The way in which firms such as Disney interact with the wider community is becoming an increasingly important factor in investment decisions. Across the board, from small retail investors to institutional funds, decisions on whether to buy a stock or not are factoring in Corporate Social Responsibility (CSR) policies. This means CSR is more than a ‘feel-good’ factor. In the current climate, the fate of a firm’s share price can depend on how it interacts with other stakeholders and manages the social, environmental, and economic impact of its operations.

YOUR CAPITAL IS AT RISK

This review of Disney’s CSR policy will consider whether the firm’s aims are appropriate and if it is likely to achieve them. Once the good and the not-so-good are weighed up, it’s then time to decide if it’s time to buy or sell Disney shares. That part of the investment process, booking a trade, is in many ways easier, and a step-by-step guide will show you how.

Table of contents

- What is Corporate Social Responsibility?

- What is Disney’s CSR Policy?

- Environmental Policies

- Social Policies

- Corporate Policies

- How Does Disney's CSR Policy Compare to Other Companies?

- How to Invest in Ethical Companies

- Open & Fund an Account

- Research Companies Using Technical & Fundamental Analysis

- Open an Order Ticket and Set Your Position Size

- Set your Stops and Limits

- Select and Buy Disney Shares

- Is Disney an Ethical Investment?

What is Corporate Social Responsibility?

Reflecting the mood of investors and customers, CSR policies have grown in size and now cover a wide range of topics ranging from water use management to community outreach programs. There are some hot topics, such as ‘carbon footprint’, which are found in most policies, but each firm develops its own document, and the bespoke nature of them makes it hard to make like-for-like comparisons. Establishing where a firm sits in terms of social interaction is made even harder by the fact that many CSR policies now run to over one hundred pages.

The subject of CSR policies is continually evolving. What started out as simple gestures relating to business practice has evolved into non-binding and voluntary compliance with self-determined targets. An often-used benchmark is the ISO 26000 policy laid out by the International Organisation for Standardisation. It doesn’t stipulate any hard and fast rules, nor does the organisation enforce them. Instead, firms are able to extract from it the most appropriate measures for their business model. This upgrade in terms of consistency and standardisation helps when trying to make comparisons across different sectors and countries.

There is more to analysing CSR policies than establishing whether or not a firm like Disney matches up to ISO26000 standards. Additional initiatives specific to a certain time and place are also thrown into the mix and need to be factored in. This is important because there is a competitive advantage to be gained by firms that demonstrate a strong CSR policy at the core of their operations. This feeds into the bottom-line and share prices, meaning that CSR policies are something that is needed to be considered prior to pulling the trigger on an investment idea.

What is Disney’s CSR Policy?

Disney is the largest media and entertainment conglomerate in the world. A lot of its business operations involve direct interaction with customers and are service-based. This all stacks up to CSR credentials being very important to the firm. In the same way that good press can help the share price, bad press can have the reverse effect.

It’s little surprise then that the firm has for some time been a front-runner in the CSR space. As early as 2009, Disney was named a leader in Corporate Social Responsibility, according to the Boston College Center for Corporate Citizenship and Reputation Institute. A lot of the firm’s success stems from its emphasis on CSR policy, which runs through all parts of the business, as demonstrated by the emphasis on employees volunteering in the community.

Environmental Policies

Disney has focused on the environment from the beginning and sometimes in a way that other firms cannot. The firm has promoted the subject and expanded audience understanding through educational television programs and Disneynature films. Environmental policies have, therefore, become a strong point for Disney. Not because it doesn’t have significant carbon and water footprints, it does, but because the firm has provided clear, measurable targets and demonstrated an ability to meet them.

