Founded in 2014, IQ Option is one of the fastest growing online trading platforms in the world. IQ Option provides traders with access to thousands of trading and investment opportunities across stocks, ETFs, forex and cryptocurrencies.

Based in Cyprus and regulated in the EU by the Cyprus Securities and Exchange Commission (CySec), as well as several other leading financial authorities, IQ option provides a good place to trade for its global community of millions of registered users.

But is IQ Option the right broker for you? In this IQ Option review, we’ll be taking a look at everything you need to know about this broker, including account types, what fees to expect, regulation, trading platforms on offer and more.

What Can You Trade?

Forex

| Min Deposit | App Support | Max Leverage | Trading Fees |

| $/€50 | Good | 1:30 | Low |

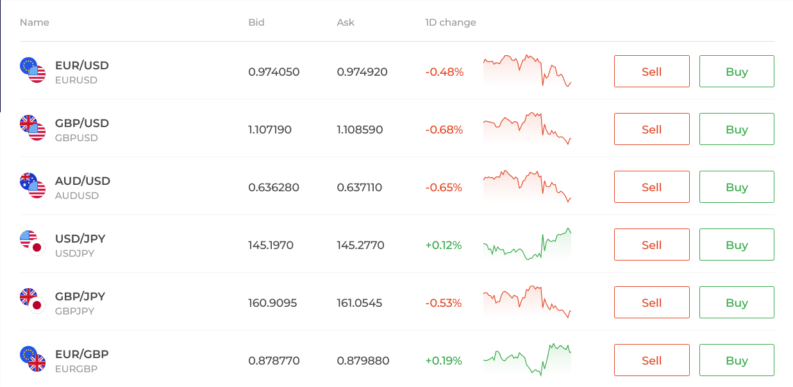

IQ Option offers traditional forex trading in the form of FX options and spot forex trading. Users have access to a wide wide variety of currency pairs, including majors, minors, and exotics. In total, there are over 30 currency pairs. Below is a selection of some of the most popular forex pairs:

IQ Option offers a solid mix of currency pairs that is very much on par with its competitors. In line with ESMA (European Securities and Markets Authority) regulation, maximum leverage rates – which IQ Option calls a ‘Multiplier’ – of up to 1:30 are available for retail clients, although we should point out that the maximum available leverage will vary depending on the currency pair you opt for.

For example, the maximum leverage rate (1:3o) is only available on 14 of the 44 FX pairs available, which is around 32%. Fortunately, this included the most popular currency pairs such as GBP/USD, USD/JPY, EUR/GBP and EUR/CHF. For everything else, the maximum leverage that is available is 1:20. Spreads are competitive when compared against competitors, starting at 0.3 pips on major currency pairs such as EUR/GBP.

As a market maker, IQ Option has lower entry requirements versus ECN brokers, which typically have larger minimum trade and capital requirements. For traders, this means they can benefit from lower minimum deposits and smaller minimum trades with no commission fees.

This is reflected by a minimum deposit level of 50 $/€ and no swap fees for holding positions overnight – a benefit offered by very few brokers. Overall, the number of currency pairs available, along with competitive leverage rates up to 1:30 and a minimum deposit of 50 $/€ makes IQ Option a great choice for FX traders.

CFDs

| Min Deposit | App Support | Max Leverage | Trading Fees |

| $/€50 | Good | 1:30 | Mid |

IQ Option offers its users a wide variety of CFDs (Contracts for Difference) to choose from, including:

| Instrument | No. Available |

| Currency pairs | Over 30 |

| Stocks | Over 190 |

| Cryptocurrencies | 12 |

| Commodities | 3 |

| ETFs | Over 20 |

Stocks

| Min Deposit | App Support | Max Leverage | Trading Fees |

| $/€10 | Mid | 1:5 | Mid |

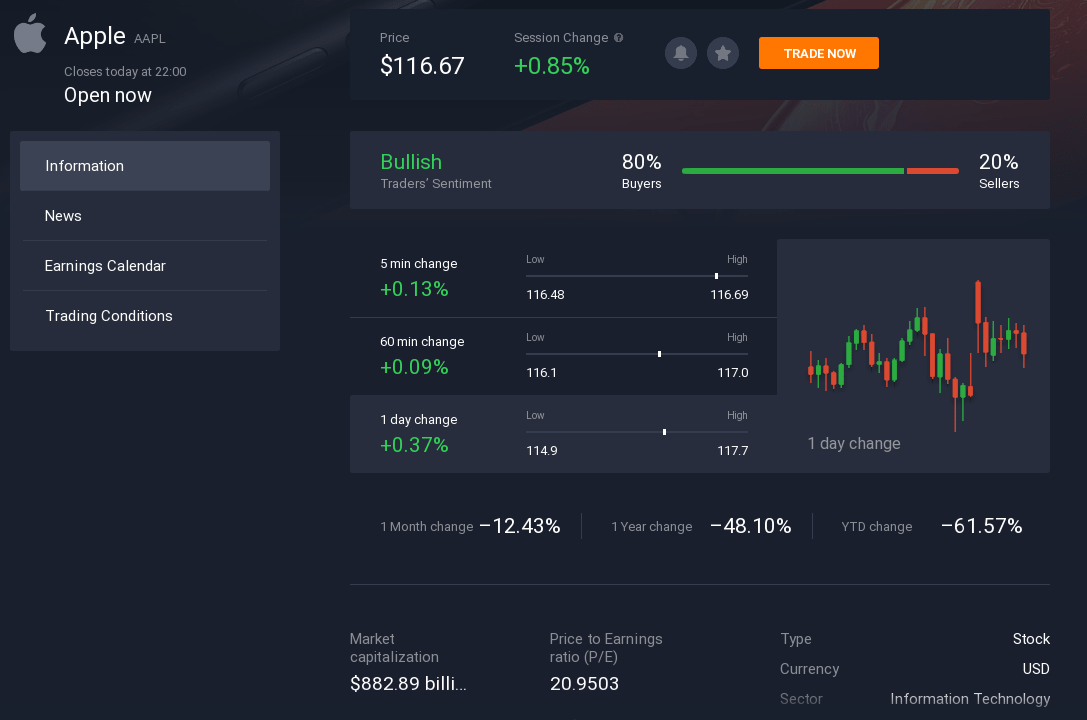

The IQ Option trading platform allows you to trade stock in the world’s leading businesses listed on NASDAQ and the NYSE including Apple, Facebook, Tesla and more. In total, this broker offers traders access to 181 stock CFD which is comprised of a mix of traditional blue-chip stocks and stocks drawn from a wide range of sectors including Energy, Healthcare and Real Estate.

With just 181 to choose from, IQ Option doesn’t offer nearly as many stocks to choose from as some of its competitors. However, with a focus on quality and not quantity, there is more than enough choice for the average trader looking to start trading stocks.

