World equity markets have enjoyed a sharp squeeze over past weeks. Sentiment a few weeks back was all about the downside. Prominent investors were only talking about the recession and the trade war escalation. Fast forward, and it is all gone. US markets are close to all time high levels. European indices have all been surging with most indices reaching new highs in a long time. Nobody talks about the Italian crisis anymore (MIB is the best index in Europe this year). The China deal is of little concern, and talking about the recession is yesterday’s news. Impressive!

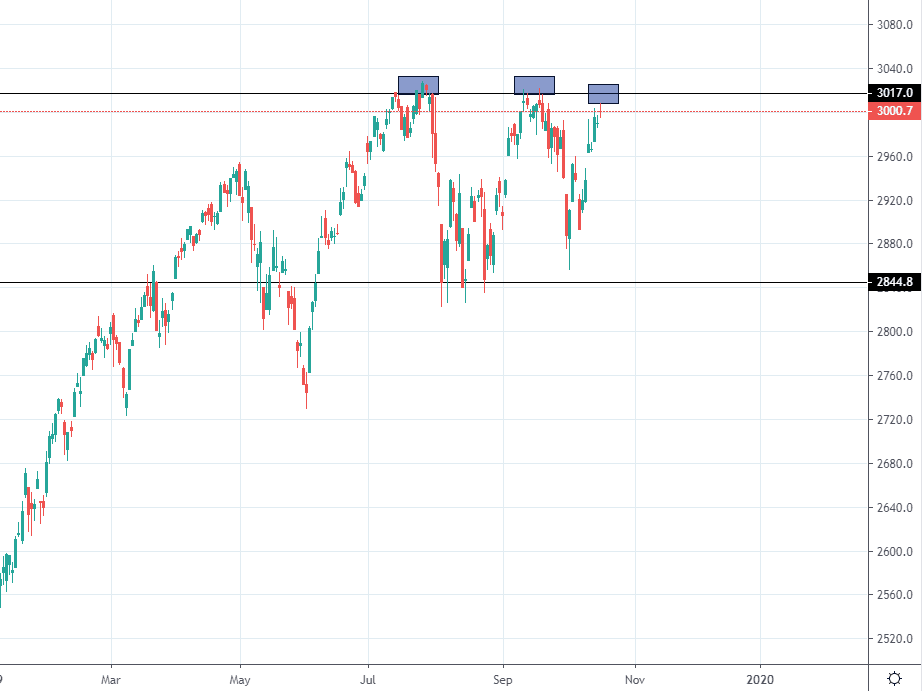

Despite the recent move higher in equities, most big US indices remain stuck in big ranges. Trading ranges can be rewarding, but only if you do not start pushing the break out set ups, as they fail to occur in a range. Most people like pushing momentum as trading ranges is very frustrating at extremes.

Below is the chart of SPX. If I would show this to my youngest, he would say sell. Maybe things are different now, but the resistance at these levels is big and you should “respect” these levels. Trading a range is frustrating as the current “trading story” usually has managed changing shape, although nothing really has changed. This leads to the squeeze or sell off, that makes more and more people believing the “old” story is gone and we can try pushing the break out.

Of course, there are times when we break out of ranges, but this is not the focus right here. Pushing the break out here is a late trade, and given the big resistance levels I would look at taking most chips off the table and start looking at possible shorts. If, contrary to my belief here, the SPX does break out, there will be good opportunities to buy “things” slightly higher.

