Litecoin’s price does not exhibit a regular moving pattern. The price is volatile and to create a solid trading strategy, an investor must look at the historical performance of the cryptocurrency and a sample price of predictions provided from credible expert commentators.

- Litecoin is currently trading well below its all-time high value of over $375

- Even with the recent low prices, Litecoin’s value has grown more than 20-fold in just 3 years

- Some experts are bullish on Litecoin, while others – bearish at best

- A cautious long-term investment strategy must be adopted

Litecoin Price Performance: A Historical Overview

In order for the investor to understand the potential price performance of Litecoin, it is useful to first look at the recent performance of the coin. (At the time of this writing, Litecoin is trading at $55 per coin).

Created in 2011, Litecoin traded at just $0.04 per coin in August 2012. Over the next year, the cryptocurrency’s price strengthened against the dollar’s and reached a peak in late 2013, when it traded for around $25 per coin. From then on, the price volatility continued to increase.

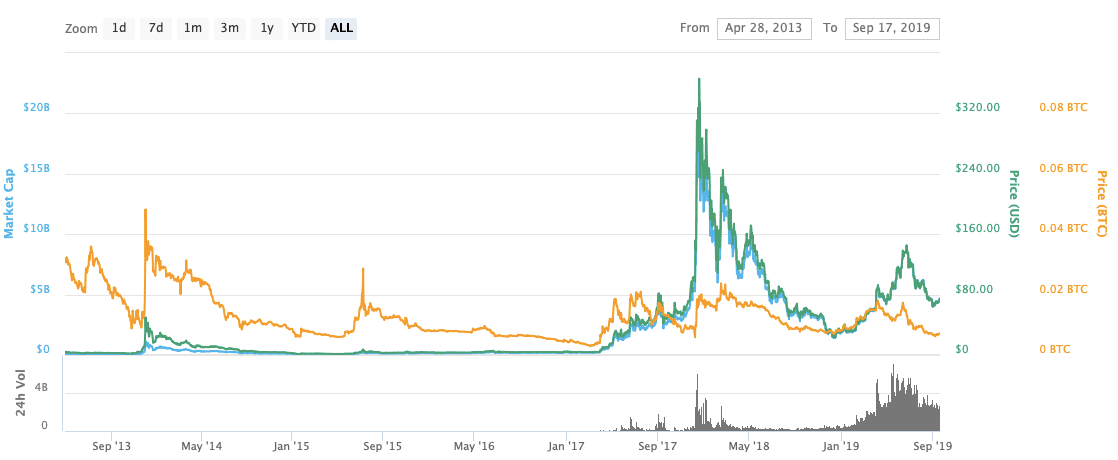

In terms of price fluctuation, Litecoin experienced a sharp decrease in its price in early 2014 and traded in the $2-$4 range until the end of 2016. Then in 2017, the price skyrocketed to new unexpected levels. The graph below shows the rapid price increase from 2017 to mid-2018 and then the sudden decline in the beginning of 2018 to 2019.

- Overall, cryptocurrencies exploded in 2017, especially in the winter months. In December 2017, Bitcoin traded for almost $20,000 per coin. Litecoin’s excellent price performance also surprised the financial world.

- Litecoin hit multiple all-time highs throughout 2017, and in December 2017, Litecoin hit $350, realizing a 250% month-on-month return. Then, the “crypto winter” hit, as some expert have called the period of December 2017 to February 2018, when the cryptocurrency market lost 70% of its market capitalization in under two months. During this volatile market time, Litecoin’s price went back to $100 by mid-2018 and bottomed out to around $30 per coin by the end of the year. In contrast to previous price cycles, though, LTC and its peers had now piqued the interest of mainstream investors.

Market Trends

At the peak of the cryptocurrency euphoria in December 2017, the founder of Litecoin, Charlie Lee issued a warning statement to the cryptocurrency markets. Mr. Lee noted in a series of tweets that a sizable price correction is to hit the market and that buying Litecoin was in fact risky. Not long after, the market experienced a 90% price correction.

While the digital coin market has experienced ups and downs, this is an understandable phenomenon, as immature markets are usually volatile. There are many reasons for that, one of which is that investors tend to greatly speculate about what an asset is worth, especially when the value of that asset is 99% driven by market sentiment. For digital currencies, a 5% – 10% fluctuation range is the norm, and the overall market continues to be volatile.

