- Absolute returns from the Facebook share price might not currently stand up to the more dynamic price moves of market sweethearts such as Zoom and Lemonade.

- Facebook is at a more mature stage of its business development. Its share price rally of 670% in the space of five years is possibly a signal of the past rather than the future performance.

- The firm's considerable market capitalisation and position as the world's most popular social media platform offer investors some interesting trading opportunities.

- Price action is trending sideways but the firm does have protection from a coronavirus second wave.

- The real opportunity appears to be to trade the short-term dips as negative news reports come and go.

The Facebook share price has, for some time, had a feeling of ‘steady as she goes', with the business morphing from being a plucky upstart into a mature global multinational corporation. In less turbulent times, this might lead investors to skim over the analysis of the stock, to move on to something with a little more juice. But 2020 is proving to be one of the most dramatic periods the markets have ever seen, which leads to the Facebook share price and its relatively low volatility seeming more attractive.

On a longer-term chart, the Facebook share price has been treading water for two years. Even on a 2020 year to date basis, the stock is up 13%. A fantastic return considering the events of the last six months but one with much less drama than the Wirecard (liquidated) or Zoom share price +284%.

Facebook share price – Monthly candles – June 2012–July 2020

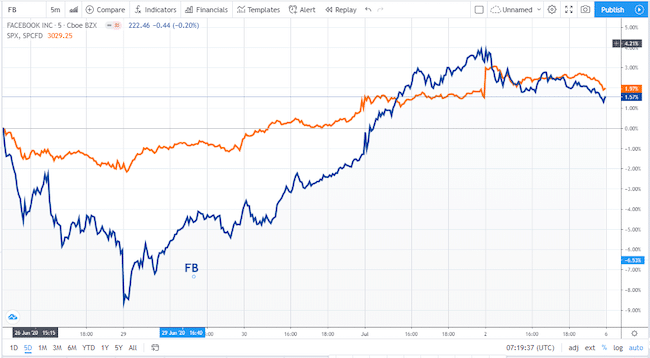

The good news for those looking to take on long positions is that there are still short-term dips to buy. Even last week, within five trading sessions, the Facebook (FB) share price diverged from the S&P 500 index by eight percentage points and then recovered. The FB share price finished the trading week with only basis points between it and the flagship index. A chance to pick up cheap stock in a firm with a market cap of $665bn but with the short term sell-offs of a much smaller operation.

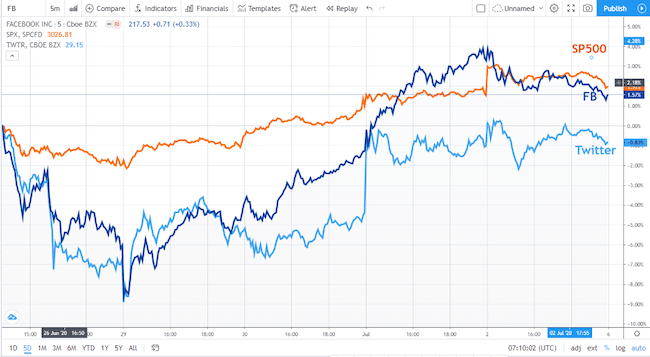

Facebook share price vs. Twitter share price vs. S&P 500 – three-month price chart as of 6th July 2020

Facebook has coped well with the COVID-19 pandemic. Its clients have faced the challenge of tightening their belts during the lockdown. They'd have also noted that cutting back on advertising expenditure on Facebook would miss out on that platform's increased traffic volumes as the global population spent more time socialising online.

COVID-19 isn't generating the opportunities to buy dips in the Facebook share price. Instead, they are being driven by noise and confusion relating to a boycott by advertisers that use the platform. The causes of a short-term correction are easy to appreciate. The reasons why the Facebook share price bounces back are more nuanced; however, they point to strong fundamentals and its ability to weather the storm.

The firm is always high-profile, but it has recently been making headlines in the mainstream media when clients announced the short-term withdrawal of advertising spending on the site. The campaign led by NAACP (National Association for the Advancement of Colored People), the Anti-Defamation League, Sleeping Giants, Color of Change, Free Press and Common Sense, seems to be going viral.

