Swing trading is a strategy that focuses on taking advantage of short-term trends to make small, consistent profits. Although your profits may be smaller, they add up over time and can compound into healthy annual returns.

Interested in swing trading and want to learn more?

In this guide we’ll be taking a look at:

- What swing trading is

- Swing trading vs day trading

- Example strategies you can use

- The main technical indicators for swing trading

- Advantages & disadvantages

What Is Swing Trading?

Swing trading primarily involves holding a position (short or long) for a period that extends beyond one market session, usually up to several weeks.

Of course, this is just a general time frame and some swing trades may require longer holding periods (i.e. a couple of months). Ultimately, the market dictates the length of time that any position will need to be held.

In many cases, swing traders will utilise fundamental analysis techniques in addition to technical chart price patterns to decide when to enter and exit a trade.

Swing Trading Vs Day Trading

Key distinctions exist when comparing day trading and swing trading. Specifically, swing trading will usually require positions to be held overnight whereas a day trader will generally close all positions prior to the end of each market session.

When holding onto positions overnight, swing traders are exposed to the added risk that is associated with multi-session trades. For these reasons, swing traders will often use smaller position sizes (and reduced leverage) when compared to intra-day traders. Holding positions overnight also creates an additional need for protective stop losses on all trades.

Swing Trading Strategies

Since the term “swing trading” encompasses a broad approach to the market, there are several different strategies that can be used.

In the following technical analysis strategy examples, we will examine the ways swing traders combine some of these tactics to identify profitable opportunities in the market.

Strategy #1

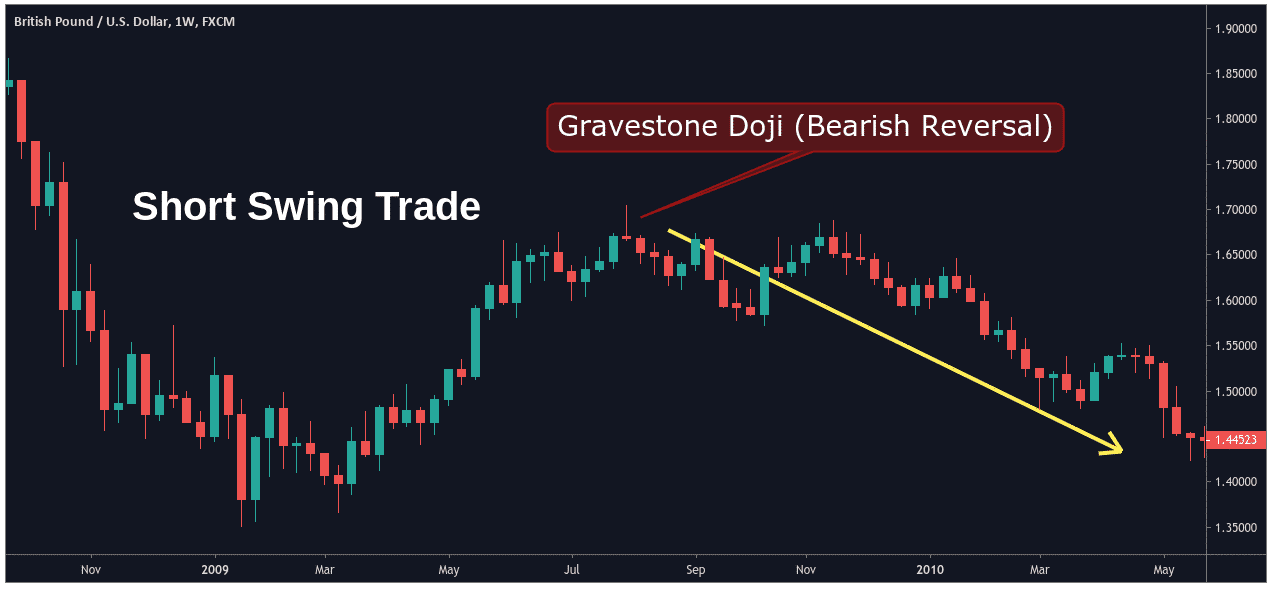

Our first swing trading example is a basic candlestick reversal signal.

In the chart above, there is a Gravestone Doji pattern which suggests bull market price movement might be coming to an end. On its own, the Gravestone Doji can be a powerful candlestick pattern.

However, this signal becomes stronger when we are able to identify supportive signals which indicate further evidence of a specific market outcome (in this case, a bearish swing reversal).

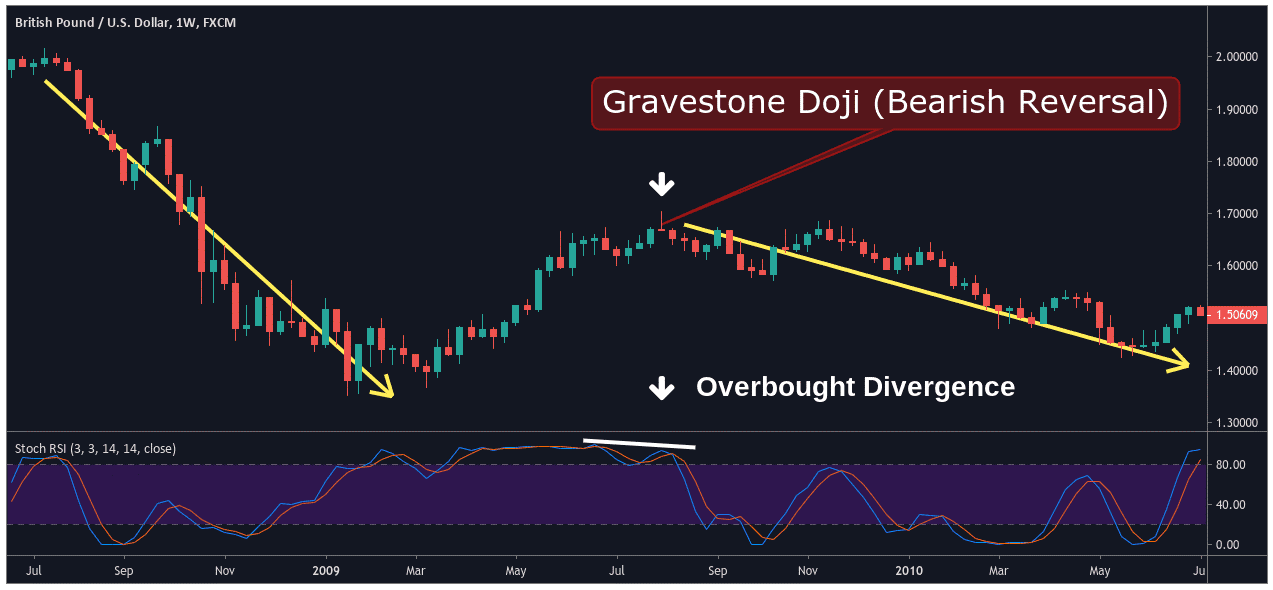

Taking a closer look at the same chart, you can see that the prior dominant move was bearish. In other words, the asset is already caught in a downtrend indicating negative price momentum.

At the same time, you can overlay a Stochastic RSI indicator against the chart to give us an alternative view on the recent price activity. You can now see that an overbought bearish divergence has developed in conjunction with the Gravestone Doji.

This gives us enough evidence to initiate a swing trading short position on our chosen timeframe, in this case, the one week chart.

Strategy #2

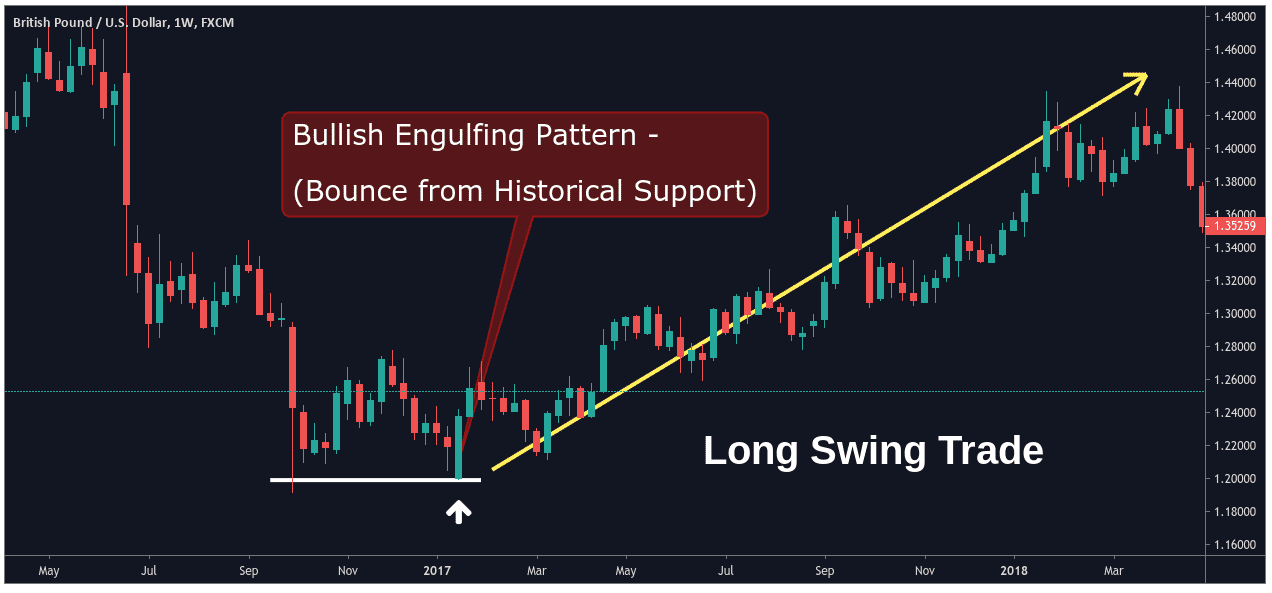

The next trading strategy is looking at engulfing patterns.

In the first case, a Bullish Engulfing candlestick pattern has developed in an area of prior price support.

The combination of these two positive factors is enough to allow us to initiate a long trade. Stop losses should be placed below the outlined support levels (profit targets should be set at a minimum of 3x the risk tolerance on the position).

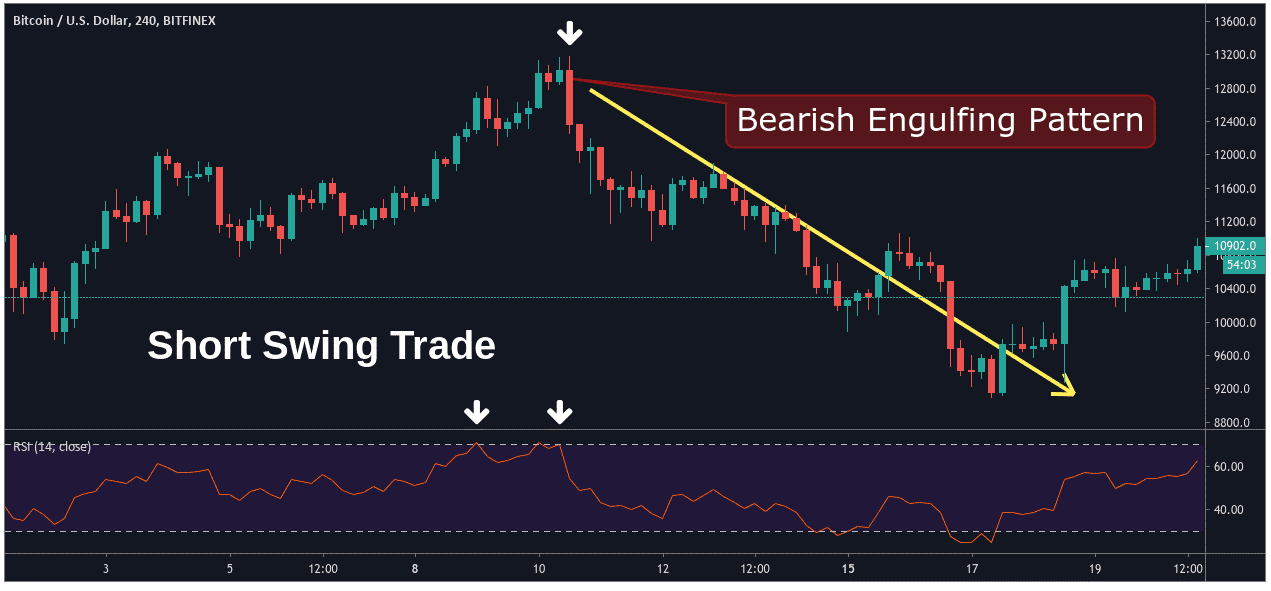

This can also be flipped to look at Bearish Engulfing patterns.

When this occurs, you can also see that the Relative Strength Index (RSI) has reached overbought territory and started turning lower.

This combination of the indicator and candlestick reversal pattern signals a short swing trading position with stop losses placed above the high of the Bearish Engulfing candlestick formation.

Technical Indicators For Swing Trading

A few of the tactics often utilised by successful swing traders include:

- Candlestick Patterns

- Price Action

- Fibonacci Retracements

- Support and Resistance

- Indicators and Oscillators

- Moving Averages

One thing that is important to note when swing trading is that your stop-loss levels will need to be far wider than if you were day-trading.

However, it is still important to adhere to a strict risk management plan. One of the most important things with any type of trading is limiting losses.

Advantages & Disadvantages Of Swing Trading

While swing trading definitely has some advantages over day-trading or scalping, there are also negative aspects, and we have outlined both the pros and cons below.

Advantages

- Swing trades require less time and active management when compared to intra-day trading.

- Swing traders are able to capture a large portion of the trend, allowing for maximized profit potential.

- Swing traders can devote most of their attention to analysis, which helps simplify the trading process of finding exits and entries.

Disadvantages

- Swing trading positions are often vulnerable to overnight and/or weekend market risks.

- It can take a while before the perfect setup occurs.

The Bottom Line

Swing trading can be particularly useful if you don’t have an enormous amount of time to spend watching charts all day.

It is also a great way of learning and understanding financial markets, by reducing the noise of the charts and making sure you are specific with your entries into the market.

- Swing trades can last anywhere from a few days to several weeks in order to capture maximum profits from trends.

- Swing trading employs various technical analysis strategies to identify reversals within larger market trends.

- Trading stances are strengthened when multiple technical indicators suggest a clear directional trading outcome (either bullish or bearish).

- Swing traders must establish favourable risk/reward parameters of at least 3:1 so that maximum profitability levels may be attained.

- Swing trading creates exposes to additional overnight, which is why smaller position sizes, reduced leverage, and protective stop losses are always essential.