- Some firms with big market caps have had a barn-storming decade.

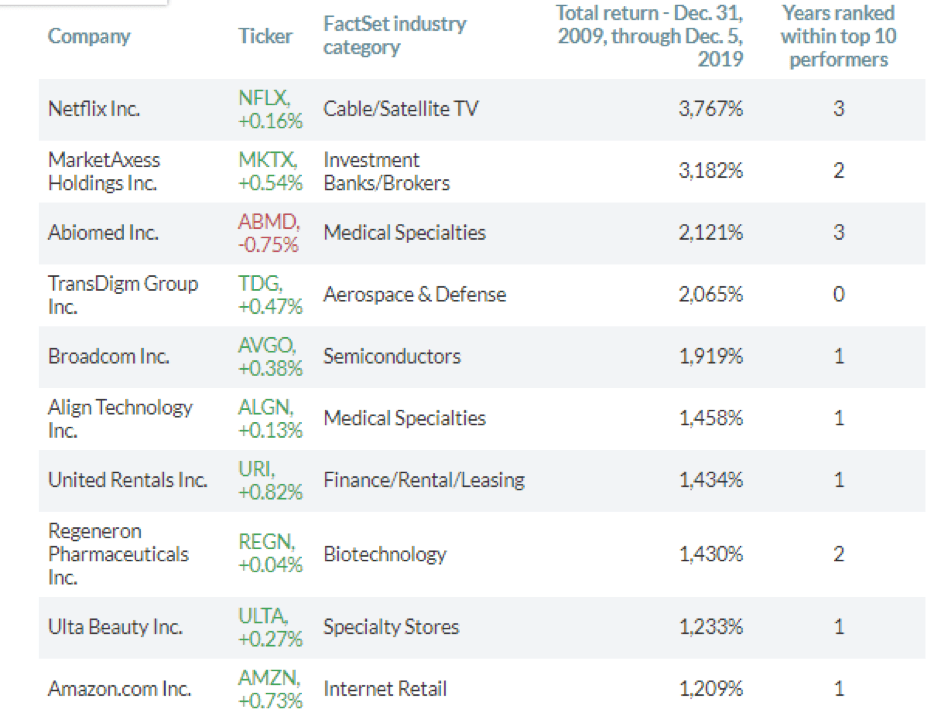

- Investors in the equities of a host of firms have made returns of up to 3,767% in ten years.

- The positions have combined abnormally high returns with relative security. These weren’t high risk-return unicorns but everyday firms and well-known brands.

Looking in the rear-view mirror might not necessarily help those looking to navigate the financial markets of the future. But then again, as information goes, back data is as useful a tool as is available. The passage into a new decade provides a timely opportunity to analyse which trends have brought about the greatest profits. There is no reason to suggest the winners of the last decade will be the winners of the next, but there may be some juice left in the now identifiable trends.

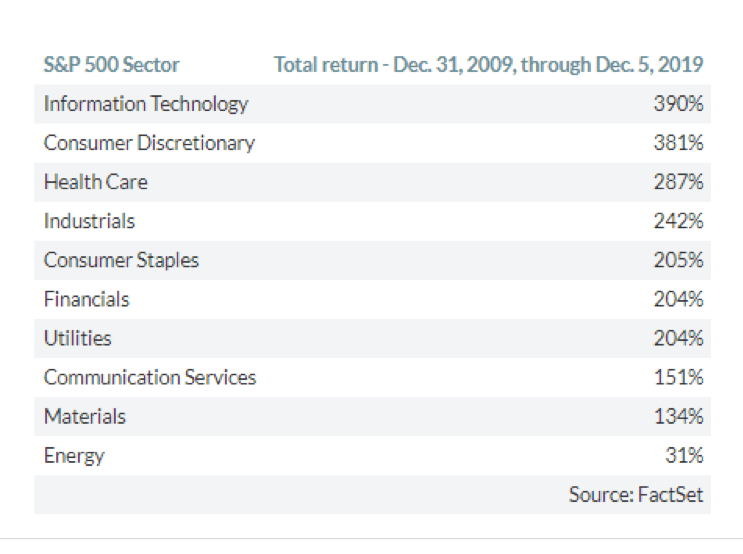

Industry site MarketWatch calculates that the S&P 500 index, which includes the 500 US-listed firms with the largest market capitalisation, is over a 10-year period posting a net return of 244%. This includes reinvested dividend and represents an annual compound interest of 13.2%. The years 2009–2019 proved particularly fruitful for equity investors.