Disney’s CSR Approach to Carbon

The most recent Disney CSR report revealed the good news that the firm had achieved its targets. The reduction of net greenhouse gas emissions (GHG) levels has been followed up by even more ambitious targets for 2030. Applying the recommendations of the Intergovernmental Panel on Climate Change (IPCC) the firm aims to achieve:

- Net zero emissions for direct operations by 2030

- Purchase or produce 100% zero-carbon electricity by 2030

- Reduce Scope 3 emissions

- Investment in natural climate solutions

Not only are GHG emissions heading in the right direction, but they are also much smaller than some other firms. Microsoft, for example, has reported GHG emissions of 14 million tonnes in 2018.

Disney’s CSR Approach to Water

The United Nations calculates that nearly 2 billion people currently lack access to safe drinking water and forecasts suggest the situation is getting worse. The World Health Organisation estimates that half of the world’s population will, by 2025, be living in water-stressed environments. Given the increasingly high profile of the subject, Disney’s focus on the topic is to be welcomed, and its 2030 targets are detailed below.

- Implement localised watershed stewardship strategies

- Source sustainable seafood

Part of the proceeds from ‘Earth,’ ‘Oceans,’ and ‘African Cats’ – the three Disneynature films to date – have seen the planting of 3 million trees in Brazil’s Atlantic Forest. They’ve also funded the conservation of 50,000 acres of savanna wildlife corridors in Africa and the protection of 40,000 acres of coral reef in the Bahamas.

The Disney Worldwide Conservation Fund, established on Earth Day back in 1995, supports efforts of local and global non-profit organisations that protect wildlife. Total spending by the fund has exceeded $100m.

Disney’s CSR Approach to Waste

As with the GHG targets, Disney has met its most recent aims and has now set itself new challenges over the coming years. The milestone just passed was to achieve a 60% diversion from landfills and incineration. The firm also sends less total waste to landfill than it did in 2015.

New waste targets for 2030 include:

- Target of zero waste to landfill for its parks and resorts.

- Reduce single-use plastics in parks and resorts

- Eliminate single-use plastics on cruise ships by 2025.

- Permanently reducing waste on its properties.

- Use recycled content or sustainable textiles for apparel.

- Sustainable production processes for Disney products.

Disney was able to pick some low-hanging fruit in this area. Cutting back on single-use plastic had a dramatic effect due to the large amounts of waste that the firm traditionally generated. From cruise liner toiletry bottles to theme park plastic spoons, the upgrade in policies has led to the firm taking a large step in the right direction.

Social Policies

Disney engages with the global community using direct and indirect projects. Some schemes receive grant funding and others are able to draw on Disney’s vast library of image rights to initiate schemes that benefit the wider community. More than $230m of cash and in-kind charitable donations were made in 2022.

- ‘Volunteerism’ is a big thing for Disney. The firm offers tickets to a million people in exchange for a day of volunteer service at an organisation of their choice.

- Even some of the Disney characters get involved in community projects. Mickey Mouse was previously used by Common Sense Media to create an online safety video for younger audiences.

- Disney calculated 13m service hours contributed worldwide over 40 years.

- Several of its businesses supported beach clean-up events last year.

- The company's employees were also involved in the protecting butterflies scheme.

- Responsible marketing – The firm operates strict internal guidelines that consider the rights and maturity of children. Among other things, these guidelines take into consideration children’s cognitive and emotional maturity and susceptibility to influence, child safety, and privacy.

Corporate Policies

Disney worked hard to help staff during the Covid-19 pandemic, and in general, the company believes that supporting staff is a priority. Health and well-being concerns during the COVID-19 pandemic included implementing a COVID-19 employee case intake process, including case tracking and reporting. Now, the firm is evolving its COVID health and safety practices, in line with local, regional, and federal guidelines.

- Disney prioritizes destigmatizing mental health challenges and breaking down barriers to access resources and care.

- Disney launched learning content and resources to educate its leaders, employees and production crews on company health and safety protocols. There have been more than 90,000 training completions to date.

- For hourly employees in Disney’s US parks and resorts, the median hourly earnings are over $17.50/hour, with all employees earning minimum wage or higher.

- Almost all of the hourly full-time and part-time US Disney parks and resorts employees earn $15/hour or more.

- Disney’s global workforce comprises approximately 78% full-time and 22% part-time employees.

Diversity & Inclusion

Disney's D&I policies are based on six pillars. Three of them focus on internal dynamics – transparency, accountability and diverse representation, and three more focus on external interactions through inspirational content, community investments and culture.

- 47% of Disney’s US employees are identified as people of colour.

- Women represented 51% of Disney’s global employee population.

- The firm’s compensation committee has stated that performance-based pay for executives will be weighted heavily towards how successfully they implement and meet D&I targets.

- The firm’s Black Employee and Consumer Experience team has been working since 2019 to advance diverse workforce, culture and market opportunities.

- Walt Disney Studios also has Inclusion Champions embedded within its business functions.

- The Disney Aspire program pays tuition costs up-front at a network of schools. Its strategy is to help hourly employees by providing them with degree programs, coaching, and job skills designed for a rapidly changing workplace.

How Does Disney's CSR Policy Compare to Other Companies?

The sector a firm operates in can help or hinder its CSR objectives. McDonald’s for example, can’t get away from the fact that its core business, mass-producing food, is a huge drain on global resources. Disney, on the other hand, largely works in a virtual world and does well to use its entertainment resources to good effect. The hard cash and volunteering hours given up by the firm are easy to measure, but there are other less tangible social ‘goods’ which need to be factored in.

The firm has, for example, made an editorial commitment to broadcasting appropriate and largely upbeat material. The positive impact of such actions is hard to quantify. Even without these ‘grey-area’ issues the firm is already a front runner in terms of CSR. In the 2019 Forbes CSR rankings, Walt Disney Company came an impressive fifth place.

How to Invest in Ethical Companies

Choose a Broker

CSR policies are now so detailed that it can take a long time to read through them. The good news is that setting up a new account with a broker is, in comparison, incredibly easy to do. The onboarding process takes minutes to complete, but there are some simple guidelines to follow if you want to ensure you end up using a trusted and safe broker.

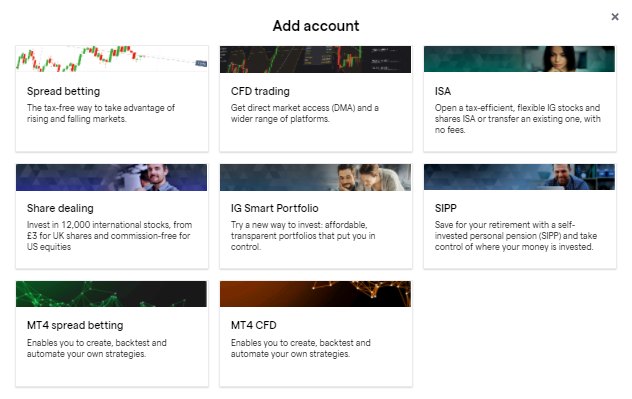

Source: IG

Disney’s $320bn market capitalisation and strong brand name mean that most brokers that offer equity markets offer investors a chance to buy Disney shares. The firm is listed on the New York Stock Exchange under ticker DIS. To buy Disney shares, it’s simply a case of building a shortlist of regulated brokers and trying them out to find a best fit.

Whichever broker you choose, the most important aspect is to ensure it is regulated by one of the below Tier-1 authorities.

- The Financial Conduct Authority (FCA)

- The US Securities and Exchange Commission (SEC)

- The Australian Securities and Investments Commission (ASIC)

- Cyprus Securities and Exchange Commission (CySec)

Open & Fund an Account

Opening an account at a broker is done online and can even be done using a handheld device. Some personal details need to be shared to ensure that you and only you have access to the account. There is also a selection of questions designed to help the broker build a profile of what type of trader you are. These questions on subjects such as ‘your investment aims’ help the broker comply with Know Your Client (KYC) rules but also offer a chance to double-check what you want to get out of trading. Having a clear strategy is important and the questionnaire can help with that.