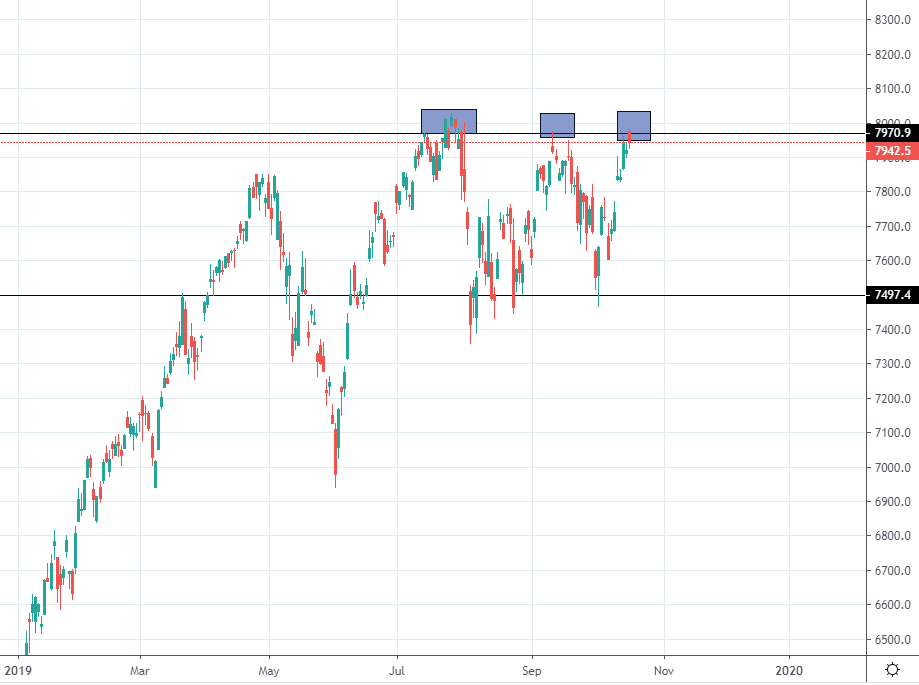

NDX has done exactly the same squeeze move as the SPX. Chasing “them” longs here is not my preferred choice. This is also a “take profits” set up in my view, at least for the short-term trade. Depending on where we go from here in the coming days, I would even be inclined to try a few overall shorts.

It was only 2 weeks ago people spoke about the break down in IWM on CNBC. Since then the small cap space has bounced nicely and is trading in the middle of the range. All trading must have an edge, and trading an index in the middle of a range has no edge to anybody. Forget the IWM here is my view.