The last 10 years have seen equities perform better than the long-term average. Another trend is that the strength has also been concentrated in US stocks. Interestingly the valuation of equities on a traditional price to earnings (p/e) ratio does suggest the outperformance is not all hot air.

Toppy?

The S&P 500 price to earnings ratio was 17.6 in 2010 and whilst that multiple has crept up to approximately 21, it has managed to keep pace with equity prices 10 years later. Corporate earnings have blossomed as the aftershocks of the great financial crisis of 2008 have subsided.

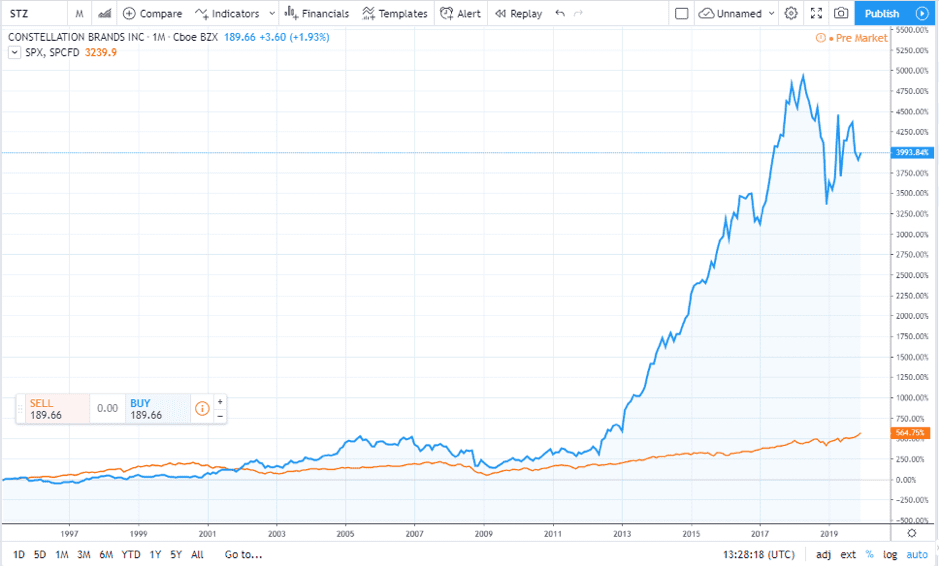

As confidence returned, firms that had rationalised their businesses in the aftermath of 2008–9 reaped the benefits of being leaner and hungrier. Headlines at the start of the decade still mentioned the Greek government debt crisis. By comparison, by 2018 one of the largest brewers in the world, Constellation Brands (NYSE:STZ), was looking to diversify its production by investing $4bn in Canadian cannabis firm Canopy Growth (TSE:WEED). It has been firms such as Constellation Brands, which have demonstrated a dynamic approach that have reaped the most rewards. The chart of performance between 1997–2019 shows the take-off in share price is a relatively recent event.

Constellation Brands (NYSE:STZ) vs S&P 500 index 1997–2019:

Constellation Brands has posted returns of $1,124% over the decade, making it the top performer in the consumer staples sector. A long position of $100 would have therefore been converted into $1,224.

