AFC Energy (LON: LON: AFC), the hydrogen power technologies firm, has seen its share price climb higher on Tuesday after the company announced it has signed its first UK Strategic Partnership Agreement with international consultancy and construction business, Mace Group.

AFC Energy's share price is trading at 52.70p, up 7.6%.

The deal will see Mace and AFC Energy develop long term UK and international deployment strategies to support a transition from diesel generators to zero-emission hydrogen generators for construction sites.

The partnership is AFC's first UK construction sector collaboration and supports Mace's sustainability commitments, including removing diesel generators from its sites by 2026.

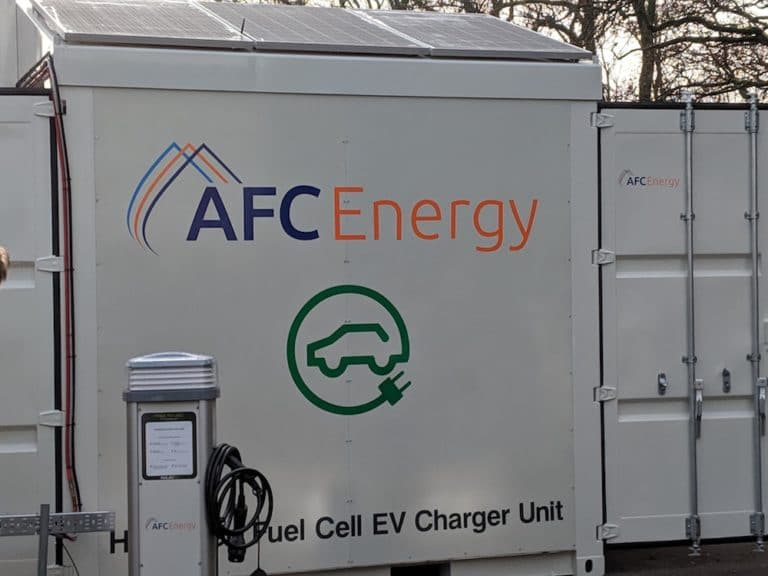

In the UK and internationally, multiple sites under Mace's control will be identified for the initial leasing of AFC Energy's off-grid, zero-emission H-Power system from early 2022.

AFC said the partnership will focus constructor support in driving incumbent plant hire businesses to invest in sustainable hydrogen power generator technologies.

“A sustainable construction industry and the need for improved urban air quality is driving growing contractor interest in transitioning away from diesel generators in meeting today's temporary power needs,” commented Adam Bond, CEO at AFC Energy.

“AFC Energy's zero-emission, hydrogen-fuelled power generator addresses this growing demand for cleaner power,” he added.

Should you invest in AFC Energy shares? AFC Energy shares are traded on the AIM market of the London stock exchange (the alternative investment market) which is the sub market specifically for smaller companies. AIM stocks are attractive to investors as they have tax advantages and smaller companies have the potential to benefit from rapid growth. But are AFC Energy shares the best buy? Our stock market analysts regularly review the market and share their picks for high growth companies