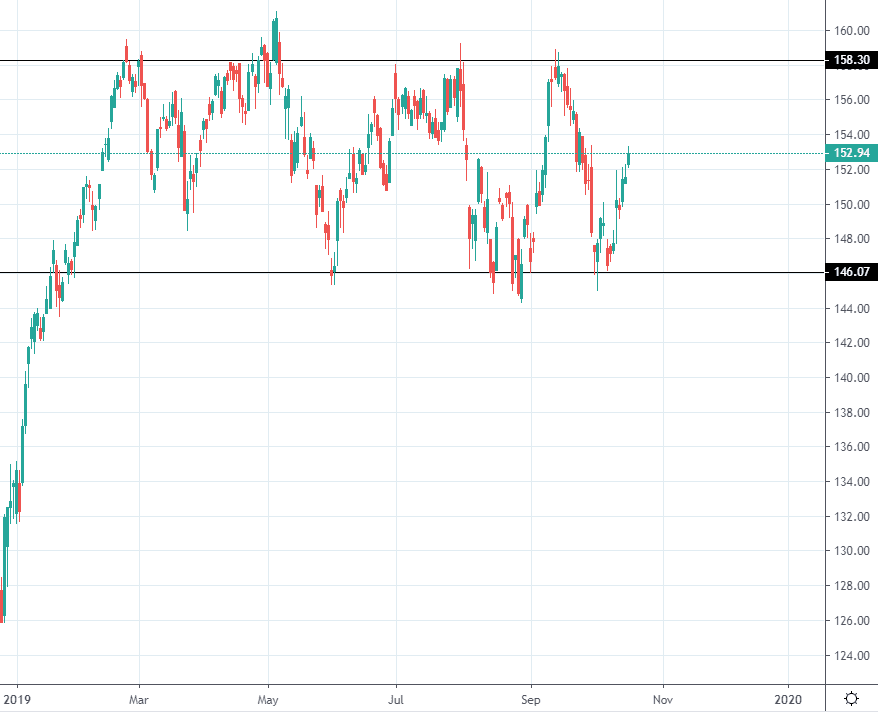

German DAX has enjoyed a big bullish run as some of the worst performing sectors in Europe have rebounded sharply: autos, banks among a few. DAX bounced right on the longer-term trend a few weeks ago, but chasing it here looks very late. This would be a “scared” short, but definitely another index where you “take chips off the table”.