The accusation being made is that Facebook is allowing “racist, violent and verifiably false content to run rampant on its platform, thereby, “letting its platform be used in “widespread voter suppression efforts and using targeted disinformation aimed at Black voters”.

By the end of June, more than 400 firms had signed up to the boycott, including Verizon, Unilever, Starbucks, Adidas, and Denny's – notable names!

Analysis of the situation doesn't need to second guess the motives of the big corporations to note the effect of their actions on the Facebook share price. One possibly cynical take on the situation is that cash-strapped firms are taking the opportunity to signal their ability to capture the zeitgeist and simultaneously scale back on spending. Ford, for example, is pausing all US social media advertising (not just Facebook) for the next 30 days to evaluate its presence on the platforms. The scaling back on ad-spending has been coming down the line long before the recent surge of political activity. Cheryl Sandberg, the chief operating officer of Facebook, was speaking back in April when she said:

“Marketers of all sizes have more limited budgets, so they need to make every dollar work as hard as possible.”

Source: The Drum

The Ad revenue in the first three weeks of April was flat. Sandberg stated that the Q2 earnings update would be likely to disappoint, even compared to Q1.

“Some countries will be open for business sooner than others, and ad spending will start to rise there, but other countries will remain largely on lockdown into May and possibly beyond. Even within countries, such as in the US, businesses will open up at varying rates, making it incredibly difficult for a company like Facebook to get its ad sales momentum back.”

Source: The Drum

Stop-loss

Dip-buyers may take comfort from the fact that the situation appears, at this stage at least, to have downside risk capped to some extent.

The issue is being actively discussed by the parties involved. They may not have reached an agreement but initial negotiation points have been outlined.

The ten demands being made of Facebook include giving refunds to brands whose ads show up next to offensive content that is removed later. Also, by allowing people who experience severe harassment to speak with a Facebook employee.

Civil rights group representatives insisted that Zuckerberg also be at the table. Late on Tuesday, a Facebook spokeswoman confirmed that would be the case.

The apparent stalemate led to a recovery in the Facebook share price. Facebook's executives were reported to have repeatedly referred to an audit process which would include hate speech controls and plans to label newsworthy content that would otherwise violate its policies. There were few other concessions and in the ‘Our Principles' section of the ‘About Us' page on Facebook's site the lead item is still:

“People deserve to be heard and to have a voice — even when that means defending the right of people we disagree with.”

Source: Facebook

Facebook has avoided taking on a range of civil rights groups directly. The free-speech element of their argument looks like one they may be able to build a negotiating position on and could even be flipped around to their benefit. Just recently, new social media sites have emerged with a mandate to permit more controversial ideas to be raised. Whether this is unsavoury or necessary depends on individual viewpoints, but from a commercial point of view, it highlights the demand for “defending the right of people we disagree with”.

Parler is a ‘censorship-free' platform for debate and discussion. Launched in 2018, as of May 2019 it had 100,000 users. In June, CEO John Matze, 27, said that the number of users had jumped from one million to almost two million in a week. Still some way off the total number of users at Twitter and Facebook, however, those giants are long past the stage where they could aim for 100% user growth in such a short space of time.

A comparison of the Facebook share price to that of Twitter suggests there could be something in this approach. Twitter has adopted a more censorious approach to the situation and last week the Twitter share price underperformed both the S&P500 and the Facebook share price.

Facebook share price vs. Twitter share price vs S&P 500 – five-day price chart as of 6th July 2020

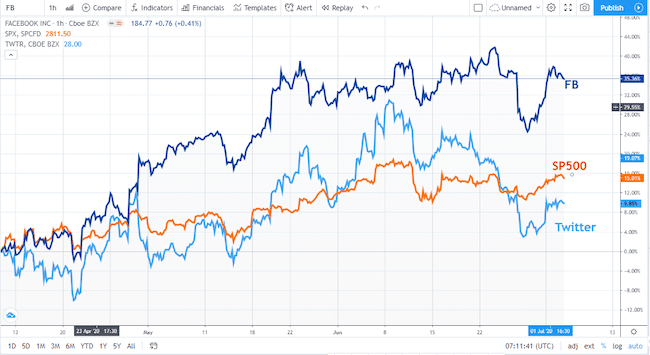

The price trend is also applying to the respective share prices over a longer time scale.

