With Reddit IPO happening this month, and rumoured to be heavily oversubscribed, there are many other names that would like to tap the public markets.

There is always great excitement among investors when privately owned companies come to the stock market allowing outside investors to buy shares in the company for the first time. It's a critical moment in the firm's journey towards further growth, as the extra capital raised will fund expansion projects. For investors, it's a chance to be involved in a success story from day one by. One they can be prepared for by knowing what Upcoming IPOs are on the Horizon.

YOUR CAPITAL IS AT RISK

Initial Public Offerings (IPOs) describe the moment a firm lists its stock on the market for the first time, and its value is determined by the forces of demand and supply among investors. Many IPOs don't live up to expectations, partly because the listing price might form an unrealistic valuation, but a quick scan of the record books shows that the stock price of firms can take off after the first listing.

The ‘pipeline' of IPOs also needs to be considered. Owners of privately held firms try to time their entry to the market in a way that maximises their personal gain. Avoided are times when markets are highly volatile or bearish, as listing firms and their advisors delay a launch date. 2022 was a year when market conditions were unfavourable, and a host of companies which delayed going public are beginning to suggest they are now ready to do so. Let's dive into some of the best upcoming IPOs to observe in 2023.

Table of contents

YOUR CAPITAL IS AT RISK

REDDIT (ESTIMATED VALUE $6.5BN)

Speculation about Reddit's IPO date has been mounting since the firm disclosed its intention to go public in 2021. It has massive numbers of daily users and interestingly appears to be one of the internet companies which might prosper from the shake-up promised by more extensive use of AI. The ChatGPT AI search engine, which revolutionised some aspects of internet use in early 2023, scours the internet to provide digestible search results for its users – and one of the sites it favours for its source material is Reddit. That could result in extra traffic heading to that platform, as has happened with recent Google updates.

The IPO will happen March 20th 2024, expected with a target share price between $31 to $34. The results of the Reddit IPO is likely to have an impact on the sentiment of other companies on this list that have been rumoured, or wanting to tap public markets for some time. The listing will happen on the New York Stock Exchange, and Reddit shares will feature using ticker NYSE:RDDT.

REVOLUT (ESTIMATED VALUE $33BN)

Since it was established in 2015, the app-based bank Revolut has secured 25m registered users. The stripped-back operational structure of Revolut allows it to compete against incumbent banks, which still have brick-and-mortar buildings dragging down their balance sheet. Revolut is a rare UK-based technology success story which means institutional UK fund managers are likely to try and tap into the growth potential of Revolut stock due to the FTSE index being dominated by safe but limited value and dividend stocks.

The latest funding round secured Revolut a value of $33bn, so this will be a big name wherever the listing eventually lands.

BREWDOG (ESTIMATED VALUE £2BN)

Scotland-based brewer BrewDog has moved on from crowdfunding among its ardent fans and originally planned to list in 2021. Adverse press reports about the firm's “toxic work culture” saw that launch stall, and then the sell-off in equity markets in 2022 delayed the listing even further. That has provided time for workplace reforms to be processed, but the short-term hangover could make the listing price attractive for long-term investors.

Some Previous Names On The List ‘Parked' For Now

HUEL (ESTIMATED VALUE £1.0BN)

Nutrition and plant-based food producer Huel has used its impressive social media operations to expand into the US, Japan and Europe. Suggested to be in the running to bring the innovative firm to the London Stock Exchange in 2023 were JP Morgan and Goldman Sachs. Since public markets appetite for IPOs stalled last year, this one has been parked for the time being, but with sales growth still not stemming losses, public markets could well the path to further raises if the appetite is there.

TIK TOK (ESTIMATED VALUE $250BN)

The international arm of the social media sensation TikTok has been rumoured to be lining up an IPO for a new internationally facing company ‘TikTok Global' since mid-2020. Regulatory concerns and a cooling of relations between the US and China have hindered the process.

The phenomenal success of the TikTok platform, and the popularity amongst its' users likely means investors will be eagerly anticipating buying stock as soon as conditions allow. Recent offers to buy back $5bn worth of shares made by owner ByteDance would value the company just over $250bn and seem to indicate that the IPO chances here remain slim for the future.

YOUR CAPITAL IS AT RISK

WHY INVEST IN IPO STOCKS NOW?

Several factors drive the appeal of IPOs.

INNOVATION

Some of the firms coming to market will be at the cutting edge of their sector, and spotting new trends is the key to successful investing.

WIDE-SPREAD APPEAL

Retail and institutional investors can take part in IPOs. They offer an opportunity for the little guy to get into a position at the same time as a massive pension fund, and that additional momentum can drive valuations higher.

INITIAL PREMIUM

A lot of pride is at stake in an IPO. The investment banks who manage the float and the listing firm's management want to extract as high a price as possible, but for the advisors, it is vital the IPO is seen as a success. If the initial listing price is too high, there may not be enough buyers for the sizeable amount of stock coming into the market. If an IPO flops, future IPO contracts with other firms considering listing are jeopardised. For that reason, initial listing prices are often set just below what is regarded as fair value to ensure investors buy up all the stock on day one.

YOUR CAPITAL IS AT RISK

WHAT TO KNOW BEFORE INVESTING IN IPO STOCKS?

The fact that some institutional funds have investment mandates that restrict them from buying IPO stock should be a warning sign for retail investors. It is a relatively high-risk-return end of the stock market, with several reasons for adopting a cautious approach.

VALUATION

Long-established blue-chip stocks suffer dramatic price swings as bulls and bears have different opinions on their valuation. That is even with abundant historical reports and investor update notes to draw on. Consider then how hard it is to value an IPO of a firm with a much shorter track record. The task is made even harder if a firm's competitive advantage involves using innovative technology in a new and challenging to-quantify market. The market ultimately provides a valuation of a recently IPO'ed stock, and there are instances of those managing the launch overvaluing a firm.

TIMELINE

Regular IPOs take approximately a year to come to market. Regulatory and stock exchange protocols must be adhered to, which leaves an extended period for good or bad news to come into play. Lead managers offer an estimated range for the listing price in the run-up to launch, but moving too far from that could cause alarm, so there is a question as to whether last-minute bad news is appropriately priced in.

BIG BANK FEES

Listing a stock in an IPO is an expensive process. The advising bank will invest significant resources promoting the listing and lining up buyers for part of the sale. Lead Managers also offer commitments to buy any unwanted stock. As a result, recent IPOs in the UK have been associated with fees charged by investment banks reaching up to 7% of the total size of the float.

BIG BANK POLITICS

With fees so high and IPOs associated with prestige for those involved, major investment banks are incentivised to make their IPOs appear more successful than their rivals. Chinese walls are in place to ensure asset management divisions of a bank aren't swayed by the IPO team, but if a deal at a rival flops, that can be chalked up as a win. That leaves retail investors at a disadvantage because if there were to be some collusion between banking chiefs, smaller investors would be the last to know about it.

THE PRIMARY AND THE SECONDARY IPO MARKET

Investment banks that take on the Lead Manager role prioritise getting all the stock released into the market. Leveraging off established relationships, they allocate chunks of the new firm to other prominent players in what is called the Primary Market. The Secondary Market refers to all subsequent buying and selling activity as share ownership broadens into the wider market. The Lead Manager takes the decision on whether or not to allow retail investors to participate in the Primary Market.

YOUR CAPITAL IS AT RISK

HOW TO BUY UK IPO STOCKS

A ‘pipeline' of companies coming to the market makes finding the right IPO stock easier. The listing process takes months, and targets are easily identified because there is a lot of press attention. Brokers such as IG also have dedicated areas of their sites covering the IPO market.

1. CHOOSE A BROKER

One crucial check to make is that the broker you are considering using to buy UK IPOs is trustworthy. Our broker shortlist includes firms which cover the market but are also well-respected in the trading community as well as reviews by AskTraders' team of expert traders.

When choosing a broker, it's important to check levels of client protection, platform functionality and T&Cs. Regarding the security of funds, signing up with a broker regulated by a Tier-1 regulator from the below list is an ideal start.

TIER-1 REGULATORS

- The Financial Conduct Authority (FCA)

- The U.S. Securities and Exchange Commission (SEC)

- The Australian Securities and Investments Commission (ASIC)

- Cyprus Securities and Exchange Commission (CySEC)

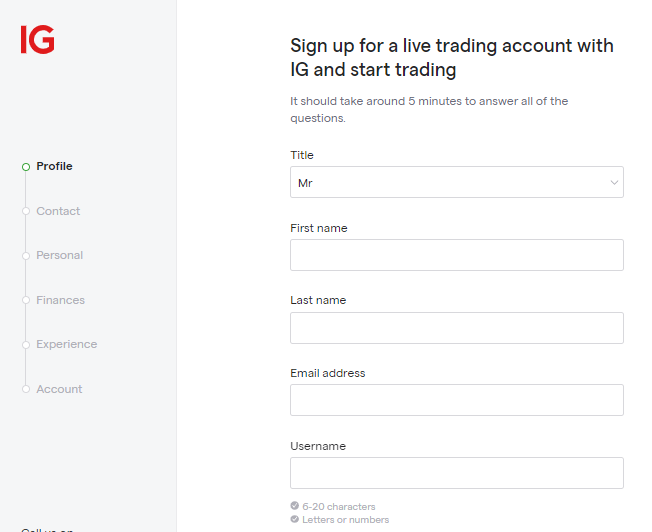

2. OPEN AND FUND AN ACCOUNT

The account opening process is relatively straightforward and should only take minutes. It can be done using handheld or desktop devices. The first step involves sharing personal information. This allows the broker to comply with KYC (Know Your Client) protocols but also ensures they can identify you and that you, and you only, have access to your account.

Transferring funds to a new account can be done using debit and credit cards, bank transfers and e-Payment agents. Processing times vary, and some incur administration costs, so it's worth checking the T&Cs.

YOUR CAPITAL IS AT RISK

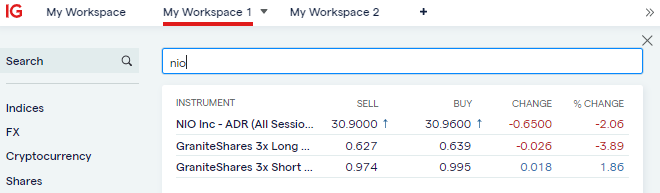

3. OPEN AN ORDER TICKET AND SET YOUR POSITION SIZE

After the cash hits your brokerage account, the next step is to wait for the IPO date and list price to be confirmed and then enter the number of shares you want to buy into the platform. Stocks can be located by using the ‘search' function.

4. SET YOUR STOPS & LIMITS

Stop Loss instructions and Take Profit orders are risk-management tools which instruct a broker to automatically close out some, or all, of a position if price reaches a certain level. Stop-losses kick in if price moves in the wrong direction and limit downside risk. Take profit orders lock in gains should the price of your IPO stock suddenly skyrocket.

Buy-and-hold investors who buy IPO stocks often decide not to use either of these orders because price volatility can be intense. Whipsawing price action can result in a trader getting stopped out on a trade when they intended to ride out the volatility to target long-term gains. Alternative risk management techniques include trading in small sizes to make riding out extreme price moves easier.

5. MAKE YOUR PURCHASE

During trade execution, the account cash balance will reduce, and the platform will report a position in the IPO stock. This will fluctuate in value in line with live market prices until the time to sell arrives, and profits or losses will be crystalised in cash terms.

Whether you're a new trader looking to make your cash work a bit harder for you or are just looking to keep up to date with current trends, these trading platforms are perfect for beginners. Not only are each fully regulated – providing a safe and secure trading environment – they are fully equipped to help their clients optimise returns. They also offer free-to-use Demo accounts, a risk-free way to try out trading. Platform functionality and T&Cs vary from broker to broker. However, the core offering across the sector includes a wide range of stocks to choose from and educational resources to help you get started and make your first trade.

YOUR CAPITAL IS AT RISK

SUMMARY

Make no mistake, IPOs offer a chance for investors to make money. At the same time, there are significant risks to factor in and a lingering sense that those inside the deal-making have an advantage. Following the progress of launches can give an idea of the broader health of the market, the number of IPOs being seen as a bellwether of investor appetite. It's not necessarily a market to avoid, but it is one to treat with care if allocating capital.