Market Analysis

There are multiple ways in which Litecoin prices can be analysed and forecasted. The most common tool used by traders is technical analysis, which seeks to identify common patterns (trends) in the market that can signal the future behaviour of the asset in question (Litecoin).

Technical Analysis

In a technical analysis, traders can pick out key “resistance” or “support” lines. These thresholds act as signals for buying / selling opportunities. Other investors use complex algorithms to execute market commands based on mathematical inputs.

Other Methods

In addition to technical analysis, traders also track the value of Litecoin relative to another (mature) asset’s price. When the ratio stretches, this might be a sign that a market correction ensues – a signal used by many investors not only in the cryptocurrency space, but in financial markets overall. The difficulty in adopting this method in the digital currency field is that almost all “assets” are not established or mature enough in terms of price behaviour. However, Litecoin’s price is very often benchmarked against Bitcoin’s.

Another popular method is to outsource the analysis of the market and stick to the predictions given out by expert commentators and successful investors.

Litecoin Fundamentals: Experts’ View

- Smartereum’s prediction: Positive

- Optimistic on Litecoin’s price development and prospects. Smartereum believes that Litecoin

- Litecoin has a solid support network and significant growth potential

- Litecoin’s decentralisation (via an open-source cryptographic protocol) means that no central government agency or authority is involved, and investors can count on autonomy and less regulatory oversight

- According to Smartereum, the currency has undergone numerous technological enhancements indicating a potential to keep up with the changing cryptocurrency market

- Key milestones such as the adoption of the SegWit system and the Lightning Network transaction underscore Litecoin’s adaptability and value

- WalletInvestor’s prediction: Negative

- WalletInvestor, a website made up of cryptocurrency experts, is less optimistic about the outlook for Litecoin in the coming years

- The team uses its own proprietary forecast system and has classified LTC as a “bad” long-term investment opportunity

- WalletInvestor’s real-time forecasts put LTC prices at $77.14 in a year. This equates to a loss of 25% over the forecast horizon

Can Litecoin surpass Bitcoin in terms of value?

As Bitcoin was the first cryptocurrency to be created and Satoshi Nakamoto introduced the technology of blockchain with it, cryptocurrency enthusiasts like to compare the value of different alt coins to the value of Bitcoin. Litecoin and Bitcoin have great similarities in their underlying architecture. There seems to be a positive price correlation between the two coins At the time of this writing, Bitcoin was worth over 100 times as much as Litecoin, on a per-coin basis.

The perception is that Bitcoin is superior to Litecoin – mainly because of Bitcoin’s more limited supply. Once all available supply has been mined there will be 84 million Litecoins in circulation – exactly four times as many Bitcoins (21 million). Litecoin is referred as the “silver to Bitcoin’s gold”, a trend that hints at a psychological barrier to it being accepted as a higher quality alternative.

This gap, whether psychological or technical, can be bridged once Litecoin achieves even higher technological edge over Bitcoin. Experts have pointed out that LIT is around 4x faster than BTC. The growth pace of LTC use has also been more rapid in the past year.

Potential External Influences that Could Impact the LTC Market

Apart from the supply, demand and technological considerations of Litecoin, the cryptocurrency market is highly dependent on external political, societal and economic factors that have the potential to boost or diminish the appeal of Litecoin in the long run.

The first crucial consideration is that of supporting infrastructure. If Litecoin is to become more than just a niche investment it will require widespread adoption as a payment method for merchants, and inclusion at more cryptocurrency ATMs. Further development into these areas will boost LTC’s popularity and long-term value.

Regulations – both at the national and supranational level – will also have a strong impact on the future viability of LTC and its peers. Cryptocurrencies are effectively unrestricted in most jurisdictions at the present moment. However, regulatory requirements will predictably get tighter as governments figure out how to adapt to this new financial technology.

Finally, the rapidly evolving nature of the crypto industry leaves it exposed to disruption. If weaknesses in the underlying blockchain technology were to be exposed, that could hurt Litecoin’s prospects. By the same token, the arrival of a revolutionary new currency further down the line has the potential to indirectly impact LTC.

Conclusion:

Litecoin can be an excellent investment opportunity for an investor, or a very bad one – it all depends on the investor’s portfolio and risk appetite. Just as any cryptocurrency, a guaranteed Litecoin’ price prediction is not possible and volatility in price still prevails the market. Using a range of methods to analyse the market is also a good way to decide if LTC is right for you or not.

PEOPLE WHO READ THIS ALSO VIEWED: