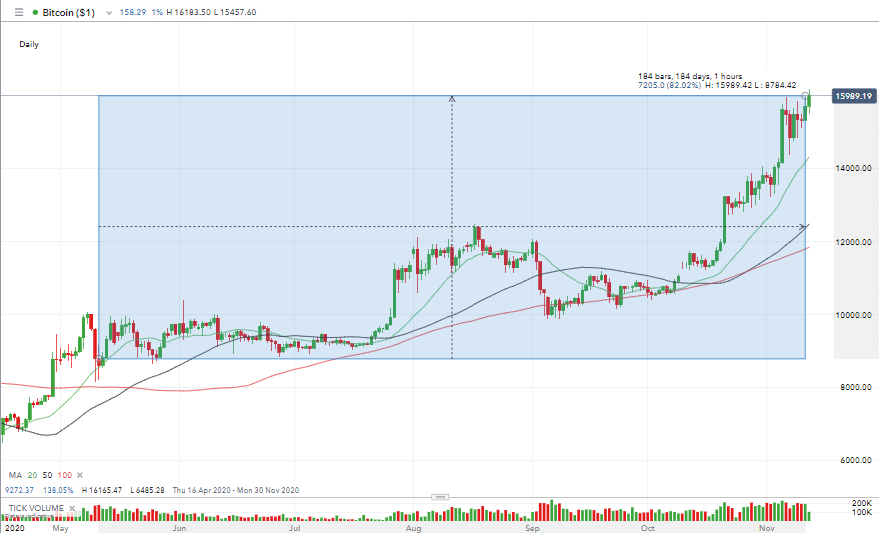

Source: IG

Halving

The theories about bitcoin price rallies following a halving appear to be coming good. Bitcoin has seen its price skyrocket by more than 80% since its halving on May 11 2020.

Litecoin, on the other hand, has seen its value fall since its last halving.

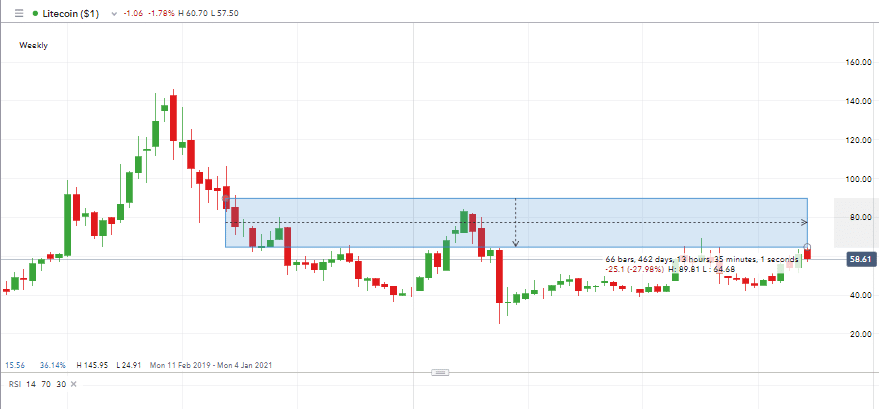

Source: IG

Lagging indicator

Another strategy for trading litecoin works on the principle that if silver lags, price moves in the price of gold. Then, LTC will lag, but ultimately will follow moves in the price of BTC.

With this in mind, LTC should soon begin to play catch up with bitcoin. Between May and November 2020, BTC rose in value by 75% while LTC ‘only’ rose by 21%. If the relationship between the two prices has disconnected, then litecoin may be cast adrift.

Playing wing-man to bitcoin might not be a great look for litecoin, but it’s better than being just another crypto.

