Demo trading accounts are an incredibly valuable tool. The virtual funds and live data feeds that brokers give to new clients provide a realistic environment in which to test new forex trading skills. They are free to use and can be very easy to access. There are slight differences in approach, so, to get the best start in currency trading, it’s worth using this review to find the best forex demo account for you. In this article, we’ll look at:

- Basic principles of demo accounts

- Benefits of using a demo account

- First steps

- Ease of access

- Platform quality

- Special considerations

- Next steps

Basic principles of demo accounts

If you’ve never traded before, using a demo account can, in a matter of minutes, provide the full trading experience. The really neat feature is that using a demo account is not risk-free, but that there is also no charge.

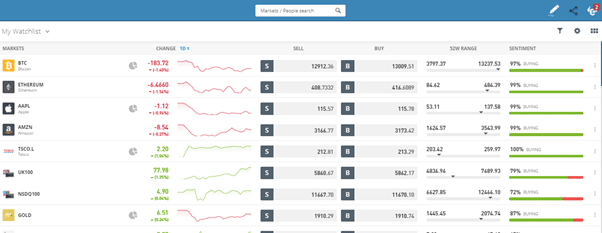

The demo accounts and live accounts on broker platforms run in parallel. In fact, they’re so similar that it’s sometimes hard to tell if you are actually trading on a virtual or live account. This means the simulated trading environment is a full-scale introduction into the ‘dos and don’ts’ of trading.

Your broker will assign you some virtual funds, maybe $50,000 or $100,000. From then on, trading activity will register a P&L (profit / loss) based on real-time prices. The execution of trades will follow exactly the same functionality as if you were putting on real positions in the markets.

All of these features help traders get to grips with how trading works and how different platforms across different brokers differ from each other.

Source: IG

Benefits of using a demo account

Demo accounts aren’t just for novice traders. Experienced traders will continue to use them even once they’ve started live trading. They are a great place to develop and test new strategies.

A quick side note is that in most cases, the number of markets provided in live and demo environments is the same. In technical terms, it would be harder to run two different formats. So, whether you want to trade major, minor or exotic currency pairs, if you’re broker covers them, you’ll likely see them in demo.

One exception from this is copy trading. This involves hooking your account up to other traders and taking trade signals from them. It’s a popular hands-off way of trading. But because third parties are involved, it’s not always possible to allow copy trading in demo accounts.

To its credit, the broker, eToro, does provide copy trading to its clients using demo accounts. So, if that is of particular interest to you, then this link would be a good place to start.

First steps

Stage one of your demo account journey is all about getting a quick risk-free glimpse of what is on offer.

First impressions count. You’ll very soon get an idea of whether the functionality of a broker is for you.

Source: eToro

Stage two involves more rigorous testing. You’ll want to know what trading ‘feels’ like. But also learn about portfolio reporting, risk management, strategies and market analysis. These are all the features you need to build your skills come as part of the free demo account.

It’s important to go with your gut instinct. If an account ‘just works for you’ then you’ll be more likely to fit trading in with your day-job. If you’re not sure, then there is no harm in trying another one.

The reality is that most retail investors jump straight in with the first account they try. As with most important decisions, there is a lot to be said for researching the market. Trying three different demo accounts would be a good first step.

Ease of access

There are differences relating to the on-boarding process at different brokers. They can actually play an important part in terms of choosing which broker to try out.

The background to this is that well-regulated brokers have a duty of care to their clients. Even if you are trading a demo account, they need to know a bit about you. If they don’t tick the right compliance boxes, they can get in trouble with their regulator, and that’s bad for business.

Brokers take different views on how much KYC (Know Your Client) information is needed to set you up on a demo account. Even though forex, the product, is unregulated, the brokers in each domicile still have a duty to citizens of that country.

Make no mistake. One of the most important lessons to take from trading is to use a broker regulated by one of the Tier-one authorities. These include:

- The Australian Securities and Investments Commission (ASIC)

- The Financial Conduct Authority (FCA) in the UK

- The Cyprus Securities and Exchange Commission (CySEC) in the EU

As you start setting up demo accounts, you’ll soon find that some take moments to complete. The most straightforward require just an email address, setting up a username and creating a password. If you then decide to move up to live trading, you have to provide more KYC details.

Brokers that allow almost instant access to demo accounts:

Other brokers require a greater degree of on-boarding right from the off. This can come across as being a bit heavy-handed, but is an indication of how much regard they give to regulatory protocols.

The good news is that if you decide to upgrade from demo to live, most of the KYC work has already been done.

Source: Pepperstone

Brokers that have stronger client protection procedures on their demo accounts:

The above lists are a guide to one part of the process. It’s worth offering a reminder that the brokers that require a touch more form-filling to get on to ‘demo’ are very successful businesses. They are highly regarded in the trading community and just like to do things properly.

Platform quality

You’ll very quickly begin to see the top-ranked brokers all offer first-rate trading platforms. The functionality can vary — which will make your test-trading interesting. Some of the brokers offer the same platform as third-party products, such as MetaTrader’s MT4, which is incredibly popular.

Forex brokers which offer a choice of platform include:

Some brokers have invested considerable amounts of time and money developing unique in-house platforms. This means if you want to demo trade their very high-quality proprietary platforms, you’ll have to set up an account with them. This can be worth doing as some of them show just how good the trading experience can be.

- IG

- CMC

- Saxo Bank

Source: Saxo Bank

Other brokers have set up forex platforms, which are a great fit. These include:

- Plus500 (CFD provider: offer CFD service only)

- eToro

- City Index

Next steps

Start factoring the quality of the live trading experience

Some brokers focus on the live trading experience. It might be they offer super-tight trading spreads or excellent customer service.

Source: FXTM

It’s worth highlighting some of the brokers which have a good reputation for ongoing Live trading. They might not necessarily have Demo accounts which score highly enough to make a top three in any of our Demo-specific grading process. These brokers are still worth considering. As when you go Live, they’ll deliver:

How to get the most out of demo trading

Don’t be overawed by having a free state-of-the-art trading account to experiment with. Now, with no real cash at stake, is the time to test the system. Book trades that you may not otherwise, get a better understanding of risk and the pitfalls of bad trading.

If you’re going to make any mistakes, then do them on demo mode. Testing should be comprehensive and robust. If you’re thinking of trading using hand-held devices, then make sure you test that out as well. You’ll want to be sure everything works before you commit real funds.

There’s nothing to lose from having various demo accounts. Whether that’s across different brokers or with the same one, if account A, B or C represent you trading a different strategy, then it will all add up to additional learning.

What is slippage in forex?

Slippage explains the situation where trades are not executed at the price the system predicts. Markets are a dynamic environment and the order to trade might not be filled at the price that is on your screen when you click.

Slippage is less of an issue when trading using a demo account but when stepping up to Live trading it might come into play.

Slippage is a fact of trading life and something traders keep an eye on. It’s certainly not significant enough to put people off altogether. But if the returns on the forex trading strategy you are running are slightly different in demo and live trading environments, then it might be down to slippage.

How to develop a trading psychology

Trading using virtual and real funds is something of a paradox. On the one hand, the high-tech platforms provide exactly the same trading experience. On the other, there is a big difference in terms of human behaviour when real cash is at stake.

Developing a trading psychology involves taking emotion out of trading. In that way, using a demo account is a good way to start. It is important to be aware that moving up to live trading is a big step. It might mean your decision making is impacted as the raw emotions involved with making and losing money come into play.