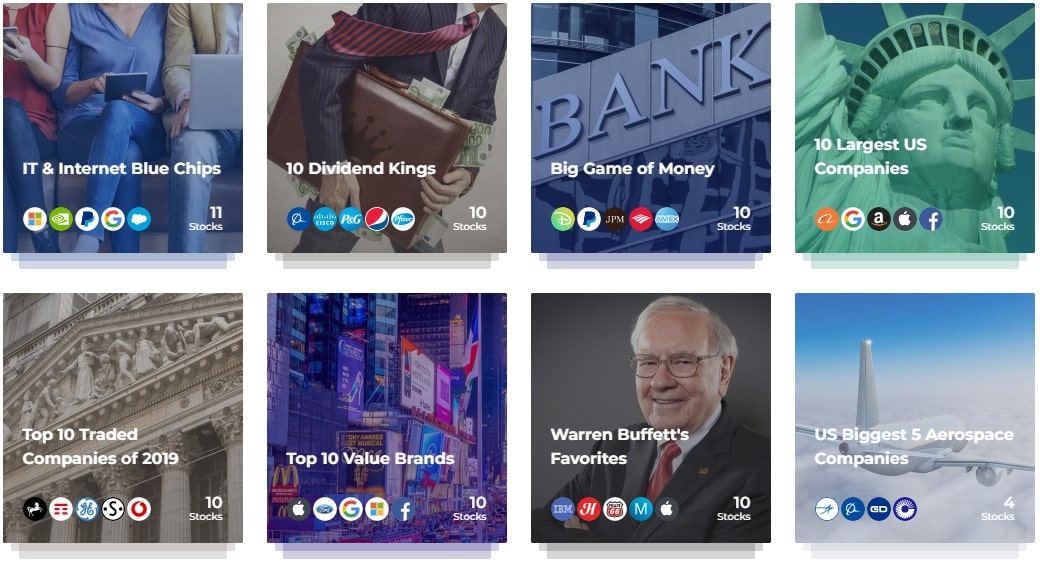

One thing we really liked was how IQ Option curates its stocks into user-friendly ‘collections’. If you’re a new trader or just don’t know where to start, this is particularly useful as it puts similar stocks into ‘buckets’ that you can invest in:

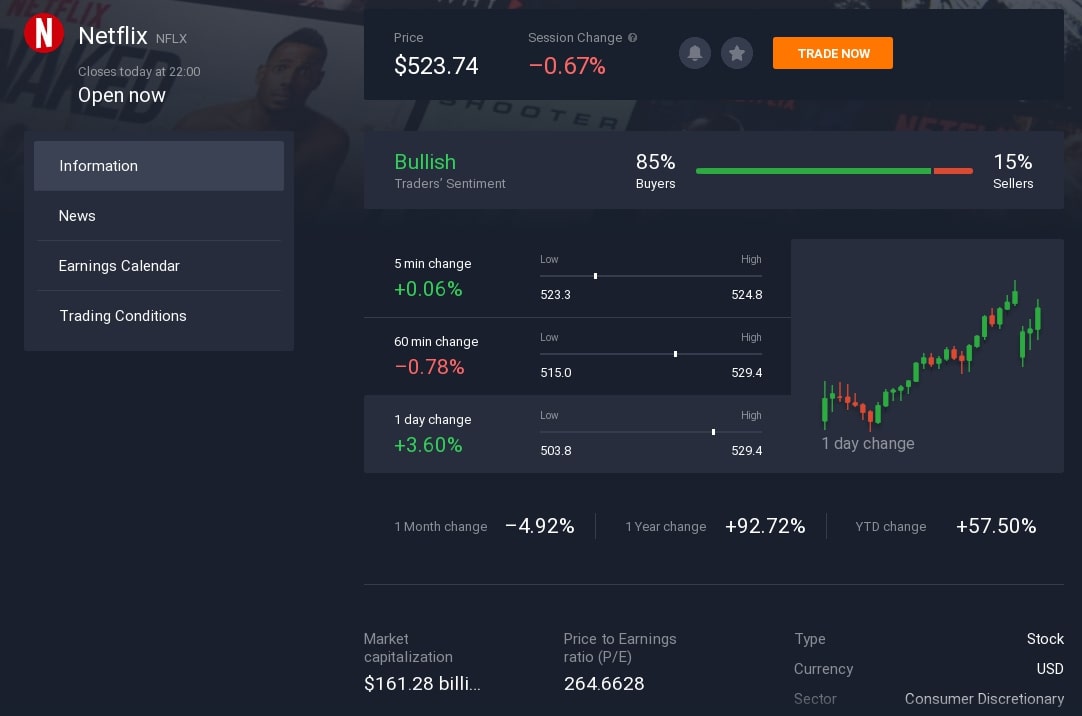

Inside the platform itself, you also have access to a handy information page for each stock which provides a visual ‘snapshot’ about how a particular stock is performing. For example, in our example, we can see that Netflix (NFLX) at the time of writing is in a bullish trend:

Leverage of up to 5:1 (x5) is available on all stocks for retail clients, with razor-thin spreads starting as low 0.003 on selected stocks. In general, however, you can expect to see spreads starting from 0.01 on the more popular stocks.

