In trading, managing risk is essential to ensuring long-term success. There are various risk management strategies you can employ, and trailing stop-loss orders stand out as a versatile tool for minimising potential losses.

YOUR CAPITAL IS AT RISK

The right trailing stop will keep you in a trade for the duration of the trend and take you out when the trend is exhausted. It will protect you from closing a trade too soon or too late. In this article, we will cover the best stop-loss strategies you can utilise.

Table of contents

What Is a Trailing Stop Loss Order and How Does It Work?

A trailing stop is a stop-loss order that tracks the price of the asset you are trading and is automatically adjusted. The trailing stop is different from the traditional stop-loss order as it moves in line with the asset’s price, hence securing your profits.

A trailing stop loss is usually set at a fixed distance away from the current market price and moves in line with the price. If the trailing stop is placed on a buy trade, it will rise as the price rises while maintaining the set distance. However, the trailing stop loss will not move if the price reverses, closing your trade.

Let’s say we opened a buy trade on the EUR/USD currency pair trading at 1.1200 and had a 15-point trailing stop on our position. The trailing stop would be positioned at 1.1185 at the start but would keep rising with the currency pair’s price.

Over the course of the day, the EUR/USD currency pair rallied to a high of 1.1300, giving us an open profit of 100 pips with our trailing stop at 1.1285. The next day, we have negative news from the eurozone triggering a selloff in the pair to a low of 1.1250.

However, our trade will be closed at 1.1285. This is where the trailing stop was positioned protecting much of our open profits.

Trailing Stop-Loss Strategies

With this in mind, let’s move on to potential trailing stop-loss strategies to deploy in your trading strategy.

Strategy 1: Average True Range (ATR)

The Average True Range (ATR) trailing stop strategy is one of the best trailing stop-loss strategies and is very popular among traders. The strategy’s popularity is based on the fact that it is based on an asset’s current volatility. Hence, it is an accurate reflection of the price action.

Most traders use the 3 ATR values as their preferred trailing stop-limit since it gives trades a sufficient distance to run. Let’s compare the different ATR values and how they respond to price changes.

The main advantage of the ATR trailing stop is that it moves with the price and locks in profits on open trades. It works well when automated, as it can work independently even when you are not monitoring your trades.

For example, you can use the ATR values on the hourly chart if you want to hold the trade intra-day or for a few days. You can switch to the ATR values on the daily chart if you plan to hold your trades for several days at the least, extending into a week or more.

YOUR CAPITAL IS AT RISK

1 ATR trailing stop-limit

You can see that you would have been stopped out of the trade very early and missed out on the rest of the trend.

2 ATR trailing stop-limit

The 2 ATR trailing stop distance is much better and would have kept you in the trade for much longer.

3 ATR trailing stop-loss distance

While the 3 ATR trailing stop-loss limit is much better, it would not have been enough to keep you in the trade for the entire duration.

YOUR CAPITAL IS AT RISK

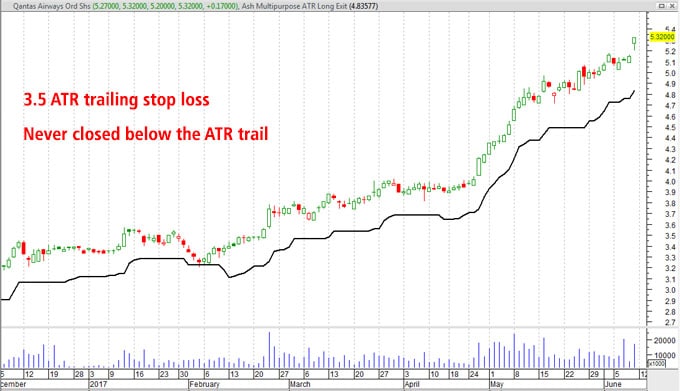

3.5 ATR stop-loss distance

In this trade, a trailing stop-loss distance of 3.5 ATR values would have kept you in the trade for much longer, leading to your reaping the trade's maximum profits.

From the above charts, it is clear that the wider trailing stop-loss distance could have kept you in the trade for longer than the smaller ATR multiples.

