There are, of course, other questions that then arise – How do I short stocks? What are the fees involved? What are the risks? All of these are completely valid, and asking them is a sign that you’re approaching the subject in the right way. The fact that in a few years, Webull has picked up more than 11 million registered users gives an indication of how well the platform has done in addressing those points.

How to Buy Stocks on Webull

The easiest way to break down the stock-buying process on Webull is to consider the basic data fields. It is possible to progress on to more sophisticated orders, but, in its most simple form, trading is just a matter of entering an amount you want to trade and clicking ‘Buy’.

Step 1 – Find Your Target Stock

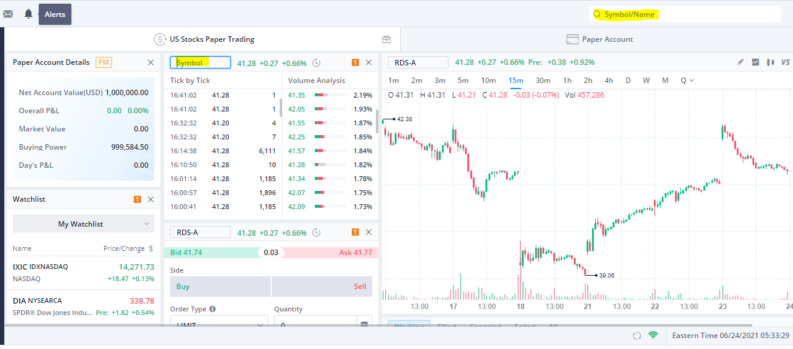

Firstly, you have to identify and locate the stock you want to trade. From the homepage of the platform, you can browse different markets, including US or European stocks. Alternatively, use the search bar to enter the name of the stock you are interested in.

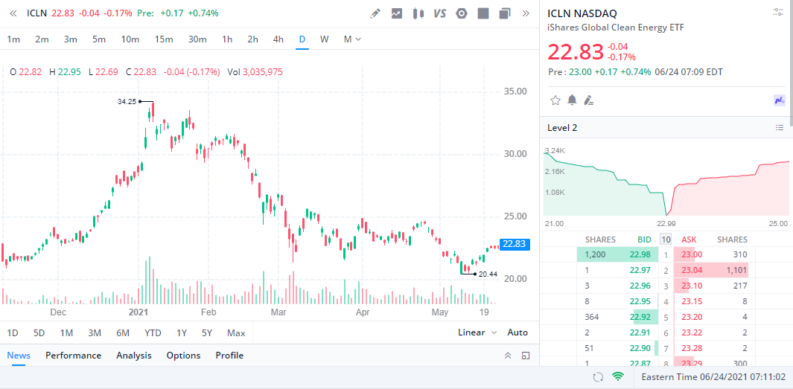

The dashboard for each stock comes with a selection of useful analytical tools. The Tick by Tick and Volume Analysis monitors allow you to look into the market and see what the recent trading activity has been. The price chart shows how price has moved and can be set to a variety of time frames so you can study the market as it moves minute by minute. Equally, you could take a long-term view and switch to the monthly chart, which shows price moves over several years.

Step 2 – Enter the Quantity You Want to Trade

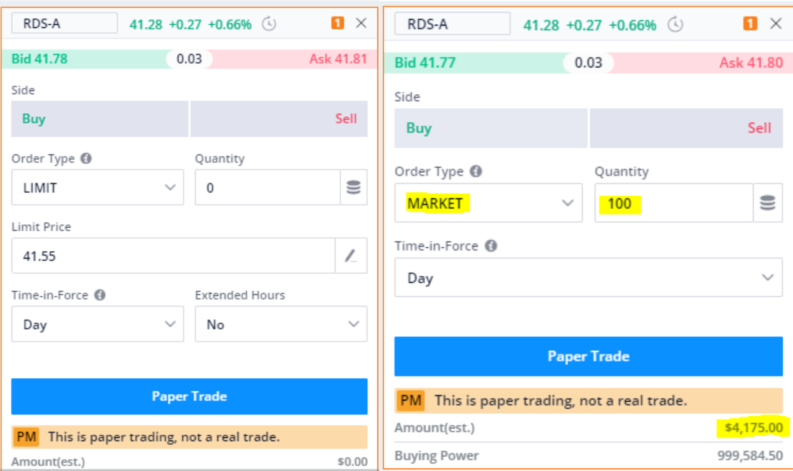

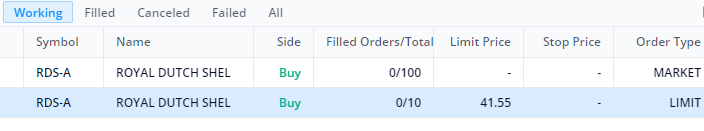

The above trade instruction is to buy 100 shares in UK-listed energy giant Royal Dutch Shell (RDS-A). It’s a Market Order, which means the deal will be done at whatever the current market price is. The ‘Amount Estimate’ information in the bottom left-hand corner offers a sanity check on what is about to happen. The value of the trade should be in the region of $4,175, but the exact amount will be confirmed once the order is filled. To find that out, it’s simply a case of clicking ‘Buy’.

