Sony shareholders will soon find themselves with more Sony stock than they started the year with, as a 5-for-1 stock split looms on the horizon for October 8th, . Apart from the ongoing debate about the benefits of stock splits on share price, and the affordability improvement, is Sony a buy according to analysts?

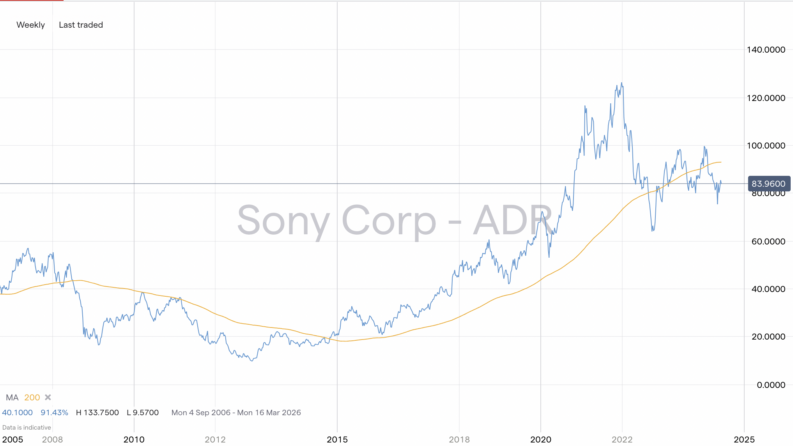

The Sony Group Corporation has, for a long time, been a favourite stock pick for investors. It has a track record of generating impressive returns, such as the +146% capital gain posted between March 2020 and January 2022. The past 12 months however have not been so great for holders of Sony stock (NYSE: SONY), as the price has dipped 15%.

YOUR CAPITAL IS AT RISK

With its strong brand recognition, Sony has been seen as a safe bet, but optimising returns relies on picking the right time to enter a trade and there is no such thing as a ‘sure thing’.

The Sony stock forecast below draws on technical and fundamental analysis and outlines the reasons to buy Sony and how to identify the best time to do so.

Where will the Sony Stock Price Be in The Next 12 Months?

Analysts are currently bullish on Sony shares, with 19 out of 22 assigning the stock a Buy rating and three giving it a Hold rating. Out of 19 analysts offering 12-month price targets for Sony shares, the average price target for its ADRs is $107.07, representing a potential 27% upside. The highest target is $130.69, while the lowest is $79.82.

The 1-year Sony stock forecast allows more room for the firm’s actions to determine the share price’s direction, even if macroeconomic headwinds play a part.

Those headwinds are sizeable for consumer-facing tech stocks. The US Fed’s guidance is that interest rates will remain high until inflation is confirmed to be retreating to 2%. The Federal Reserve expects to cut rates just once this year.

However, the Bank of Japan’s decision not to raise interest rates at the same rate as its peer group has created a currency effect that could help boost Sony’s profits. With the yen depreciating against other major currencies, Sony products manufactured in Japan will be relatively cheaper on international markets.

Sony has navigated challenges like recession many times in its 76-year history. The firm’s agenda in 2023 included revamping some traditional business practices, which could help the share price gain momentum.

The products the company chose to promote at the all-important Consumer Electronics Show (CES) in Las Vegas in January 2023 demonstrated its change of focus. Sony did not include TVs in that flagship event for the first time in its history. Instead, it tapped into the booming video game market by using the event to show off its PlayStation VR2 product.

Sony’s electric vehicle products also had a spot at the CES expo. Sony Honda Mobility’s new Afeela EV took to the stage instead of TV monitors. It also has an artificial intelligence unit, Sony AI.

This change in direction is good news for investors. It indicates the firm is a well-integrated business operating in growth sectors that can balance out investment in innovative ideas by relying on reliable income streams to keep its balance sheet healthy.

Sony News

In June, it was announced that Sony Pictures had acquired Alamo Drafthouse, the seventh-largest movie theater chain in North America.

In May, reports stated that Sony Pictures was planning to use generative AI to reduce film production costs.

Previous reports stated Sony and private equity firm Apollo Global Management made a bid to acquire Paramount Global for $26 billion.

Who is Sony (NYSE: SONY; TSE: 6758)?

Sony Group Corporation designs, develops, and manufactures a range of globally recognizable electronic equipment and devices for the consumer, professional, and industrial markets. Its move into online streaming in the form of Sony Interactive Entertainment has excited investors and complements its operations in a range of other sectors.

Sony’s other interests are diverse, ranging from film production to life insurance, making it hard to factor in every permutation that might influence a Sony stock valuation.

Sony is a global brand headquartered in Tokyo, Japan. The primary listing of Sony stock is on the Tokyo stock exchange, but to accommodate international investors, it is also listed on the New York Stock Exchange. The ticker of the NYSE listing changed from SNE to SONY in 2021.

Most good brokers offer their clients the opportunity to buy shares listed in Japan or New York. The Tokyo listing is priced in Japanese yen. Therefore, those with accounts not denominated in yen must factor in that total returns in Japan-listed shares will incorporate forex price moves and price moves in the underlying stock itself.

The purpose of American Depositary Receipts (ADRs) is that investors can easily buy the same stock as the foreign listed one. This Sony stock forecast will therefore use data and reports relating to both stock listings.

YOUR CAPITAL IS AT RISK

Where will the Sony Stock Price Be in 5 Years?

With Sony stock’s Price-to-Earnings (P/E) ratio currently at 15.83, some consider Sony undervalued compared to the broader tech market, which has a P/E ratio of 35.04. For Sony’s P/E ratio to align with its peer group, earnings must fall, or the stock price must increase. There are good reasons to believe the latter is more likely to occur.

Sony is the world’s top music publisher, and Sony Music has benefitted from the growth of online music services that have revolutionised the industry. Sony is one of the winners in that revamp of how music is consumed and has secured profit margins of nearly 20% in its music division.

The firm is also investing in developing a pipeline of new artists and keeping up with new trends. During an investor Q&A session, a spokesperson stressed the firm’s ambition to keep up to date with developments. Speaking of the increased influence of platforms such as TikTok, it was explained that

Those represent additional exposure opportunities for music, so they are both a risk and an opportunity.

The firm’s statement continued:

“History plainly teaches that the music industry is one where new platforms are apt to rise and be prone to technological disruption of the market. As such, we believe it important to stay on top of the latest trends and respond accordingly.”

Source: Sony Corp

Sony Group earnings have held up relatively well over the last two years despite geopolitical problems, supply-side issues, and global economies raising interest rates to deal with inflation. With a more favourable wind, the Sony stock price could appreciate significantly.

Quarterly earnings announcements over the next 12 months will allow analysts to test if this growth keeps up with forecasts. Each statement can be expected to give a steer to the stock price. The numbers given the greatest significance will be those relating to gaming and music streaming.

Is Sony a Good Buy?

Sony’s relatively complicated business model means there is some difficulty in answering the question; Sony buy or sell? While the more traditional revenue streams are exposed to the risk of an economic downturn, the firm’s positioning in key growth sectors results in the answer leading toward ‘buy.’

The sell-off in the stock in 2022 impacted Sony more than was warranted, and with solid fundamentals, Sony shares can be expected to rebound. Timing is everything, but the 1-year and 5-year forecasts suggest building a position is best done sooner rather than later.

There are potential trip-hazards to avoid, but short-term price dips could offer an opportunity to buy Sony stock and take a position. That partly explains why many analysts tip it as a ‘buy’.

YOUR CAPITAL IS AT RISK