Strategy 2: Moving Average (MA)

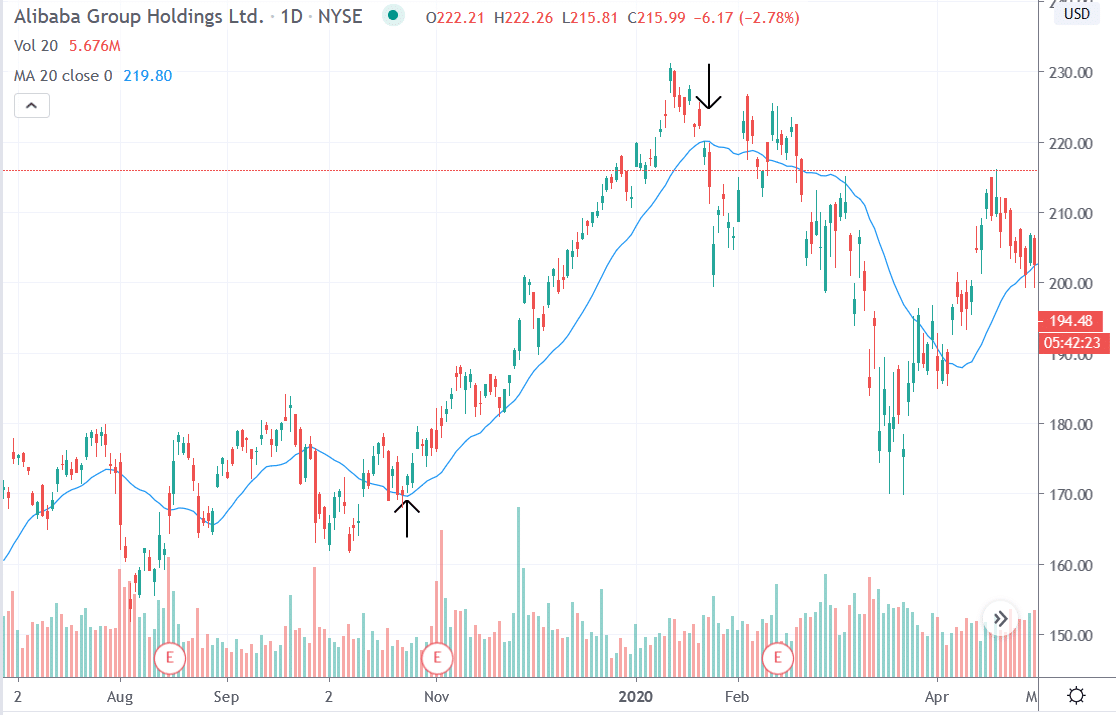

You can also use the moving average indicator as a trailing stop, given that it tracks the price of an asset very smoothly. The MA works in much the same way as the ATR indicator, but you cannot have multiple MA, as is the case with the ATR.

Most traders use the 20-period moving average or exponential moving average (EMA) to ride a trend up to exhaustion. Therefore, you can use the same setting to stay in a trending trade up until the trend is exhausted and the MA takes you out of the trade.

You can see that the MA trailing stop above would have kept you in the bullish trend on Alibaba stock, which started on October 24, 2019, and lasted for three months up to January 27, 2020.

You can automate your trailing stop-loss orders and limit orders by using Expert Advisors made to track changes in the ATR, the MA, and any other indicator you choose.

The main advantage of the ATR and MA trailing stop-loss indicators is that a spike in the price may cause them to be triggered, kicking you out of the trade. You could be taken out of a trade prematurely due to the spike since the ATR and MA are lagging indicators; hence, they will not react immediately to sudden price changes.

YOUR CAPITAL IS AT RISK

What Is a Good Percentage For a Trailing Stop-Loss Strategy?

A good trailing stop-loss percentage to use in this strategy is either 15% or 20%, which works most of the time for stocks. Another way to determine a trailing stop-loss distance is to use the stock's average volatility as a guide.

However, a 15% move in a currency pair is almost impossible as most currencies move about 0.5% – 2.0% daily. Therefore, the best way to set a trailing stop on a currency pair is to use pip values known as points, with most traders preferring to use 15-20 points (pips).

FAQs

A trailing stop-limit is an order that allows traders to set a limit to their losses while enabling them to reap maximum profits from their trades. A trailing stop-limit moves with the price when the market moves in your favour.

The trailing stop-limit order works by continually moving in line with the price if it is going in your chosen direction. However, the trailing stop-limit remains fixed if the price reverses and starts moving in the opposite direction. You will be taken out of the trade once the price hits the trailing stop-limit order.

A trailing stop-loss order is a market order that instructs your broker to close the trade once the price hits the specified level. However, a trailing stop-limit order requires the broker to close your position at the fixed price or better. A trailing stop-limit ensures that you get the price you requested or better, unlike a trailing stop-loss order, which could be filled at a worse price than you wanted.

The main difference between a stop-loss order and a trailing stop-loss is that a traditional stop is fixed, while a trailing stop moves with the asset’s price. The trailing stop also locks in your profit once the price moves in your favour, unlike the normal stop-loss, which remains fixed below or above your entry price at all times.