Healthy returns are only part of the attraction of Swedish investments. The country's regulatory system is top-tier and corporate governance is of the highest level. Those looking to buy and sell shares from Sweden's investment opportunities will find the route into the market easy, but there are a few pitfalls to avoid to ensure client funds are kept safe and returns optimised.

OMX30 Daily Price Chart – 2019-2021 – Undervalued?

Source: IG

Local and international investors have been buying into Swedish stocks using well-regulated and trusted online brokers that have slashed the costs associated with trading. The user-friendly platforms on offer open the door to firms operating in a wide range of sectors.

WHY BUY STOCKS IN SWEDEN?

Sweden's economy posted one of the fastest and hardest recoveries from the Covid pandemic. The tech-heavy Nasdaq 100, which is packed full of IT and outsourcing firms that benefited from ‘the new way of doing things', has since rebounded by more than 140%, and the OMX30 has managed to be one of the leaders in the chasing pack. The UK's FTSE 100 index, in comparison, is ‘only' up 50% from the March 2020 lows.

Momentum has recently shifted and over the last six months the Swedish index has done a much better job of keeping pace with the US one. Between 5th July and 12th October 2021, returns on the Nasdaq 100 and OMX 30 were within 1% of each other. With successful investing being about spotting and joining up with current trends, a lot of attention is turning to Stockholm listed companies.

DIVERSIFICATION

International investors considering investing in Sweden will benefit from the market's unique characteristics. Given its location, there are some distinct geographical benefits from having some investments in a stable and thriving north European economy.

Domestic investors also have the opportunity to diversify their positions to manage risk. Sweden is home to firms operating in a range of sectors, from tech start-ups to traditional heavy industries.

The Swedish economy is much more than a one-trick pony. With some research, it's possible to get exposure to a target market by buying Swedish shares. Firms like the engineering company Sandvik or hygiene and health multinational Essity are up for grabs.

SWEDEN – FIRST MOVER ADVANTAGE IN THE GREEN ECONOMY

The EU Green Deal, which investment bank Goldman Sachs has termed the “largest economic stimulus Europe has seen since the Marshall Plan” (source: CNBC), aims to achieve net-zero carbon emissions by 2050 and a 50%-55% cut in emissions by 2030, compared to 1990 levels.

This ambitious plan requires massive investment in green energy now, and Swedish firms such as Eolus Vind AB form only a handful of major players in a position to meet global demand. Not only are order books full, but incumbent firms also stand a good chance of claiming a first-mover advantage, which could diminish the ability of new rivals to enter the sector.

AstraZeneca Daily Price Chart – 2019-2021

Source: IG

SWEDEN BENEFITTING FROM A DIFFERENT APPROACH TO THE COVID PANDEMIC

Covid 19 is a global phenomenon, but each country has managed the situation differently. Sweden is one of the few countries that didn't go into lockdown. By keeping its economy ticking over, it has been able to rebound faster than many rival states.

Pharma giant AstraZeneca has a listing on the London and Stockholm markets and offers a more direct play on Covid. Its Oxford vaccine was sold at cost during the first wave of the pandemic, but there are no future cost commitments. It has a market cap in the region of $167bn and a dividend yield currently close to 2.6%.

HOW TO BUY STOCKS IN SWEDEN

Buying stocks listed in Stockholm requires using a broker. It's not possible to buy directly from the exchange. The good news is that the costs associated with using brokers have been driven down thanks to new technologies and increased competition. Setting up a brokerage account is easy to do.

Big-name online platforms offer execution only services and user-friendly functionality to a global client base. Investors are completely in charge of their accounts, and trading activity is accessible via handheld and desktop devices.

Clicking a button or tapping a screen can result in a buy or sell of Swedish stocks; however, there are some ‘onboarding' steps to work through before getting to that stage. It's also worth considering the insider tips that follow about client safety and risk management.

Market Risk

Market risk is the chance that your trade in a Swedish stock purchase might be a bad decision. That is, unfortunately, unavoidable and part of the risk-return equation. If it were easy to make money, everyone would be doing it. Some things can be done to tilt the odds, and good brokers offer tools to help develop trading skills and manage trade entry and exit points.

Operational Risk

If market risk is primarily a result of hard to influence factors, there is a lot more scope for an individual to manage their account in a way that helps them avoid scams or making newbie errors.

An example of this would be making the right choice of instrument. Contracts for Difference (CFDs) allow traders to use leverage and sell short. This extra functionality comes with risks, but one of the significant potential hazards is the associated financing fees.

CFD positions incur daily charges, whereas buying stocks outright using a share dealing service doesn't. Those fees can stack up, and investors looking to hold a position for more than a few weeks would do well to buy the shares outright rather than in CFD form.

One way to get to grips with trading is to set up a free to use and easy to set up demo account. These allow investors to practice risk-free trading using virtual funds and live market prices. It's a way to test strategies and establish which broker is the best fit for a user's needs.

1. Choose a Broker

Choosing a safe broker is rule number one of trading. It's even more important than getting your stock picks right because scammers do operate in the market. There is nothing worse than believing you've made a profit to find you can't get any of your money back.

Fortunately, financial authorities such as the Swedish Financial Supervisory Authority SFSA make it their duty to regulate the financial markets. The SFSA has a proven track record of ensuring financial markets operate fairly and efficiently. Firms licensed by the authority will have completed a range of costly and time-consuming tasks to gain that accreditation.

Swedish investors don't need to use an SFSA regulated broker, and other Tier-1 authorities operate similar schemes. Any broker regulated by any of the below authorities has demonstrated it has jumped through a lot of hoops in terms of client protection and sound business management.

- Swedish Financial Supervisory Authority (SFSA)

- The Financial Conduct Authority (FCA)

- The Australian Securities and Investments Commission (ASIC)

- The U.S. Securities and Exchange Commission (SEC)

- Cyprus Securities and Exchange Commission (CySEC)

These lists of regulated brokers have been created by the Asktraders team so that new traders can select from a shortlist of trusted firms. Using them can help you make a solid decision, and the comfort that comes with that allows more time for being active in the market.

There are other factors other than regulation to consider when choosing a broker. The trading dashboards provided by the firms all have a different ‘feel'. Those looking to trade on the go will want to know more about the quality of the mobile phone app service.

Commissions and fees can also eat into profits, so finding a broker with competitive T&Cs can help the trading bottom line. The good news is that competition between brokers and neat technological advances have driven down costs and raised service levels.

One choice is whether to use a local or an international broker. Both routes into the market are perfectly legal whether you live in Sweden or not. For domestic investors, there may be some added convenience from using a local broker; however, international brokers offer access to a range of other global markets as well as Swedish stocks.

The Swedish stock market is relatively diversified in terms of sectors in which to invest. But spreading risk is vital for successful trading and gaining access to markets other than Sweden might make sense.

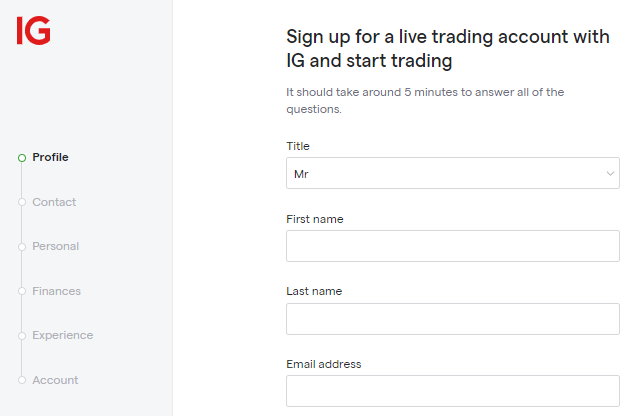

2. Open and Fund an Account

To upgrade your demo account to a live trading account or to set up a live one from scratch typically takes about 10 minutes. Most of this time is spent verifying your identity and setting up security features so that you, and only you, have access to the account.

Source: IG

Opening an Account

Onboarding is done online and may include questions relating to trading experience and investment aims. These questions are asked so that a broker can comply with Know Your Client (KYC) rules and apply an appropriate amount of client protection. They also help new clients consider their trading aims; having a clear strategy is essential when trading the markets. Once onboarding is completed, you're ready to wire funds to your account.

Funding your account

If, after some final checks, you're sure your broker is safe, then it's time to wire funds to your new account. The process is similar to other online purchases or banking transactions. Most brokers offer a variety of payment methods, including bank transfer, credit card, debit card and e-payment services. Some are processed instantly, while some can take days, so checking the T&Cs is always a good idea.

Fees and commissions are again worth monitoring. Most brokers don't charge anything on cash deposits, but some do on withdrawals, and many newbies forget to check this before signing up. It is also possible that your preferred option involves charges made by the third-party provider. There is little that brokers can do about those. Once the funds hit your account, you're ready to trade.

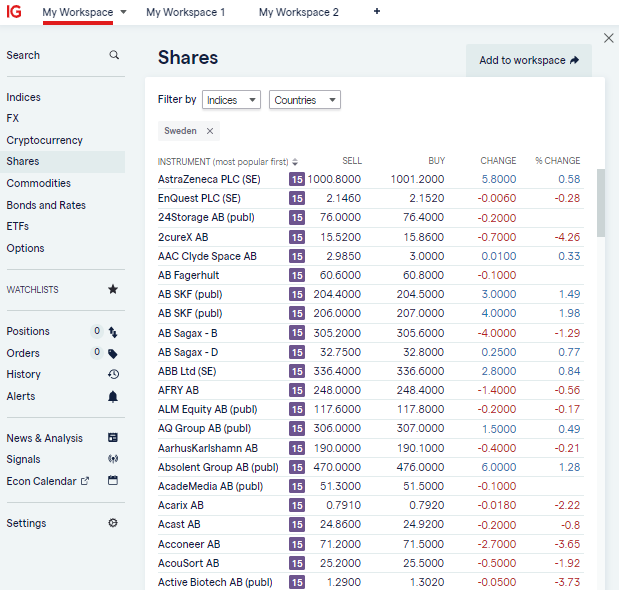

3. Open an Order Ticket and Set Your Position Size

If you already know which Swedish stock you want to buy or sell, then navigating through the trading dashboard to that market will set you up to put on a trade. Those interested in purchasing Swedish shares but haven't finalised their choice will be able to search the platform by country and pull up all the available names. Good broker platforms also provide tools that use technical analysis, charting, and fundamental analysis to help clients finalise their choices.

Source: IG

A lot of the work associated with investing has been completed, and the actual act of putting on a trade is relatively simple. All that is needed is to populate data fields with the quantity you want to trade and then clicking or tapping on ‘buy' or ‘sell'. The platforms allow clients to draw on risk-management features, which can limit your downside and enhance returns.

Alfa Laval AB Trading Dashboard at broker IG

Source: IG

4. Set Your Stops & Limits

Online trading platforms give clients complete control of their trading. Risk management tools such as Stop Loss and Take Profit instructions can be built into trades before execution or applied and adjusted post-trade. These are trading instructions built into the system that automatically close out all or part of a position if price reaches a certain point. That means clients can manage their trading without having to watch the markets all day and instead get on with their day job.

Take Profit orders work similarly to stop losses but close out your position if price moves in your favour. Once price reaches the target level, the system will close out the position and lock in profits.

An Alternative Approach to Stop Loss Use

Stop losses are often recommended for beginners and are popular with traders following speculative and short-term strategies. They are offered with the best intentions, but some investors choose not to use them.

Stop losses can be triggered by a flash crash. These are rare events, and price soon returns to normal, but if the stop loss came into play, the position would have been closed out at a lower price. In the same way, Take Profits put a cap on profits and could get in the way of further gains being made.

Practising using them in a demo account is recommended, and it's also worth remaining open-minded about alternative forms of risk management.

Buy-and-hold investors who invest over a more extended period don't always apply stop-losses to positions but instead use other techniques to manage risk. Effective portfolio management is an excellent skill to learn, and diversifying investments across different sectors can help smooth out returns and take the emotion out of trading.

Trading in small sizes is another way to gain exposure to Swedish stocks without running the risk of bailing out of positions at the wrong time due to panic arising.

Another order type that can help introduce more discipline into strategies is the Limit Order. These allow traders to specify the price they enter into a position. There's no guarantee that price will reach that target level, but the entry price will be optimised, and patience rewarded if it does.

5. Make Your Purchase

The process of buying Swedish stocks is very straightforward. The functionality of modern online broker sites is designed to make things easy. Complete beginners can set up and book their first trade within minutes. There are benefits from moving away from thinking that clicking or tapping the button marked ‘buy' is the end of the process.

After executing a trade, it's a good idea to immediately visit the Portfolio section of the platform to double-check you bought what you intended. Human error is a hazard for all traders, no matter how many years of trading experience they have. If a ‘fat finger' error, such as clicking buy instead of sell or entering the wrong quantity, isn't noticed quickly, it can prove very costly.

Trading alerts can also be used. These might relate to market news or price changes and can be easily set up so that the broker messages clients when material events impact their stocks.

The site's Portfolio section is also where existing trades will be managed. The P&L (profit and loss) on positions will fluctuate in line with market prices, and when the time comes to sell, reversing the above process will convert the stock position back to cash. The exact amount depends on how price has moved during the life of the trade.

SUMMARY

Now could be the ideal time to buy shares in Sweden. There is a feeling that the country's approach to Covid could see its economy avoid some of the worst effects of the pandemic. It's also regarded as one of the best-regulated markets in the world. While nothing is ever guaranteed in the markets, momentum in Swedish stocks is building. Adopting effective research practices and following the tried and tested ways of choosing a broker are the first steps towards investing in this unique market.