Facebook share price vs. Twitter share price vs S&P 500 – three-month price chart as of 6th July 2020

The core business still appears healthy. With over 2.6bn monthly active users (MAU) as of the first quarter of 2020, Facebook is the biggest social network worldwide. Analysts at the industry site Zephoria have outlined the strong foundations of the firm. The ability to monetise users continues to expand.

Facebook Average Revenue Per User (ARPU) for previous quarters:

- Q4 2019 Total Worldwide ARPU: $8.52

- Q3 2019 Total Worldwide ARPU: $7.26

- Q2 2019 Total Worldwide ARPU: $7.05

- Q1 2019 Total Worldwide ARPU: $6.42

Source: Zephoria

It also states that Facebook, Instagram, and Facebook Messenger occupy three of the top 10 positions on the Apple App Store. That indicates how prevalent the Facebook family is in our daily lives. It also states that nearly 75 per cent of high-income earners use Facebook.

Facebook represents a continually evolving marketing platform and communication channel. Its approach is likely, in cash terms, to insulate it from the boycott.

According to Morningstar, the top 100 brands on Facebook in 2019 brought in only 6% of Facebook's total $70 billion in annual revenue. Facebook said last year that its top 100 advertisers accounted for less than 20% of total ad revenue. This might represent a shift in terms of quality of client but does demonstrate the firm's ability to draw on advertisers from a wide range of sectors. In Q1, as auto and travel-related advertising dropped off, the demand for screen space was filled by lower-priced ads from the gaming and e-commerce sectors.

Facebook CFO Dave Wehner, said:

“We saw relative strength even then in a few categories like gaming, where you have always-on campaigns that were able to pick up some supply because the lower pricing kind of cleared at the levels that those advertisers were trying to acquire users at. So that is one of the benefits of the auction.”

Source: Business Insider

Facebook fundamentals

When to buy?

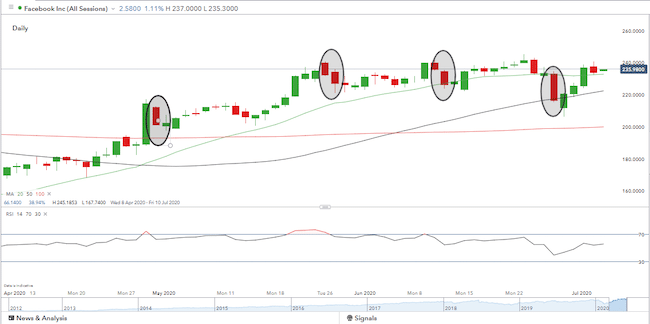

The daily candle price chart of the Facebook share price shows how active management of positions could have provided considerable profits. Buy and hold could have worked but trading off the long-term buy rating and scaling into (and out of) positions during the sideways trading would have chipped in considerable extra returns.

Facebook share price – Daily candles – 8th April–6th July 2020

The Facebook share price tumbled 8.3% to $216.32 on the 26th of June, erasing nearly all the gains since it cleared a $215.38 buy point from a cup-with-handle base on the 19th of May.

On the 29th of June, the Facebook stock fell 3% in morning trade, clearly undercutting the $215.38 entry.

On Thursday, the stock closed at $235.50 and had a June high of $245.18 (the 23rd of June) suggesting it could well be consolidating before testing the $240.00 resistance level. The analyst team at Business Insider stated:

“Technically, FB stock is in buy range above the 215.38 cup-with-handle buy point, but below an alternative entry at 224.30.”

Source: Business Insider

The risk to range-trading is that a break out to the downside triggers stop-losses or one to the upside leaves investors underweight in a stock they desperately want to be long in. Given the news-fuelled wide price range, it would appear hard to resist a chance to finesse positions. Potential catalysts of a break out are also fairly obvious, “known-knowns” which makes managing the situation a little more straightforward.

The US election battle is heating up and Facebook risks being caught in the crossfire. It is a risk factor but is also an opportunity. In that instance, it would be worth looking to see if the pattern holds, but the Facebook share price just experiences a higher number of deeper dips.

“Facebook's acceptance of President Trump's 29th of May post about shooting of looters during protests over George Floyd's death isn't going away quietly.”

Source: Business Insider

But neither is the firm's strong fundamentals.