- A lull in anti-government protests has allowed the Hong Kong dollar to rally.

- The currency, which is pegged to the US dollar, is not seen as the most exciting to trade.

- The price range might be tight, but the moves still allow opportunities for profits and losses – as many traders are currently finding out.

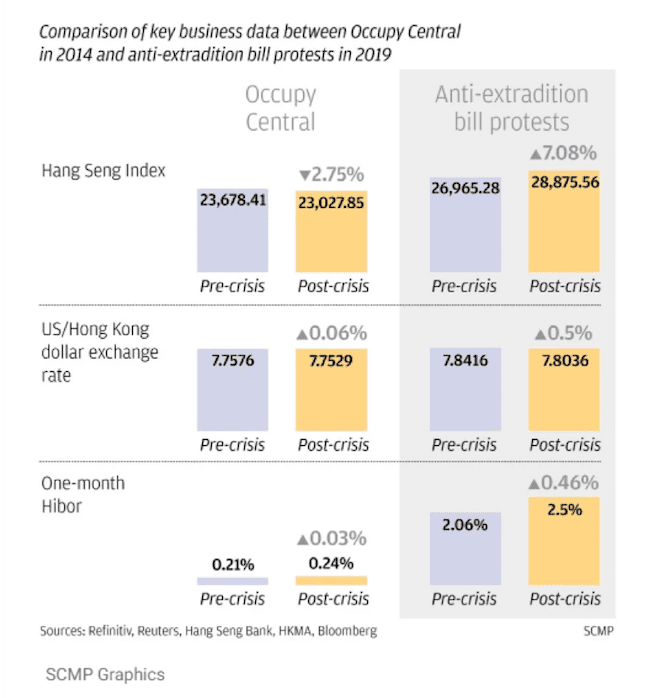

The anti-government protests in Hong Kong are undergoing a change. The demonstrations, which have taken place for over six months, appear to currently be shifting away from mass street-level protests. With no discernible figurehead for the movement, it’s hard to tell if the change in direction is temporary or permanent. The ‘five’ demands of the protestors are still a popular rallying cry, but it’s hard to establish how or if both sides might manage to negotiate a settlement.

The first weekends of protests saw millions of Hong Kong residents take to the streets to protest against the extradition treaty with China that sparked the uprising. After the chief executive Carrie Lam withdrew that proposal, the anti-government movement drew strength from various other sources of social discontent as increasingly violent protests marked each weekend. The South China Morning Postreported on Tuesday that:

“Social workers rallied in Central on Tuesday to urge Hongkongers to join a three-day strike over what they called a humanitarian crisis facing the city … The activists gathered in Edinburgh Place in support of anti-government protesters and to condemn police’s handling of the demonstrations during six months of unrest.”

Source: South China Morning Post

The number of protestors taking part is quoted as only 200.

The protest movement risks running out of steam unless it focuses on attainable issues. Whether they consider their adversary at the negotiating table to be the Hong Kong administration or Beijing, both of those parties have a lot more resources available to them to see the situation out.

One route towards having some of the ‘five’ demands met would be to channel anti-government sentiment through the district councils, which are now largely controlled by the pro-democracy camp. The use of tear gas, for example, could be challenged as the ‘one country, two systems’ policy itself included causes that state that action cannot be taken that would directly affect residents’ welfare. Even a probe into police conduct can be considered council business. It’s too early to tell if the more muted nature of protesting is a sign of fatigue, university campus holidays, or a cunning move towards a more political approach. For the markets, and particularly the Hong Kong dollar, it has signalled a moment of relief.

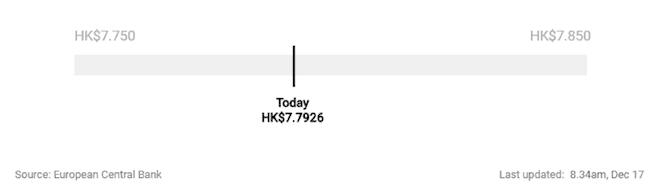

Dollar peg

The Hong Kong dollar is pegged to the US dollar. Tying HKD to USD is the legacy of a previous financial crisis in the 1980s and the stability that it enables has helped drive Hong Kong economic growth. The range of values that the currency operates in is currently $7.750-$7.850. If and when HKD trades near the low end of the band, the city’s de facto central bank, the Hong Kong Monetary Authority (HKMA), is bound to start buying up the currency to boost its value. The fact that it is currently trading in mid-range at $7.7926 belies the underlying stresses that HKD and the peg have been operating under.

Although the range is tight, there are still opportunities to profit from currency moves, and the political unrest has led to increasing pressures on the currency and the system.

Back on 30th October, CNBC reported that the HKMA had stated that “there is no obvious outflow of capital from the city’s banking system and that the local currency is largely stable.”

Source: CNBC

Fast forward to 17th December and the same subject is generating different headlines:

“Hong Kong unrest has led to as much as $5 billion in capital outflows, Bank of England says”

Source: CNBC

The Bank of England monitors the Hong Kong financial markets due to HSBC and Standard Chartered having such close links to the region. CNBC expressed the outward cash flows identified by the bank’s report, which was released on Monday, as accounting “for nearly 1.25% of the region’s GDP.”

Source: CNBC

The $5bn figure quoted denotes the move between August and December. Analysts at Goldman Sachs had suggested in October that about $4bn of deposits might have left Hong Kong for Singapore between June and August. There is a discrepancy between the official figures reported by the HKMA and other industry sources. The Band of England’s ‘Financial Stability Report’ went on to say:

“These political tensions pose risks, given Hong Kong’s position as a major financial center.”

Source: CNBC

Cash is king

At face value, this looks like an opportunity to short a currency that is being supported by a small regional institution that is trying to buck the market. There are many instances of this scenario being played out, and the market tends to win. The list of examples includes sterling leaving the Exchange Rate Mechanism in 1992, the ultimately futile actions of the Treasury calculated to have cost £3.14bn. While the peg on HKD might not actually break, there would to some appear to be room to the downside. As it turns out, the opposite has been the case.

The capital outflows appear to reflect the political mood prior to tensions easing. Slight strength in HKD has caused something of a short squeeze as stop losses have been triggered on bets against the smaller currency.

HKD rose as much as 0.13% to 7.7867 versus USD on Monday, taking its six-day gain to about 0.5% – small in international terms but sizeable for a pegged currency.

Three triggers appear to have played a part. Year-end regulatory reporting is approaching, which means that Hong Kong banks are increasingly happy to hold cash on their balance sheet and forego the returns of lending to third parties. Projected interest rate moves appear to favour HKD strength and USD weakness, and the easing of trade tensions between China and the US has also helped. Those looking to take long positions in Hong Kong assets have been buying up the currency.