Overall, a low minimum deposit combined with a solid – if unspectacular – portfolio of supported stocks, in addition to a user-friendly and powerful trading platform, makes IQ Option a great all-round choice if you’re looking to trade stocks.

Related

ETFs

| Min Deposit | App Support | Max Leverage | Trading Fees |

| €50 | 500 | 1:5 | Low |

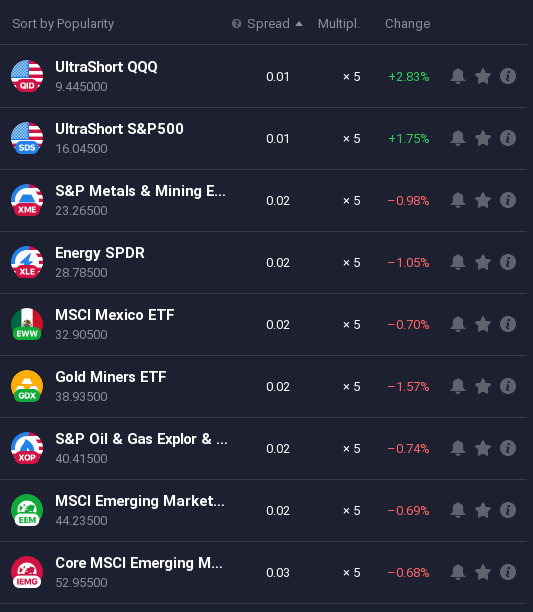

IQ Option offers users the ability to trade in 24 of the most popular ETFs such as the S&P 500 ETF from across sectors such as technology, energy real estate and more. You’ll also find the ETFMG Alternative Harvest ETF, which tracks the performance of companies within the burgeoning cannabis ecosystem.

Competitive leverage rates of 1:5 are available for retail clients, with tight spreads starting in mico lots starting at 0.01. Overall, the number of ETFs available is ample choice for most traders looking to diversify their portfolios and take advantage of traditional ETF benefits such as lower costs and tax benefits.