Wiring funds into your new account follows the same process as any other online transfer or transaction. Credit card and debit cards are a popular way of sending funds as in most cases, the transfer is almost immediate. There are plenty of other payment providers available but it’s worth checking the T&Cs to check how long they take and if there are any admin charges.

If you’re interested in buying Disney shares but not quite ready to commit or unsure about how trading works, then trying out a demo account could be a good idea. These take moments to set up and you can book a virtual trade in Disney and watch how it performs. Not only are these a great way to try out different brokers, but they also help newbies work through the mechanics of trading in a risk-free environment. As they’re free of charge, even more experienced traders use them to test new strategies.

Research Companies Using Technical & Fundamental Analysis

No one can be completely correct when answering the question ‘is now the time to buy Disney shares?’, but there are ways to unearth some clues. Two of the methods used to build a better picture of the situation are Fundamental Analysis and Technical Analysis. The former involves studying the company’s core business credentials such as profit margins, capital expenditure, annual income and dividend yield. The dividend yield for Disney is 1.74%, which doesn’t categorise it as a high-yield stock but represents a significant improvement on the returns from bank savings accounts.

Technical analysis involves collecting historical price data to spot short term trends and pricing anomalies. These are converted into ‘indicators’, which point to whether now is a good time to buy or sell Disney stock. In practice, most investors use a combination of fundamental and technical analysis. Fundamental factors may determine if a stock is a buy, or not, while technical analysis can help pinpoint an optimal time to enter the market.

Open an Order Ticket and Set Your Position Size

Disney shares have such a high profile that they typically appear on most platform home screens. The trading dashboards also have search functionality, and once you locate the Disney name or icon, just click through to head to the DIS market, where you’ll find the latest news and price charts.

Once there, trading in its simplest form is a case of entering the number of shares you want to buy and tapping or clicking ‘buy.’ This can even be done from your phone, so you can trade on the go. There are other tools that help manage risk, which you might want to consider using at this stage.

Set your Stops and Limits

Stop Losses and Take Profit orders are automated instructions to close out some or all of your position if the DIS share price moves to a certain level. Stop-losses cut your losses and close out losing positions, while Take-Profits crystalise gains. Using them can lead to a more hands-off trading experience, as the system will book the trades for you.

Risk management is an important part of trading and developing an understanding of the area can significantly improve trading performance. One thing to consider is whether to use stop losses and risk being closed out of a position if there is a short-term price crash or whether to trade in small size and ride out the bumps in the road.

Select and Buy Disney Shares

Once all the checks have been completed, the final part of the process is clicking to ‘buy’ Disney shares. At that point, cash will be exchanged for a stock position. The value of that Disney holding will depend on market price, and you’ll be able to track its performance (P&L – profit and loss) by accessing the Portfolio section of the platform. This area of the site is also where you can run a double-check on the position to ensure you didn’t make a manual error when booking the trade. It’s also where you’ll be able to sell out of your position.

When the time comes to sell your Disney shares, simply click on the position, and the system will guide you through the reverse process, and your stock will be converted back to an amount of cash based on the current market price.

Is Disney an Ethical Investment?

Now is a particularly good time to be asking how ethical Disney is. Over the last decade, the firm set itself some ambitious targets. The good news for the environment, communities, staff, and investors is that the firm has hit its targets on waste and GHG and set more with a 2030 deadline.

Disney has, for a long time, been seen as a pioneer of CSR policies, and that looks set to continue with the firm continuing to rank in the Forbes Global Top-five. Even the extreme circumstances of COVID-19 didn’t put the firm off its stride. In fact, a whole raft of policy initiatives were launched to help communities and other stakeholders.

If you’re weighing up the pros and cons and asking if now is a good time to buy Disney, then the firm’s approach to CSR shouldn’t get in the way of taking the next step and investing.