Step 3 – Consider More Sophisticated Order Types

The advanced functionality of the Webull platform allows you to finesse your trade instructions. If you select Limit Order, then the trade instruction will occur if price reaches a certain price. This is useful if you want to buy a stock but think it might have a short-term dip in the near future. You can also set a time limit on how long you want the instruction to be active.

Stop Loss and Take Profit orders are position management tools that can be built into your trade instruction. These orders instruct the system to automatically trade out some or all of a position if price reaches a certain level. Stop losses manage risk to the downside and take profits lock in gains. These come into effect after the initial purchase is made and can be adjusted or removed at any time.

The process is the same regardless of the stock you are looking to trade.

How to Sell Stocks on Webull

The process used to sell stocks on Webull depends on whether you are looking to take a naked short or sell out of an existing long position. Short selling is considered later in this review, but closing out some or all of a position you’ve previously bought is more common.

How to Sell a Position you already own on Webull

The most common selling scenario involves closing out a long position that you previously bought and held. To carry out this type of sale, head to the portfolio section of the dashboard. Click on the position and input the amount you want to sell.

The Portfolio section of the site is also where you can monitor the performance of your trading positions. Long and short positions will show up there, and you can easily follow the latest price moves, monitor the profit and loss (P&L) on different positions, set price alerts, adjust stop losses and follow links to catch up on market news.

How to Make Your Trading at Webull Safer

The previously mentioned risk management tools, stop losses and take profits, are designed to provide clients a chance to manage their positions without having to watch price charts on a 24/5 basis. There is one other very important check to run before taking a more hands-off approach and leaving your new stock position to develop.

Human error is always a possibility, so once you’ve clicked buy or sell, it’s important to check the Portfolio section of your account. This will allow you to confirm the trade was executed and that you traded the instrument you intended to in the correct size. Any errors are best rectified by ‘backing out’ all or part of the trade before the market price moves too far away from the entry point.

What Markets are Available?

There are thousands of equities and equity-backed markets to trade on Webull. Single stock trading and picking an individual firm to buy or sell can be done on a global basis. It’s possible to trade US, Canadian, European, and Asian stock markets.

You can also trade Exchange Traded Funds (ETFs) and stock indices.

Taking the Nasdaq listed ICLN ETF as an example, it’s possible to buy a basket of ‘Global Clean Energy’ stocks with one click of a button. These fund-style products are managed by ETF platforms, which, on the back of your instruction, provide exposure to a long list of individual stocks. This can help investors manage single stock risk, the diversification limiting the damage caused to your account if one particular stock underperforms.

In the same way, Indices allow investors to take a position in one of the global benchmark indices such as the Nasdaq 100, S&P 500, or the Indian Sensex index.

If you want to build a Watchlist of potential targets, that’s also possible. That way, you have all the names you want to follow listed on the same monitor.

What Fees are There?

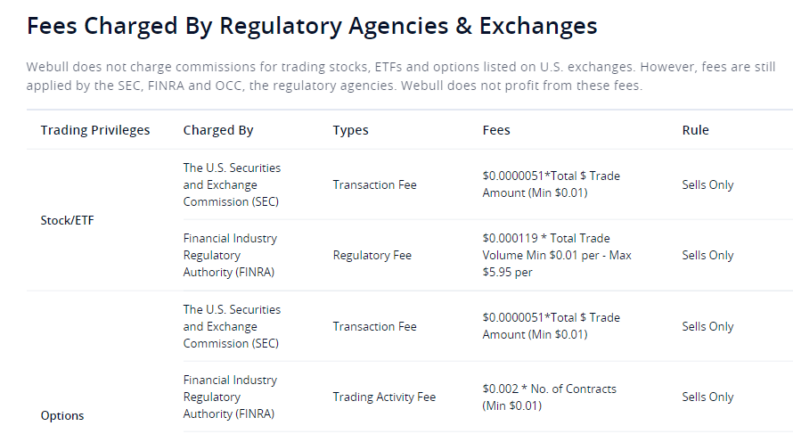

There are two bits of good news relating to fees at Webull. Firstly, the fees are low – in some instances, as low as they get. There are also plenty of stocks on offer with zero commissions charged. Secondly, the firm provides a really easy-to-understand breakdown of what the fees are. It’s often the case that the firms with the best pricing, and nothing to hide, make it the easiest to get a clear understanding, and Webull follows that pattern.