Cryptocurrencies

| Min Deposit | App Support | Max Leverage | Trading Fees |

| €50 | Regular | 1:30 | Low |

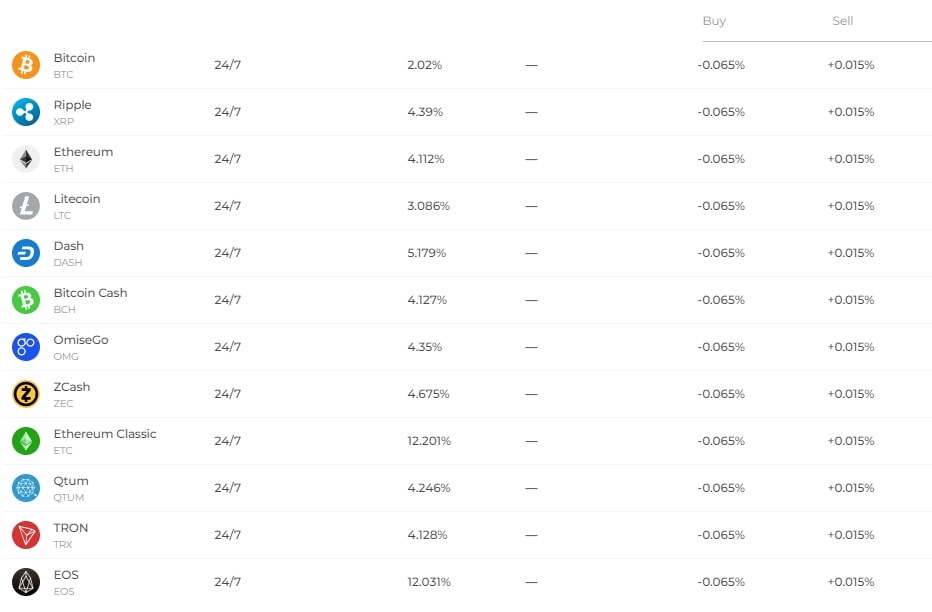

IQ Option recently added a selection of 12 cryptocurrencies to trade in, which are available as CFDs or Contracts for Difference. This includes popular cryptocurrencies such as Bitcoin, Litecoin and Ethereum, as well as lesser-known altcoins such as EOS, Qtum, Dash and Tron.

While this is far from the highest number available in the market, there is a solid mix of common cryptocurrencies and niche altcoins for aspiring crypto-traders.

Like other brokers, IQ Option makes its money off the spread. or the difference between the bid and ask price of a cryptocurrency. The bid-ask is expressed percentage, for example, the spread on Bitcoin at the time of writing is 2.02%:

‘Buy’ and ‘Sell’ refers to the fee involved for overnight funding, also known as swap fees, for positions held overnight. Leverage (which IQ Option calls a ‘multiplier’) of up to 1:2 (or x2) is available on cryptocurrency CFDs for EU residents.

It’s worth pointing out that this is very much in line with other brokers as, under ESMA regulation, brokers are not allowed to offer leverage greater than 2:1 on cryptocurrencies.

Overall, the ability to start trading cryptocurrencies with as little as 50€ combined with an easy-to-use platform packed full of useful features and a solid number of supported coins makes IQ Option a great choice for traders interested in cryptocurrencies.

Related

What did our traders think after reviewing the critical criteria?

Fees

As we’ve mentioned previously, IQ Option is a ‘market maker’ broker, which brings with it several advantages from a fee perspective, including no commission, fixed spreads and extremely low initial deposits.

Currency price movements are also less volatile when you trade using ‘Market Makers’ such as IQ Option, although this can be a disadvantage depending on your trading style, for example, scalping.

Trading Fees

There are no deposit fees (*currency conversion fee might apply) at IQ Option. In addition, the deposit amount of 50 $/€ is below the amount required by other comparable trading platforms. There are also no commission fees applied to your trades. The only exception to this is if you open a ‘long’ cryptocurrency position, in which case a 2.9% fee will be charged.

For example, if you invest $/€ 10 to buy the equivalent amount in Bitcoin, you will be charged $/€ 0.29 (2.9% of $/€ 10) for opening the position. While IQ Option claims to charge no swap fees, this isn’t quite the case.

It states that it reserves the right to charge swap fees of 0.01% – 0.6% and, in extreme circumstances, up to 1.7% on forex, ETFs, cryptocurrencies, commodities and indices.

Non-Trading Fees

While there are no withdrawal fees if you use a Payment Service Provider (PSP) to withdraw funds, there is a $31 fee on every transaction if you decide to withdraw via bank transfer. For this reason, we recommend using a Visa or Mastercard or e-Wallet such as PayPal.

There are also a couple of fees that aren’t openly advertised, such as a verification fee and inactivity fee. To avoid the verification fee, it’s important that you submit your identification verification documents within 15 days of opening your account and have a balance above $/€ 5. If your account balance is below $/€ 5, you may be charged the verification fee.

Inactivity fees, while not uncommon in the industry, can be a surprising fee to many traders that can quickly add up. Also called a ‘dormant account fee’, IQ Option charges a fee if an account is inactive for 90 consecutive days. If no trades are opened, pending, or executed inside 90 days, your account will be charged the $/€ 10 fee each month.

Related

Account types

IQ Option’s Retail Account is a turn-key trading account for the majority of traders – simply sign up for an account and you’re ready to start trading. There’s also a Demo Account for those who want to try out the platform first before signing up for a real account. It is provided free of charge and comes pre-loaded with $10,000 of virtual money which can be used to practice trading and getting a feel for IQ Option platform.

| Retail Account | |

| ICF Coverage | ✔️ |

| Level of Protection | High |

| ESMA Leverage Limits | ✔️ |

| Negative Balance Protection | ✔️ |

| ‘Best Execution’ Orders | ✔️ |

Related

Platforms

Unlike the majority of its competitors, IQ Option does not support either of the MetaTrader trading platforms. Instead, it opts for and encourages the use of its own in-house trading platform.

While many traders will consider the inability to use either MetaTrader 4 (MT4) or MetaTrader 5 (MT5) a significant disadvantage, the IQ Option trading platform still has plenty to offer users.

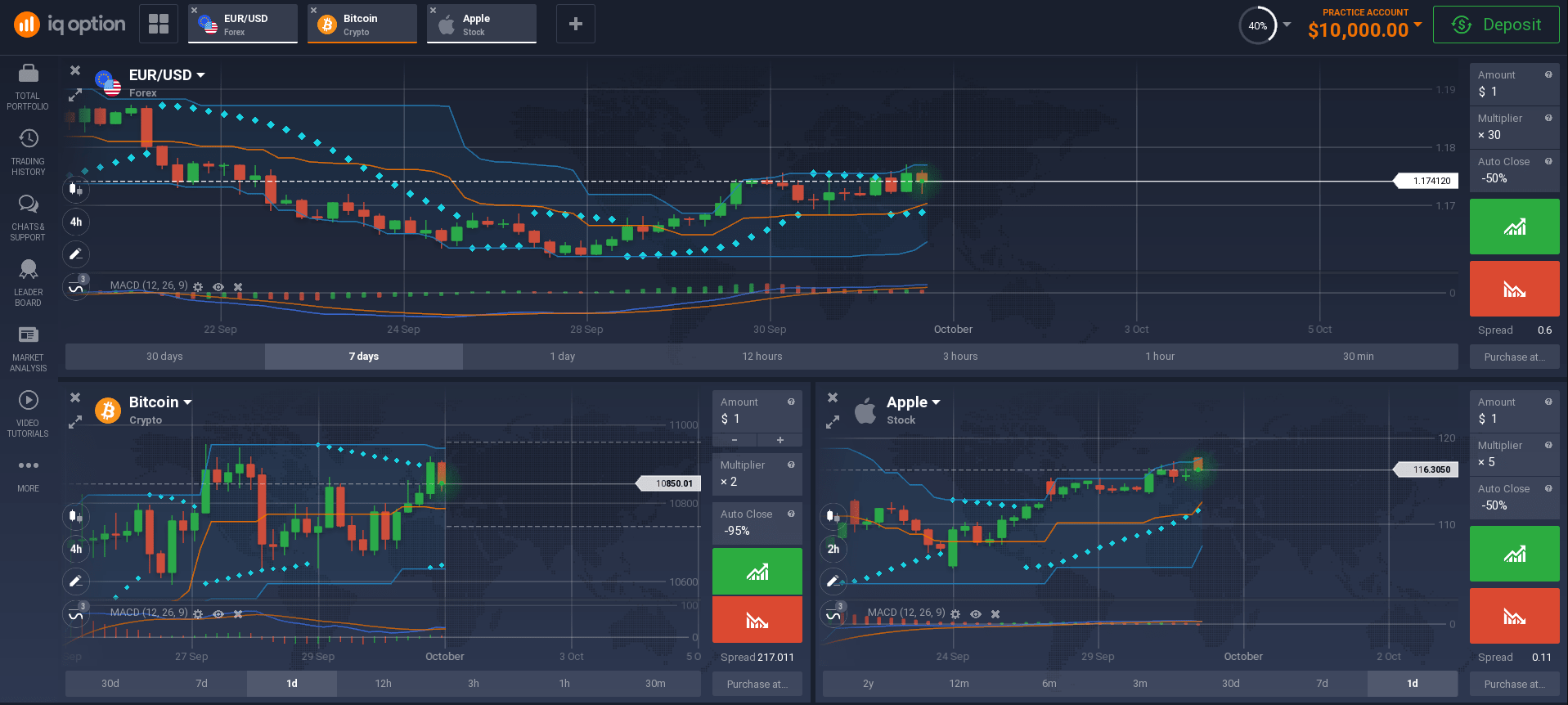

Beautifully designed, this award-winning platform is user-friendly and incredibly easy to use. Don’t let the aesthetics fool you; under the hood is a robust trading toolkit of 15+ powerful technical indicators, 5 chart types, a built-in newsfeed and price movement alerts.

It’s also configurable, giving you the ability to completely customise the look and feel of the trading platform. You’re free to set your own colour schemes, draw freehand charts and pin custom trading windows at the click of a button. In our example, we’ve selected a 3-grid window displaying three different instruments: Forex, Stocks and Crypto:

Within the trading platform, users can trade a variety of assets and financial instruments, including stocks, forex, cryptocurrencies, ETFs, and commodities.

The platform also comes with a wide selection of trading tools, including technical indicators such as Moving Averages, Bollinger Bands, MACD, and RSI.

An interesting feature of the IQ Option trading platform is the trading community and leaderboard. In the trading community, you can discuss trading ideas and opportunities with other users, share insight and choose other traders to follow.

On the leaderboard, you can see traders from around the world who have made the most profit and also your own unique ranking:

One thing that we particularly liked is the snapshot feature, which provides a visual summary of how an instrument is performing. This allows you to easily gauge factors such as market sentiment, historical performance, price and more:

Mobile Trading

The IQ option mobile app, an award-winning trading platform, is perfect for trading on-the-go. Looking around, it’s clear that a lot of time and consideration has gone into creating a well-balanced mobile app that delivers both functionality and great user experience.

The app itself has much of the functionality as the browser and desktop clients, including price alerts, traders sentiment, market analysis and technical analysis tools. The app does a great job putting the power of the IQ Option trading platform in the palm of your hand.

Related

Customer Support

IQ Option has a customer service team that is available 24/7 to provide assistance in 10 languages across the usual channels including live chat, email, social media and telephone This is a particularly nice feature of the trading platform as the majority of its competitors are only able to offer assistance 24/5, Monday to Friday.

These additional operating hours will undoubtedly add value for IQ Option users who like to trade on the weekend. In addition to 24/7 support, IQ Option also provides users with access to a functional – if somewhat limited – educational hub.

This ‘trading hub’ is geared more towards beginner traders than those with any sort of trading experience, covering topics such as ‘How To Trade FX Options’ and ‘What Are Options’. However, we would’ve liked to see more in-depth tutorials, as well as resources to help intermediate traders and information on how to customise the IQ Option trading platform.

Payment Method

IQ Option makes deposits and withdrawal requests incredibly simple and straightforward by providing access to popular payment methods such as:

- Credit Card/Debit Card (Visa, Mastercard)

- Bank Transfer (Wire Transfer)

- e-Wallets (Skrill, Neteller, PayPal)

Deposit and withdrawal methods will vary depending on your country. As you can see, minimum deposit levels and processing times also differ by payment method and IQ Option does not charge a commission on deposits. It does, however, charge a commission of 31 USD on bank transfer withdrawals.

Regulations, Deposits, and Protections

IQ Option is a regulated broker under the jurisdiction of the Cyprus Securities Exchange Commission (CySEC)in a holding company using the name IQOption Europe LTD. A benefit for clients of being regulated by CySEC is the fact that is also a member of the Investors Compensation Scheme. Under this scheme, each clients’ funds are protected up to a maximum amount of $/€ 20,000.