Front runners

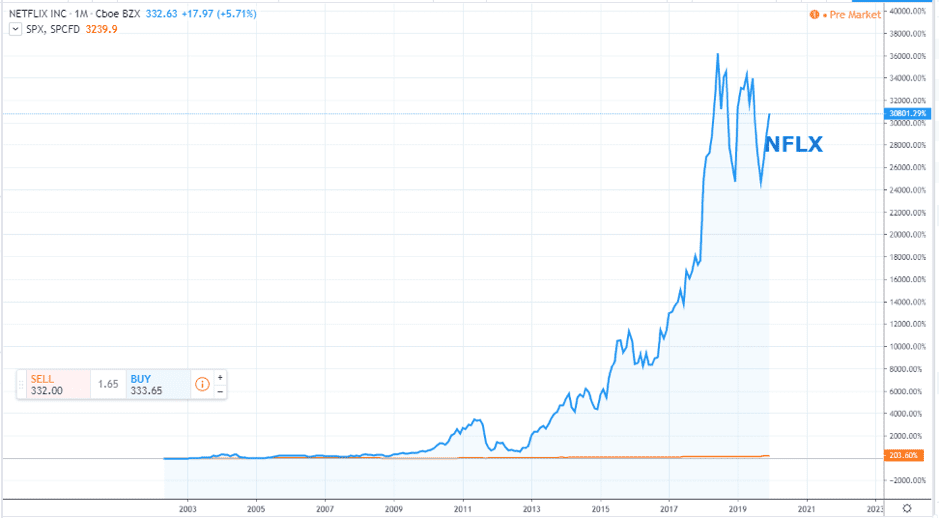

Whilst holders of Constellation Brands stock would be pleased enough with the firm’s performance, over the decade the absolute leader is Netflix (NASDAQ:NFLX), which over the same time gained 386.7%

NETFLIX (NASDAQ:NFLX) vs S&P 500 index 2003–2019:

Netflix gave a hint about its imminent surge prior to 2010. Like Constellation Brands, Netflix, which has been a pioneer of the home streaming service, found success through dynamism and invention. The firm transformed itself from a DVD hire and sales mailing service into a firm with a market cap of $145bn and 148 million paid subscribers.

The top 10 performers over the decade all posted returns in excess of 1,200%.

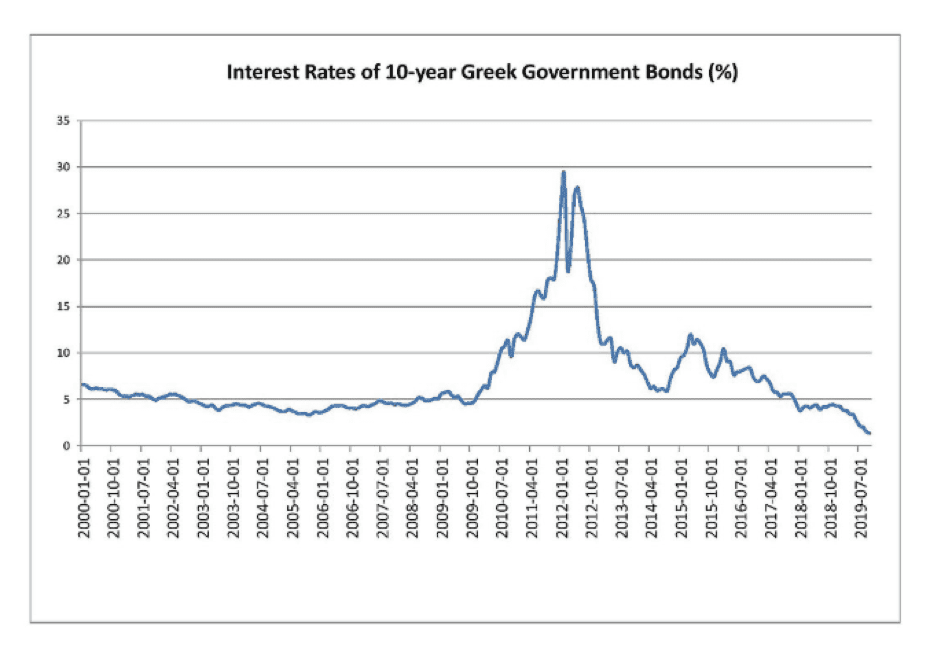

Rates

Whilst business managers deserve some credit for the rallying equity prices, there are factors outside of their control that have spurred the price rise. Antoine Gara of Forbes.com said:

“The biggest driver of the current prosperity has been the flood of easy capital spurred on by Federal Reserve and the European Central Bank. Interest rates in the U.S. have been near 0% for the better part of the decade and in countries like Switzerland and Japan they have actually turned negative.”

Source: Forbes

This explanation for the strong equity markets also picks out reasons for certain sectors outperforming:

“With low rates and dividend yields under pressure, growth stocks have led the way on Wall Street — especially for companies with digital, rather than hard assets.”

