Concept Overview

Volume is the most important factor to consider in any form of analysis, because it tells you the strength behind any other signal. Volume is the mojo that makes any signal strong, or weak. It gives you clues about when a trend is building, slowing down, or even reversing, and is more or less your best friend if you are trying to figure out which way the price is likely to go next.

“The power and force behind any candle signal depends on the volume behind it. For example a hammer on weak volume is not a strong signal, or that a bullish engulfing requires more volume on the second candle, ideally 2x the volume”

Tops and Bottoms

A general rule of technical analysis is that the most volume is found at the top, and at the bottom of a chart. Why is this the case? Often times when the price is in the middle of a channel the price can move up steadily, consolidate with continuation patterns and resume a trend with medium or even low volume. Then, once it reaches a key point where the demand supply curve shifts a battle ensues between bulls and bears, and that volume usually marks a top.

Reversal candles

Volume is a very important clue as to the strength of any reversal candle, be it a single candle like a hammer, or a two candle combination like a bullish engulfing, or bullish harami.

The reason why volume is so critical with a hammer or say dragonfly doji, is that once support breaks and bulls push back up to form that hammer or doji, you want to see a lot of accumulation rather than a weak volume price walk up, which would be more suggestive of a bull trap.

Strong Volume Hammer

Weak Volume Hammer

With Japanese Candlestick theory “the stronger the volume the stronger the signal”, and focus is always placed on the candle with the most volume in an particular period of analysis. That candle that has the most volume is the patriarch, or matriarch in the sense that the candle is in charge, and should be given the most focus.

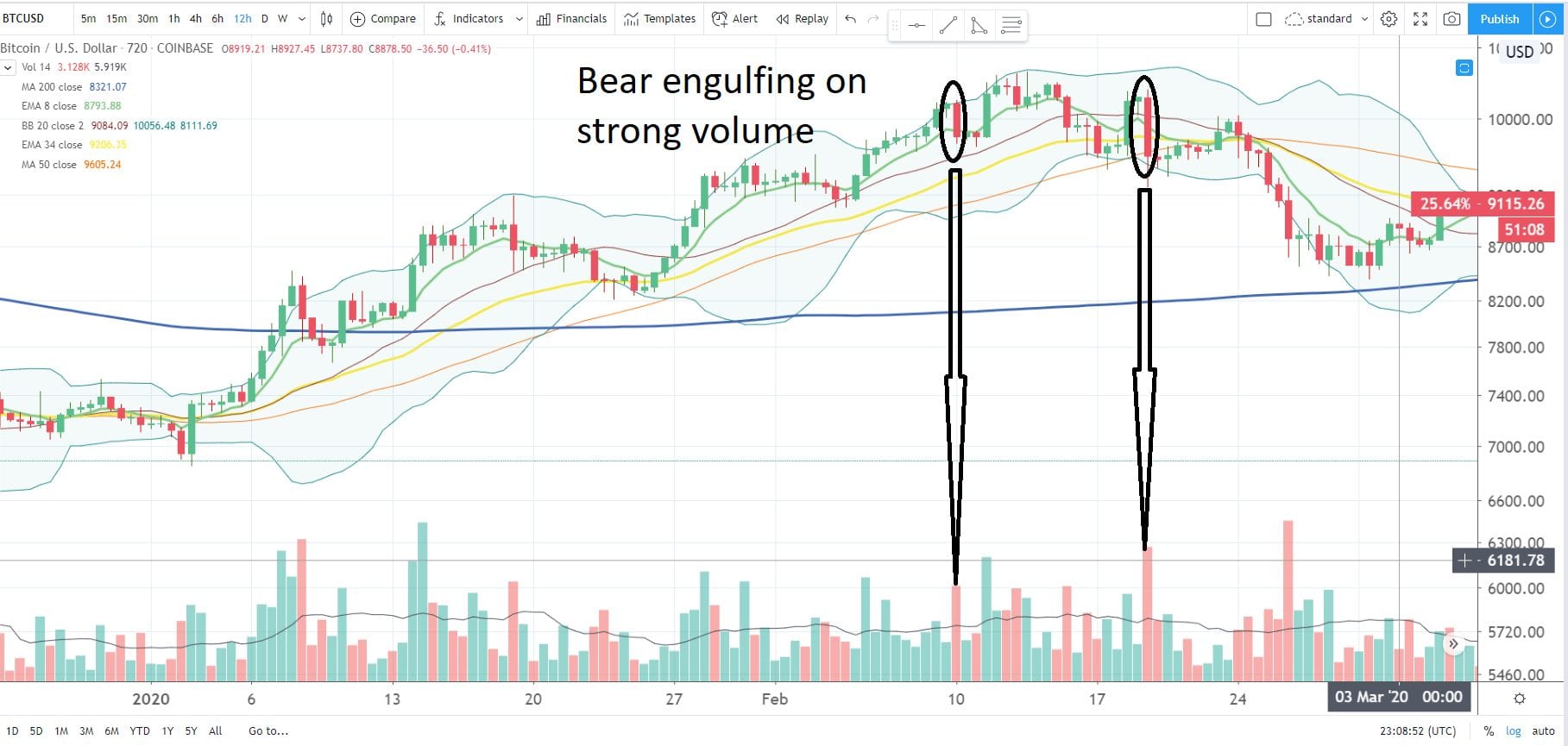

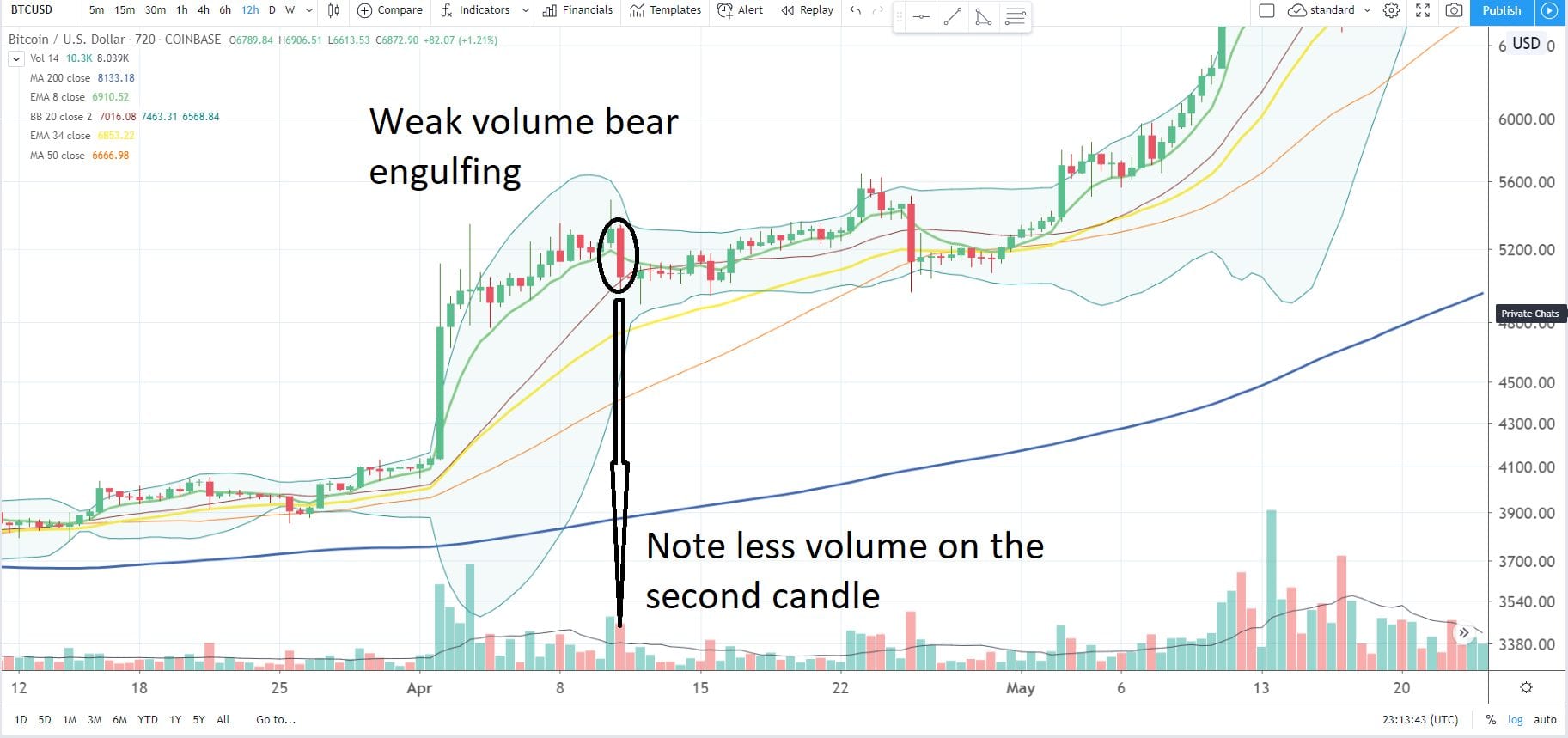

This concept of volume also plays heavily on a two candle reversal combination, because conceptually you want to see increased volume on the second candle, which suggests the force of the prior trend has been squashed. A big red candle followed by a small green candle with strong volume suggests capitulation, then accumulation as the bulls reject lower prices.

Strong Volume Bear Engulfing

Weak Volume Bear Engulfing

Volume on breakouts, moving average crosses

All patterns have a breakout point, often as the volume is about to dry up and the price re tests the support or resistance for the 3rd or 4th time, leading to some sort of breakout. When this breakout happens, a key clue to look for is the volume on the break, because that gives information about to the strength of the move.

Weak Volume Breakdown

Strong Volume Breakdown

This is also the case with moving average crosses, as you want to see the volume pick up after the cross as a sign that the trend is accelerating.

All in all, volume is our friend. From shedding light on the strength of a one or two candle signal, to giving clues as to the strength of any breakout or break down, volume should be the most important factor in any traders’ analysis. Good luck!

Cheds

PEOPLE WHO READ THIS ALSO VIEWED: