Investing in stocks inevitably comes with risks, so is sticking to safe stocks the way to go?

What is Meant by Safe Stocks?

The starting point of any analysis of safe investments requires understanding your own risk appetite and investment aims. The markets accommodate short-term speculators such as day traders, as well as buy-and-hold investors with a multi-year time horizon and an aim to generate dividend income.

Once a clear understanding has been established, it’s a case of ‘know your enemy’ and considering the different types of risk that stock market investors face.

Low Price Volatility

One of the most straightforward ways of measuring risk is price volatility. If your target stock is well established and has a long price history, it’s possible to use metrics to establish what is in store in terms of future price moves.

Price volatility measures the range of price moves and compares them to other stock prices and industry benchmarks such as the S&P 500 index. There are various statistics available to traders, including standard deviation and the 52-week trading range – which outlines the extent of the price range over the previous year.

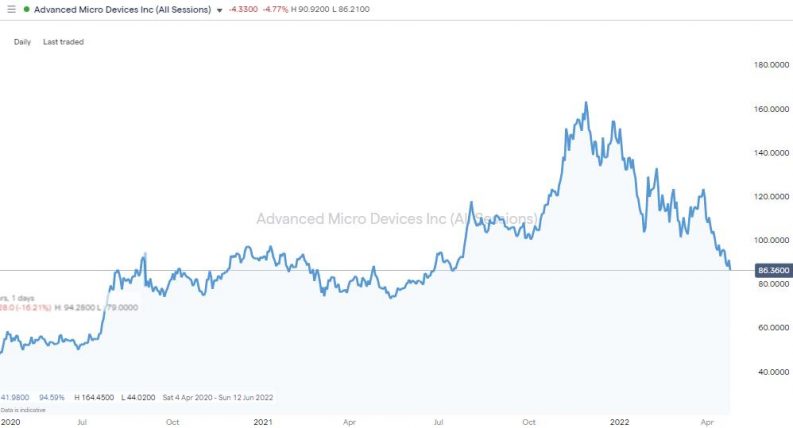

One value often quoted is Beta, which measures price swings to a peer group, with high-beta stocks such as AMD (Advanced Micro Devices Inc) being regarded as more volatile.

Advanced Micro Devices Inc – Daily Price Chart – April 2020 – April 2022 – Not a safe stock

Source: IG

Defensive Sectors

Another way of managing market risk is to invest in defensive stocks. Companies such as Tesco may have limited growth prospects, but grocers perform relatively well during recessions as no matter what the state of the economy, everyone has to eat. Other defensive sectors include utilities, and investing in the best green energy stocks could be a happy middle ground for an investor looking for secure consumer demand but with a chance of extra juice in the trade.

Safe Stocks By Region

The markets your stock operates in also need to be considered. Emerging market stocks might do well when the global economy is expanding, but established economies like the US offer some security when market mood turns sour.

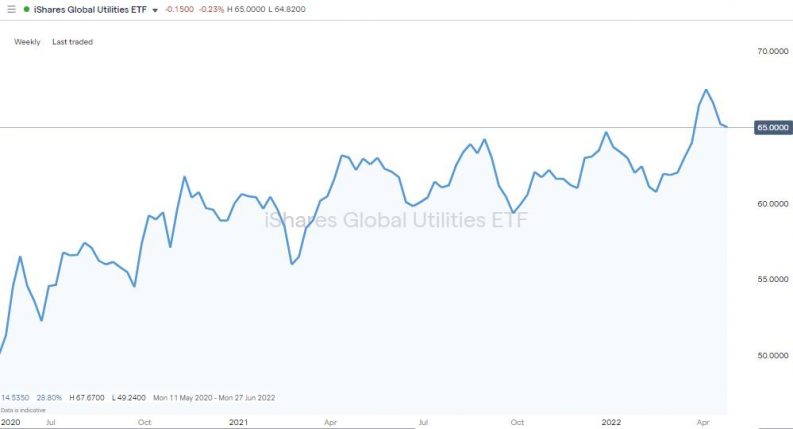

Safety can also be measured in terms of geographical diversification. Investing in US-listed stocks ticks the box in one sense but concentrating all your investments in one country is a risk-management no-no. Another approach is to consider investing in a global ETF of a defensive sector, such as the iShares Global Utilities ETF, which can be found at online broker IG.

iShares Global Utilities ETF – Weekly Price Chart – April 2020 – April 2022 – Stable Returns

Source: IG

Identifying Safe Stocks Using Fundamentals

The financial reports companies release to the market are an ideal tool for those looking to by safe stocks. Look for steady growing revenue, free cash flow, dividend growth, a lack of cyclicality and durable competitive advantages such as barriers to entry to disruptor firms.

Governance

This is a harder call to make as it requires expecting the unexpected. The general rule is that longer-established exchanges in stronger economies require listed firms to jump more through compliance hoops. In the UK, firms with a full London Stock Exchange listing have to have longer trading track records and a larger free float of stock than firms that list on the AIM (Alternative Investment Market).

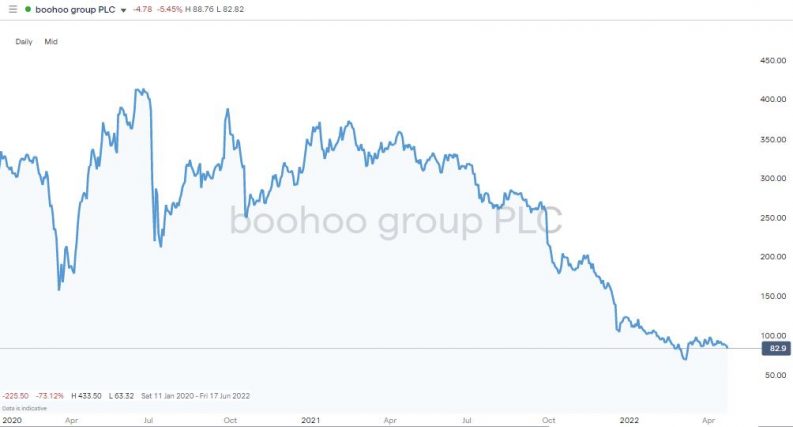

Boohoo Group, which is a member of AIM has made its investors suffer a rollercoaster as the stock has gone from ‘King of the AIM’ to one besieged by allegations of illegal work practices.

Boohoo Group – Daily Price Chart – April 2020 – April 2022 – Poor governance

Source: IG

Best Safe Stocks to Buy

- Berkshire Hathaway (NYSE:BRK.B)

- General Dynamics (NYSE:GD)

- Uranium Energy Corporation (NYSE:UEC)

- Apple Inc (NASDAQ:AAPL)

- Unilever PLC (LON:UL)

Best Safe Stock in Terms of Price Volatility – Berkshire Hathaway B – (NYSE:BRK.B)

One stock that has a track record of ironing out the bumps in the road and still generates an impressive return is Berkshire Hathaway (B). BRKB stock is the investment vehicle of legendary investment guru Warren Buffet and contains a whole basket of different stocks.

There’s no doubting the credentials of the management team, and between March 2020 and March 2022, BRKB stock rose in value by more than 118%. As importantly the stock has a track record of relative success during market corrections. The peak-to-trough price fall for Berkshire Hathaway during March 2020’s COVID pandemic was 28.6%, which compares well to the +34% price fall experienced by the S&P 500 index.

Berkshire Hathaway B – Daily Price Chart – May 2018 – April 2022 – Low Vol Returns

Source: IG

Diversification is part of the Berkshire Hathaway DNA. Although you buy one single stock, your net exposure will be to firms such as Apple Inc, Kraft Heinz, and Verizon. The firms BRKB invests in change over time, but investment decisions are weighted towards low volatility large-cap stocks, which are, in the view of the Berkshire management, undervalued.

The Beta of BRKB is 0.83 and being below 1.0 means its price moves are not as extreme as those of the S&P 500 index.

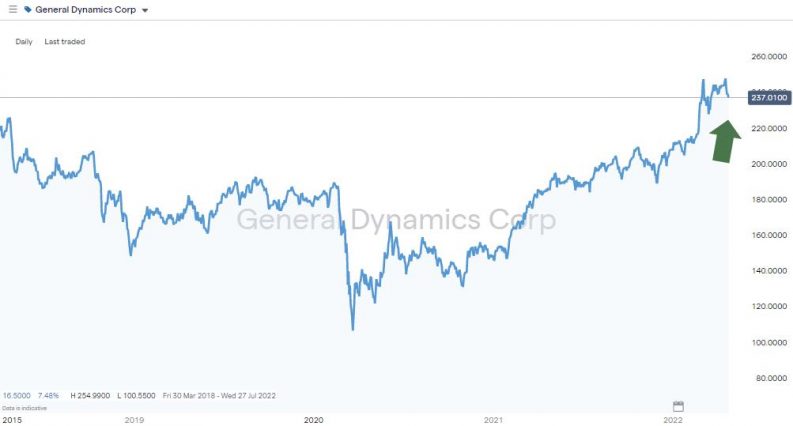

Best ‘Defensive’ Safe Stock – General Dynamics (NYSE:GD)

Defensive stocks can be found in the utilities and non-cyclical stock sector, but our current pick comes from the defence sector. No pun is intended, but instead the decision is based on the protection General Dynamics offers against political uncertainty.

General Dynamics Corp – Daily Price Chart – May 2018 – April 2022 – Hedging political risk

Source: IG

The share price chart shows how the stock with interests in shipbuilding, defence IT, and tank manufacturing has benefitted from military expenditure being consistent and planned out over many years. That constant stream of business offers stability to the GD stock price, with the kicker being that if and when the risk of military conflict rises, General Dynamics can be expected to outperform the rest of the market. Q1 of 2022 has seen major stock indices sell-off, but as of 26th April, GD stock was showing a year-to-date gain of 13.67%

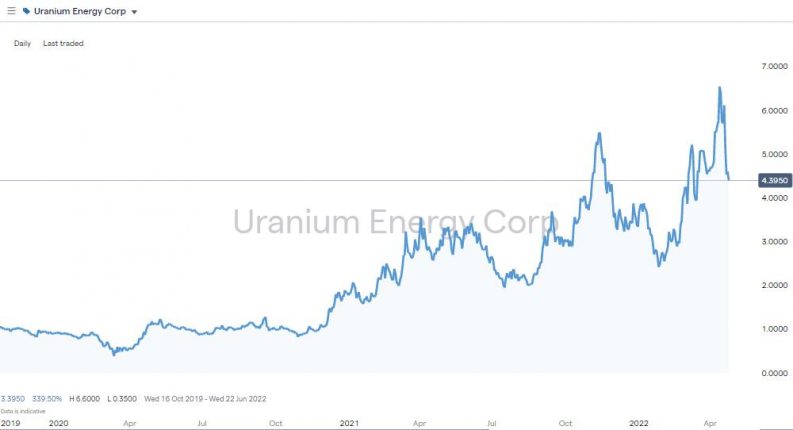

Best Safe Stock in Terms of Regional Risk – Uranium Energy Corp (NYSE:UEC)

Global ETFs have already been mentioned in terms of ensuring all of your investments aren’t held in one geographical region. Another way of considering this risk is to buy into a stock such as Uranium Energy Corp, which benefits from having its business interests protected because of where it is located.

Secure energy supplies form an integral part of government policy and with the US being one of the biggest producers of nuclear energy, the need for a secure supply of uranium is good news for US-based UEC. Other uranium miners operate on a global basis, but UEC is distinctly ‘home-grown’. That puts it in a strong position when you consider the US government has a body, The Office of Uranium Management and Policy, dedicated to ensuring a secure supply of the materials needed to keep the lights on.

Uranium Energy Corp – Daily Price Chart – October 2020 – April 2022 – Government support

Source: IG

Nuclear energy makes up approximately 19% of US electricity supply and with the move to carbon-free energy well underway that number can be expected to rise, which will be more good news for UEC investors.

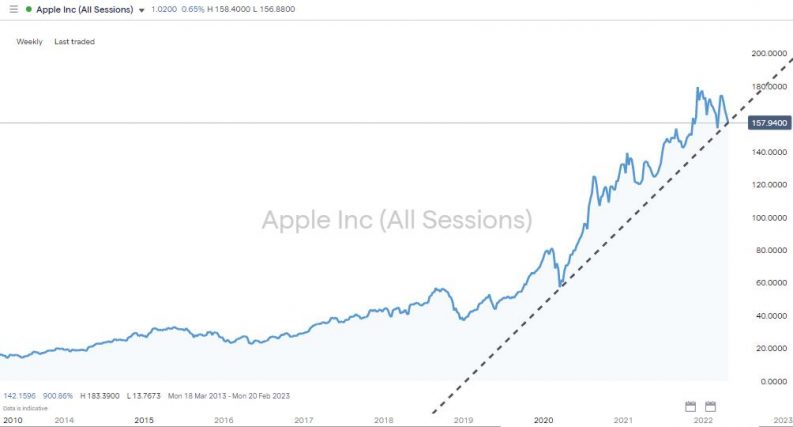

Best Safe Stock in Terms of Strong Fundamentals – Apple Inc (NASDAQ:AAPL)

Apple has generated eye-watering returns for some of its investors, which proves safe stocks don’t necessarily have to be poor performers. The security that Apple offers its shareholders stems from its incredibly strong brand and a business model that is full of barriers to entry for any competitors.