There are no commissions on buy stock trades at Webull. The broker makes its money on the bid-offer spread, the difference between the buy and sell price in any market, but there are no other trading costs on purchases.

- Stock Trading Costs $0

- ETF Trading Costs $0

- ADR Trading Costs $0

Selling out of a position you already own also benefits from the incredibly low pricing terms, but short selling does involve the platform having to borrow the stock from the market. That stock borrow comes with a fee, which is passed on to clients.

Regulator and Exchange fees can’t be avoided. These fixed charges apply to all brokers, traders and are detailed below.

Most of the reporting can be done online, but if you want hard-copy statements, there is a fee involved.

- Paper Confirm Fee: Apex (Clearing Firm) – $2/Confirm

- Paper Statements Fee: Apex (Clearing Firm) – $5/Statement

- Paper Prospectus Fee: Apex (Clearing Firm) – $2.5/Mail

There are also some banking fees relating to cash deposits and withdrawals, though it should be repeated that Webull is in a good position compared to their peer group on these.

- ACH deposit: US bank account – $0.00

- ACH withdrawal: US bank account – $0.00

- Deposit via wire transfer: US bank account – $8 per deposit – Apex (clearing firm)

- Withdraw via wire transfer: US bank account – $25 per withdrawal – Apex (clearing firm)

- Deposit via wire transfer (international): Non-US bank account – $12.5 per deposit – Apex (clearing firm)

- Withdraw via wire transfer (international): Non-US bank account – $45 per withdrawal – Apex (clearing firm)

Can I Short Stocks at Webull?

Yes, you can. Webull clients can sell-short individual stocks and Indices. There are additional risks, but the hedging approach appeals to many, so it is worth developing an understanding of how to short on Webull.

How to short a stock on Webull

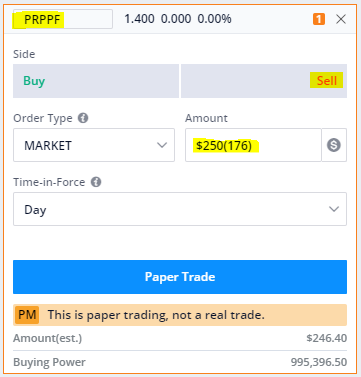

Naked shorts, also known as short selling, involves selling something you don’t own and hope to buy it at a lower price in the future. To take a short position, head to the same monitor that was used to buy RDS-A, and instead of clicking ‘Buy’, click ‘Sell’. In the below example, the short position is being taken in the online property portal Purple Bricks (PRPPF).

What Are the Risks of Short-Selling?

There are additional risks associated with short selling. Unlike long positions, where the worst-case scenario is price going to zero, the losses on shorts can be infinite. Price can, and sometimes does, continue to sky-rocket.

The famous short-squeeze in GameStop led to experienced professional traders at Wall Street hedge funds being carried out due to billion-dollar losses. The extreme situation is exacerbated by the fact that as short sellers bail out of positions, by buying back stock, they inadvertently add to the buying pressure and drive the price even higher, which increases the pain for those still short.

From a historical perspective, equity markets tend to be characterised by long periods of undramatic price rises interspersed by sudden market corrections. As the ‘natural’ direction of travel is upwards, short-sellers putting on trades during the quieter periods of gentle upward movement need to be clear about what stock-specific or general market events are going to act as a catalyst for the price to drop.

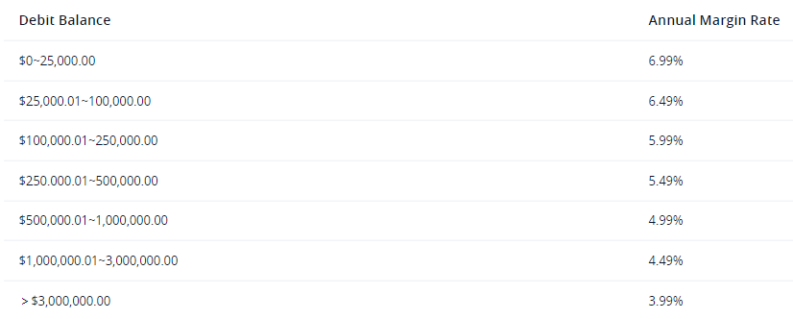

Those looking to short a stock on Webull might also be put off from pulling the trigger on the trade by the additional costs involved. Stock borrow fees are incurred due to the need to borrow the stock you want to short. These charges are variable – the more people who think a stock will fall in price, the more the demand for the stock-borrow, and so the rate of borrowing goes up. There are also margin fees associated with the process.