Key points:

- The point of Yellow Cake is to trade around net asset value

- The shares don't trade around that net asset value

- So, what's wrong, perceptions or the basic business structure?

Yellow Cake (LON: YCA) shares are, at one level, a fairly simple proposition. Here's a pile of uranium, the company should be valued at about the value of the pile of uranium. It isn't – and that's where the problem all becomes more complex. Yellow Cake should trade at around asset value. That's in fact the point and purpose of the company for YCA doesn't, in fact, do anything complex. The point and purpose is to trade around asset value.

Where this all becomes more complex is that the uranium market itself is complex. There are no terminal markets (nothing like the LME etc). As there isn't, or aren't, there are no futures and options – you can't have those if there's no deliverable market. The reason for this should be obvious, we don't want anyone to be able to buy uranium. There's a whole international system of who may sell, who can be a broker for, who can buy, uranium for those obvious radioactivity and bomb making reasons.

This causes a problem for anyone actually in the industry, they can't lay off price risk. Yellow Cake exists almost as an ETF of physical uranium – this would allow something akin to a futures market (it isn't, but could still be used to lay off risk). The point and purpose being that industry players now have an instrument which should move with the price of physical uranium. Whether that's up or down. It's a decent enough idea, the one problem with it is that the market doesn't seem to value Yellow Cake at that asset value.

Also Read: Best Uranium and Uranium Mining Stocks To Buy

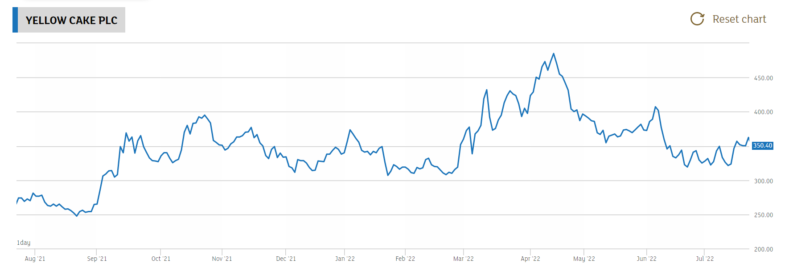

So, in theory – and the reason for the company to exist – Yellow Cake should have a market capitalisation at or around net asset value. But it doesn't, as the annual results point out: “Continued improvement in the market for U3O8 with the spot price increasing 89% from USD30.65/lb on 31 March 2021 to USD57.90/lb[1] on 31 March 2022.” So, we'd expect a distinct rise in the price over the year. Which hasn't, really and wholly, arrived. Some of that is because there were some fund raises, but the real problem is here “Net asset value of USD1,069.0 million (GBP4.42 per share)” Well, if Yellow Cake successfully traded at net asset value – recall, rather the point – then that should be the Yellow Cake share price, around 440p. It isn't, it's around 350p. Yellow Cake is trading at a significant discount to net asset value.

At which point, as traders, we've a decision to make. Will that discount to asset value close? Well, maybe, it might. But if it is to then we've got to work out why it hasn't already. The other way of looking at it is that uranium itself, the yellow cake form the company is named after, is an illiquid market. So, the valuation from the spot price might not be all that useful, or maybe we just don't think the stockpile could sell at that price.

That Yellow Cake trades at this significant discount to net asset value might show that YCA should rise – or it might show that the business case for the stock itself isn't quite right.