The network of i-branded products, which work best in conjunction with each other, now includes the iPhone, Mac, iTunes, Apple TV+, and iPads. Years of providing a premium service have created an ecosystem of consumers who look unlikely to want to move away from the Apple network and would struggle to do so even if they wanted to.

Apple Inc – Daily Price Chart – October 2020 – April 2022 – Strong fundamentals

Source: IG

Apple’s revenue stream is, as a result, consistently strong and has even led to the firm reinstating its dividend. Whilst dividend payments are a sign of a safe stock, a decision to buy Apple shares is more about capital gains. Between March 2020 and March 2022 AAPL stock appreciated in value by over 200%.

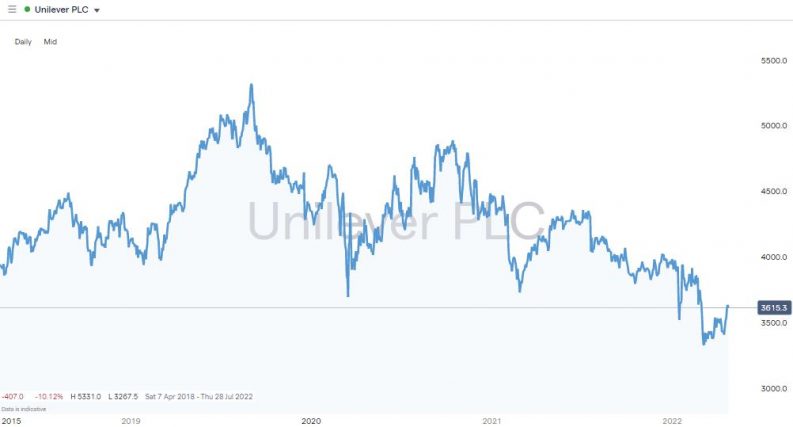

Best Safe Stock in Terms of Governance – Unilever (LON:UL)

Household goods manufacturer Unilever consistently ranks in the top five of the Good Governance Report produced by the Institute of Directors. This report ranks companies based on publicly available information and the views of investors, governance professionals and business leaders.

The report is a good way to get an insider’s view on which firms are considered to be well run in terms of protecting shareholder interests. The listing of UL stock on the London Stock Exchange, Amsterdam Stock Exchange and the New York Stock Exchange in ADR form also ticks another box. Those tier-1 exchanges apply stringent terms and conditions on firms and that ensures transparency for investors.

Unilever PLC – Daily Price Chart – April 2018 – April 2022 – Good governance

Source: IG

Unilever’s portfolio of household goods includes top-ranking brands ranging from Vaseline to Wall’s. Sales might not sky-rocket during boom years, but they do hold up even when there is an economic downturn. The share price of Unilever has trended sideways over recent years, but investors do receive a healthy dividend currently calculated to be a yield of 4.06%.

With the share price currently at a multi-year low, it is possible to buy into a solid and well-run company which pays dividends and right now also offers potential for capital growth.

Final Thoughts

Traditional investment advice suggests steering away from allocating all of your capital into one sector or asset. That helps average out returns and mitigate against risk. Safe stocks are probably one of the few sectors where that opinion could be challenged. Going all-in on shares that are selected to cap the downside has historically still generated a healthy return and certainly topped what is offered by bank savings accounts.

Opportunity cost, the risk of missing out, is the major downside of safe investments. A bit of time spent on research and breaking down the nature of risks can help identify growth stocks that still offer a degree of security. Apple has grown to be the largest firm in the world by market capitalisation just because it has managed to perform that balancing act.

This guide on how to buy Apple shares offers a step by step guide on how to set up an online account with a trusted broker. The platforms are specifically designed to be user-friendly and offer support services and cost-effective T&Cs to allow you to get your trading off to the best possible start.