Source: Forbes

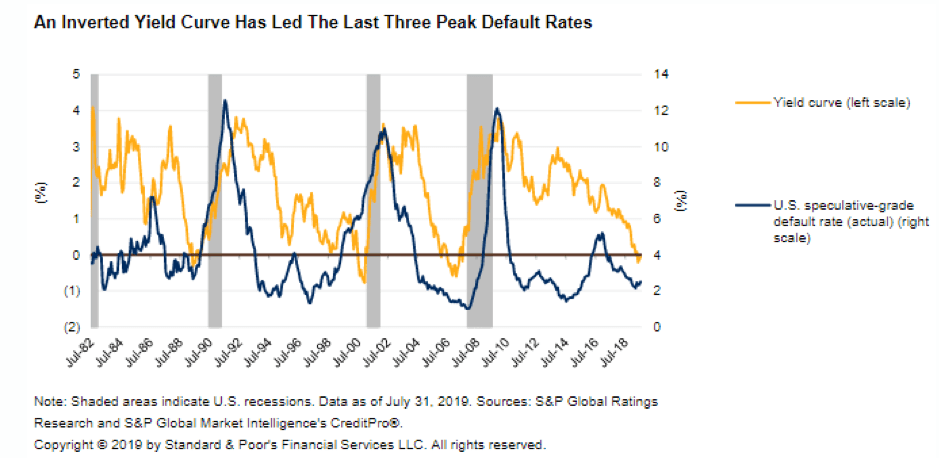

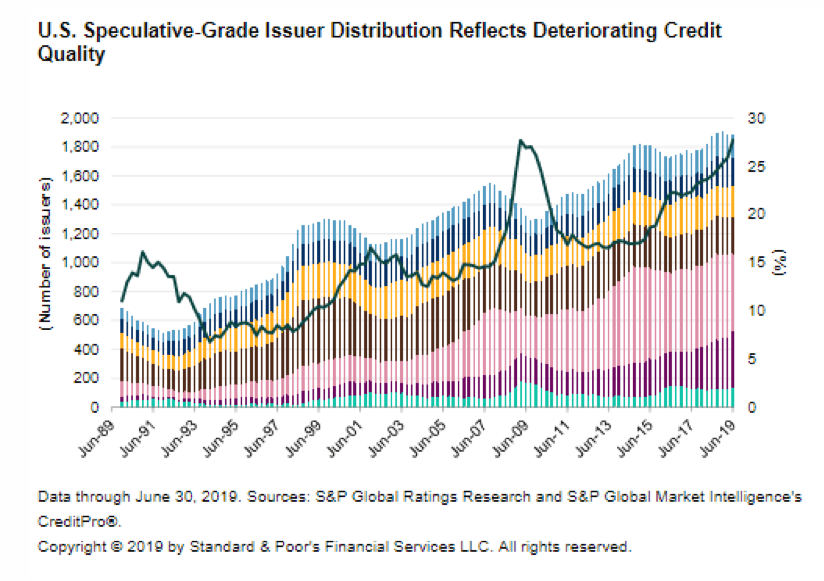

Low interest rates have also allowed less competitive firms to borrow their way out of difficulties. Counterparty default can be a drag on the bottom line for even the most well-run firms. As well as the direct hit there is the fact that it drives up the cost of borrowing for all. That trend could be about to turn. The inverted yield curve phenomena, which gained substantial media coverage in summer 2019, could signify that particular trend is about to turn.

Back data

Hindsight is a wonderful thing unless it acts as a painful reminder of the wrong trading decisions being made. Those that missed out on the 10-year long party are left wondering if there is still time to join in.

Some sectors such as energy, posted sluggish returns over the same time period. The 31% return came during the longest bull market in history and acts as a reminder that things aren’t as easy as they might appear. As the decade draws to a close, Netflix is facing considerable challenges from rivals such as Disney and Amazon, who have entered into the streaming market.

If the geopolitical environment continues its trend towards conditions, and if the firms listed continue to beat analyst expectations at earnings season, then some kind of return can be expected. These are big ‘ifs’ and it would take only a few slip-ups for the narrative to switch to the current growth cycle being in its mature leg.