The Ceres Power Holdings plc (LON: CWR) spiked 14.8% earlier today on a hold rating from Jefferies before giving up all its gains later to trade in negative territory at the time of publishing. The move by Jefferies brings Ceres Power into the spotlight, especially when the renewable energy sector is witnessing significant shifts and transformations.

YOUR CAPITAL IS AT RISK. 76% OF RETAIL CFD ACCOUNTS LOSE MONEY.

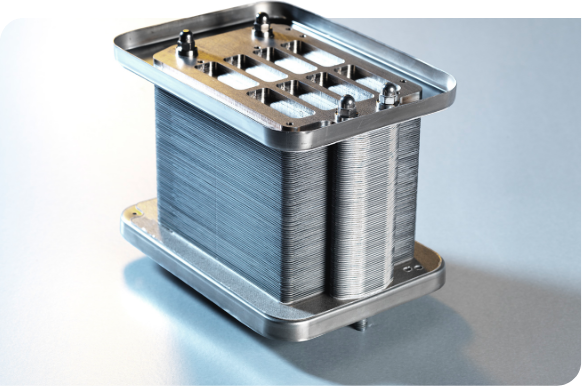

Ceres Power, known for its innovative approach to fuel cell technology, is navigating a competitive landscape increasingly influenced by the push towards electrification. The analyst at Jefferies highlighted this as a pivotal reason for their cautious stance on the company's growth prospects.

The shift towards electrification is a double-edged sword for companies like Ceres Power, pioneers in the fuel cell market. On one hand, it presents an opportunity to innovate and adapt; on the other, it introduces a level of previously unseen competition.

In addition to its established base in fuel cell technology, Ceres Power is making strides in the electrolyser market. This move indicates the company's ambition to diversify its product offerings and tap into the growing demand for green hydrogen production solutions. However, as pointed out by Jefferies, this venture is still in its development phase.

The journey from development to commercialisation is fraught with challenges, and success in this arena is far from guaranteed. The low visibility into the company's progress and outcomes in this new market segment further compounds the uncertainty, making it a significant factor in Jefferies' cautious outlook.

Despite being in the nascent stages, the entry into the electrolyser market signals Ceres Power's commitment to innovation and its desire to be at the forefront of the energy transition. The company's ability to navigate the complexities of this transition, coupled with its response to the competitive pressures from electrification, will be crucial in determining its future trajectory.

Jefferies' coverage and the accompanying “Hold” rating reflect a wait-and-see approach, underlining the uncertainties and challenges for Ceres Power.

Ceres Power share price.

The Ceres Power share price spiked 14.77% to trade at 192.075p from Friday’s closing price of 167.350p but later fell.

Searching for the Perfect Broker?

Discover our top-recommended brokers for trading stocks, forex, cryptos, and beyond. Dive in and test their capabilities with complimentary demo accounts today!

- eToro Top stock trading platform with 0% commission – Read our Review

- Admiral Markets More than 4500 stocks & over 200 ETFs available to invest in – Read our Review

- BlackBull 26,000+ Shares, Options, ETFs, Bonds, and other underlying assets – Read our Review

YOUR CAPITAL IS AT RISK. 76% OF RETAIL CFD ACCOUNTS LOSE MONEY

YOUR CAPITAL IS AT RISK. 76% OF RETAIL CFD ACCOUNTS LOSE MONEY.