The Smith & Nephew plc (LON: SN) share price rallied 5.16% after its Q4 and FY 2023 trading results were released. The company's fourth quarter showcased a revenue of $1,458 million, marking a 6.4% increase on an underlying basis from the previous year's $1,365 million. The reported growth reached 6.8%, slightly boosted by a 0.4% foreign exchange tailwind.

YOUR CAPITAL IS AT RISK. 76% OF RETAIL CFD ACCOUNTS LOSE MONEY.

The year concluded with revenues soaring to $5,549 million, a 7.2% rise on an underlying basis from $5,215 million in 2022, surpassing initial forecasts. The reported growth stood at 6.4% after adjusting for an 80 basis points foreign exchange headwind.

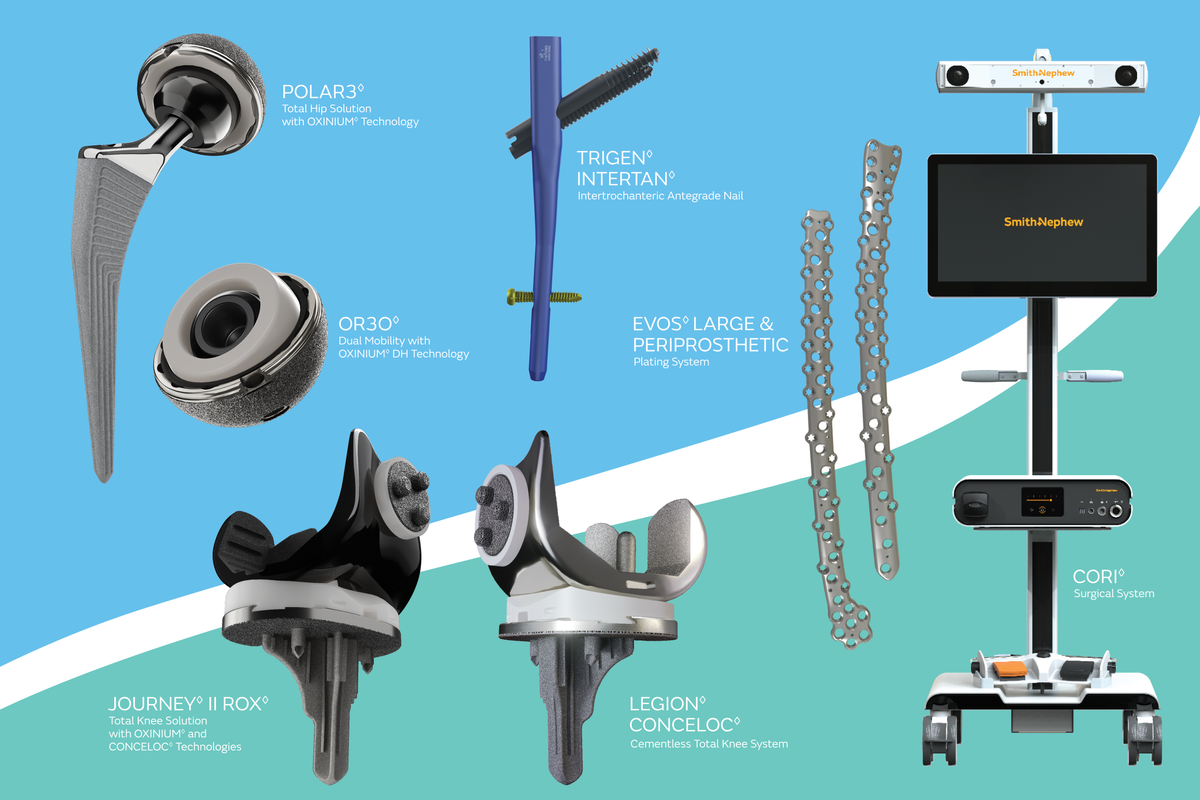

Orthopaedics experienced a 5.7% growth, laying the groundwork for future advancements. Despite challenges in the Chinese market, the Sports Medicine & ENT sectors witnessed a 10% increase. Advanced Wound Management continued its growth trajectory with a 6.4% increase, sustaining its previous year's momentum.

The company's trading profit rose 7.6% to $970 million, with a trading profit margin of 17.5%, aligning with projections. The reported operating profit was $425 million, slightly down from $450 million in the prior year.

Operational cash flow improved significantly to $829 million, and the trading cash flow increased to $635 million. Earnings per share adjusted (EPSA) were 82.8 cents, with actual EPS at 30.2 cents. The full-year dividend remained stable at 37.5 cents per share.

Implementing a comprehensive 12-Point Plan is on course, showing promising signs of impacting financial results. The innovation-led strategy is fueling higher growth and has resulted in a robust pipeline of new products. The strategic acquisition of CartiHeal underscores the company's leadership in the domain of Sports Medicine biological healing.

Despite challenges such as ongoing inflation, a 70 basis points impact from China's Volume-Based Procurement (VBP) within Sports Medicine Joint Repair, and transactional foreign exchange issues, the company anticipates positive operating leverage and benefits from its 12-point Plan to offset these headwinds effectively.

For 2024, the company projects an underlying revenue growth of 5.0% to 6.0%, with a reported growth slightly lower at 4.6% to 5.6%. The trading profit margin is expected to reach or exceed 18.0%, with steady midterm targets.

Smith & Nephew (SN) share price.

The Smith & Nephew share price rallied 5.16% to trade at 1181.0p from Monday’s closing price of 1123.0p.

Searching for the Perfect Broker?

Discover our top-recommended brokers for trading stocks, forex, cryptos, and beyond. Dive in and test their capabilities with complimentary demo accounts today!

- eToro Top stock trading platform with 0% commission – Read our Review

- Admiral Markets More than 4500 stocks & over 200 ETFs available to invest in – Read our Review

- BlackBull 26,000+ Shares, Options, ETFs, Bonds, and other underlying assets – Read our Review

YOUR CAPITAL IS AT RISK. 76% OF RETAIL CFD ACCOUNTS LOSE MONEY

YOUR CAPITAL IS AT RISK. 76% OF RETAIL CFD ACCOUNTS LOSE MONEY.