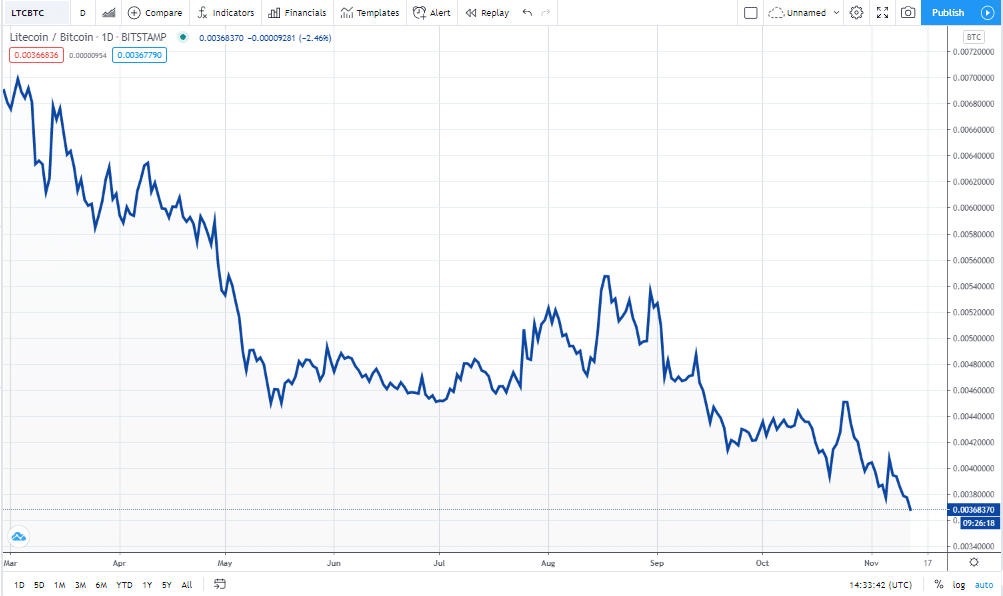

Pairs trading – litecoin vs bitcoin

The principle of pairs trading can work in any asset group. By buying one name, for example bitcoin and selling another, for example litecoin, it’s possible to trade the relative strength of the two.

At the same time, the joint position gives an element of market neutrality to the strategy. If cryptos, in general, go up or down in value then the loss on one position should be netted off by the other.

Source: TradingView

With brokers who operate CFD trading, it’s possible to sell-short as well as buy long. If you trade the names individually, then the position in LTC vs BTC can also we weighted. Going long $10k in bitcoin and short $5k in litecoin would play the spread but also generate a greater return if crypto as a whole rose in value.

Source: TradingView

Other brokers have simplified the process and provide a dedicated market in LTC/BTC. In this scenario, you’d take one position that would let you trade the spread. It can be cheaper as there is no need to lose out on the bid-offer spread on two positions, but weighting is not possible.

The article found here goes into greater detail on the long-term price predictions for litecoin.

Tips for trading litecoin?

One essential fact to remember at all times is that the crypto market has picked up a reputation for scams and scammers. Broker selection is therefore very important.

Source: IG

This top-five of crypto brokers has done some of the work for you and offers names of brokers who have earned a reputation in the market.

Whichever route you take to sell litecoin, it’s essential you use a broker that is regulated by a tier-1 authority. Names to look out for include:

- The Financial Conduct Authority (FCA)

- The Australian Securities and Investments Commission (ASIC)

- The Cyprus Securities and Exchange Commission (CySEC)

Managing counterparty risk is crucial. Another risk to contend with is market risk. The price swings in crypto can be extreme and rapid. If you are selling short, then your losses are technically uncapped. For this reason, short-selling should not be taken lightly and using a broker that provides negative balance protection would be another prudent risk-management choice.

In all instances, if you are new to trading, you may want to try selling litecoin using a demo account.

This will help you build an understanding of litecoin’s day-to-day movements. At the same time, you’ll become familiar with the pros and cons of different brokers. Demo accounts use virtual funds, so the trading is risk-free.

Final thoughts

You can trade litecoin from nearly anywhere in the world. The regulatory protection will be determined by your domicile. So, if you are selling litecoin, UK based, and using a broker that is regulated by the FCA, then that is the authority providing you with cover. Protection is based on citizenship and regulatory licenses, not by the nature of the product you are trading.