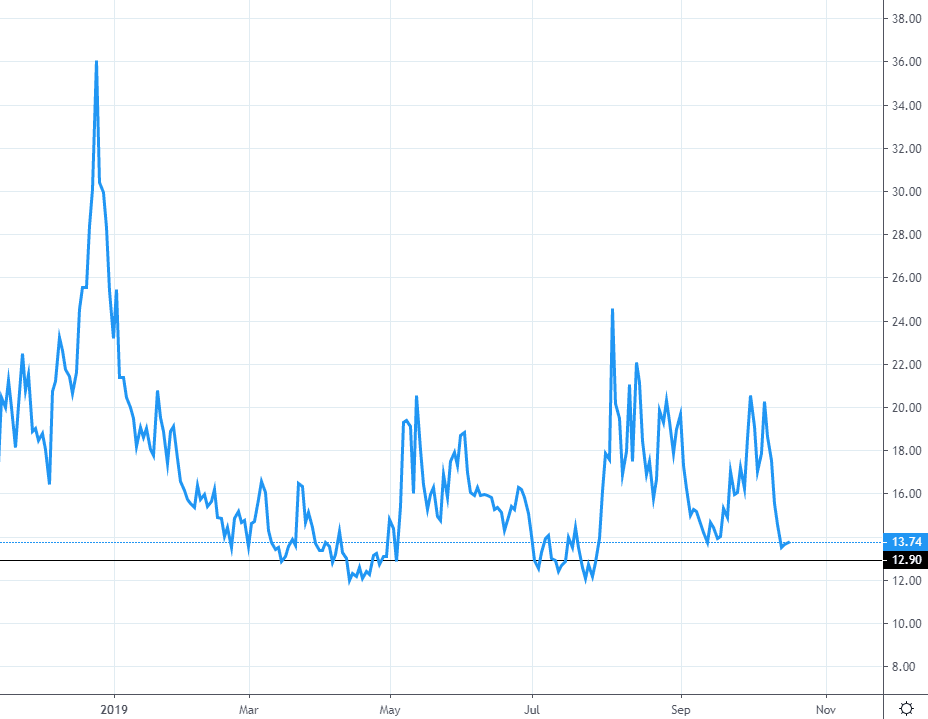

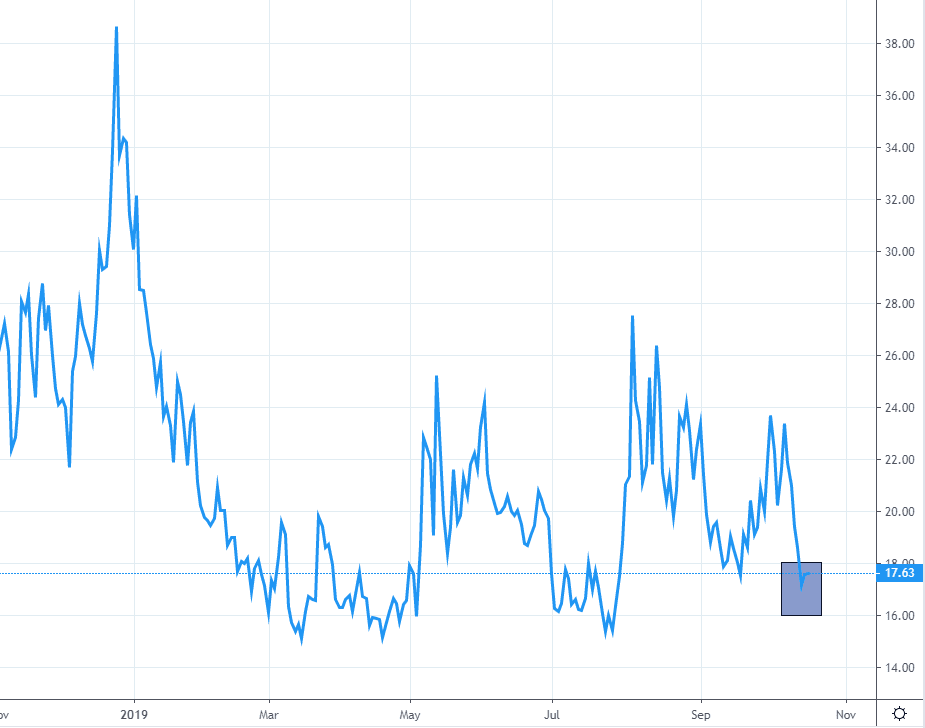

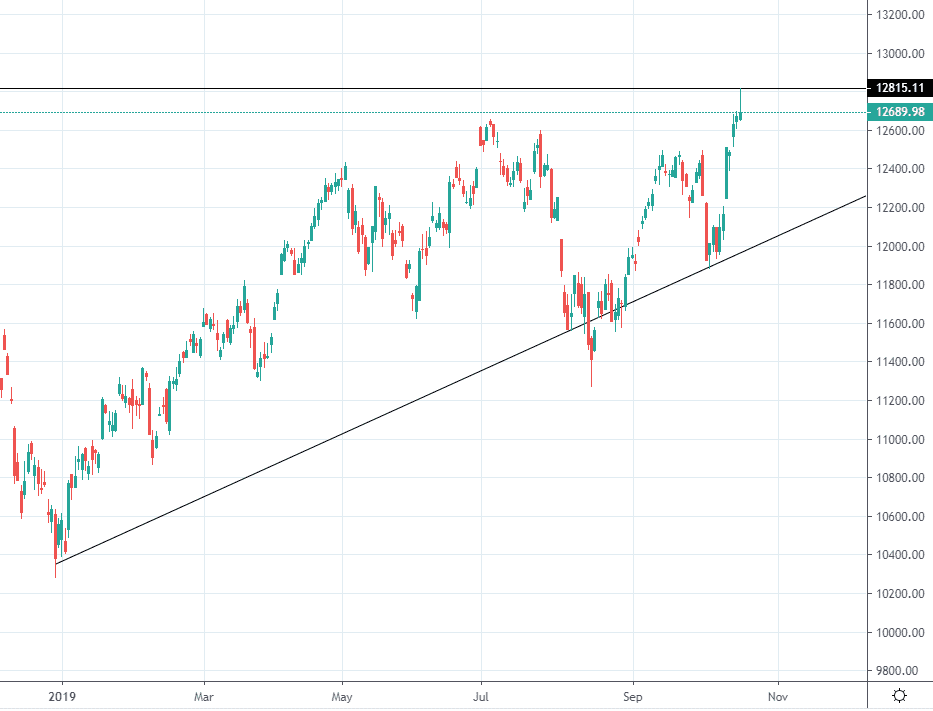

As equities have rebounded strongly, people have once again been caught wrong in volatility. The mini panic we saw earlier resulted in people buying protection at way too high levels. Once again, the same scenario has played out. People have realized once again they wasted money on hedges and have over the past days been selling volatility aggressively.

VIX at these levels is pricing very little “external “risk. Do recall that Trump can send another tweet any time. Of course, anything can happen anytime, but at current levels of volatility, the hedges look appealing.

Below VIX and Nasdaq volatility index, VXN.