There are some pitfalls to avoid, and no-one can guarantee the price is going to go in a particular direction. Knowledge of the subject is all-important, so this crypto trading guide will help by outlining how to start trading in cryptocurrencies.

Getting the basics right

The pathway to trading cryptocurrencies starts by addressing where to trade them. That involves applying a little bit of common sense and making sure you use only regulated brokers. Some crypto brokers offer markets in more types of digital coins than others, but they all support trading in the most well-known cryptocurrency, bitcoin. Below are two examples of well-regulated brokers and the kind of company profile that comes with being a highly regarded broker.

Practice, practice, practice

Competition between online brokers is intense, which means there are lots of neat perks for those looking to start trading cryptocurrencies. Brokers typically offer a free ‘demo’ account where you can register using little more than an email address and then use virtual funds to buy virtual cryptocurrencies.

Even though they are free to use, demo accounts are packed with all the functionality and features of a live account. They also use the same price feeds so you can get a life-like feeling for what it is like to be trading in cryptocurrencies.

Some useful background information is that crypto trading evolved out of a very tech-orientated environment. It operates using the principles of blockchain, which is an interesting topic. An analogy of blockchain is a group of people playing cards with their cards face-up on the table. All present can see how many cards of what value each person is holding. While it might not make for an entertaining game, there is 100% transparency.

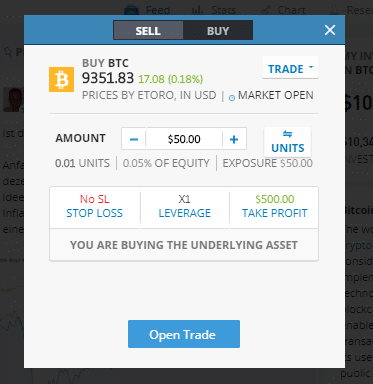

With cryptocurrencies, the information of what everyone holds is held online rather than on a tabletop. Possibly more importantly for the general public, the mechanics of the system have been simplified to make crypto trading easy to do and available to a much wider audience. When bitcoin was first traded, some degree of tech knowledge was required, but those days are long gone. If you want to know how to start trading cryptocurrencies, then the example buy trade of $50 of bitcoin at eToro is an excellent place to start. It is as easy as putting those details into the trading monitor, as per below and clicking ‘open trade’.

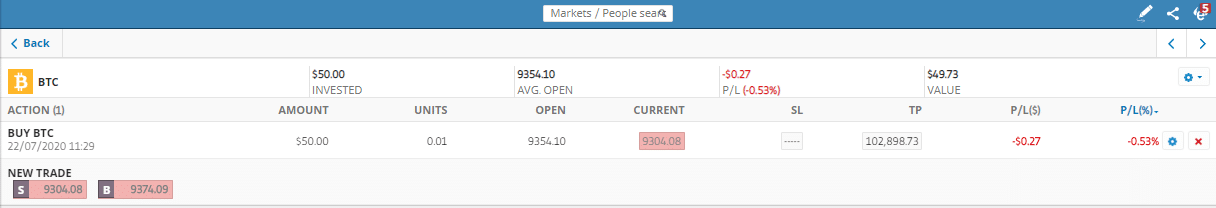

Once booked, that trade will sit in your portfolio and the value of your holding will fluctuate according to the price of bitcoin in the global market. Moments after opening your position, in this example, a 27 cent loss is showing on the position. This would mostly be made up of the difference between the bid and offer spreads that brokers offer.

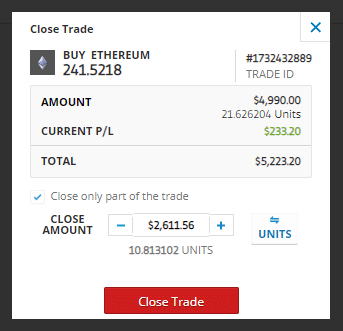

When it comes to the question of how to sell bitcoin, we simply click on our position, go through to the ‘Close Trade’ monitor, and at the touch of a button, sell out of the position. That crystalizes the profit or loss on the position and the funds used to make the trade are returned to our cash balance.

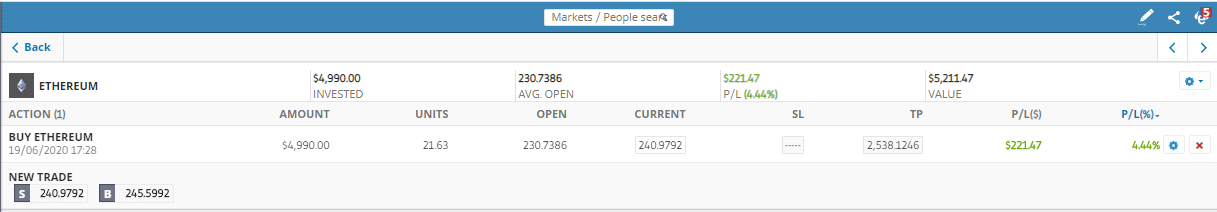

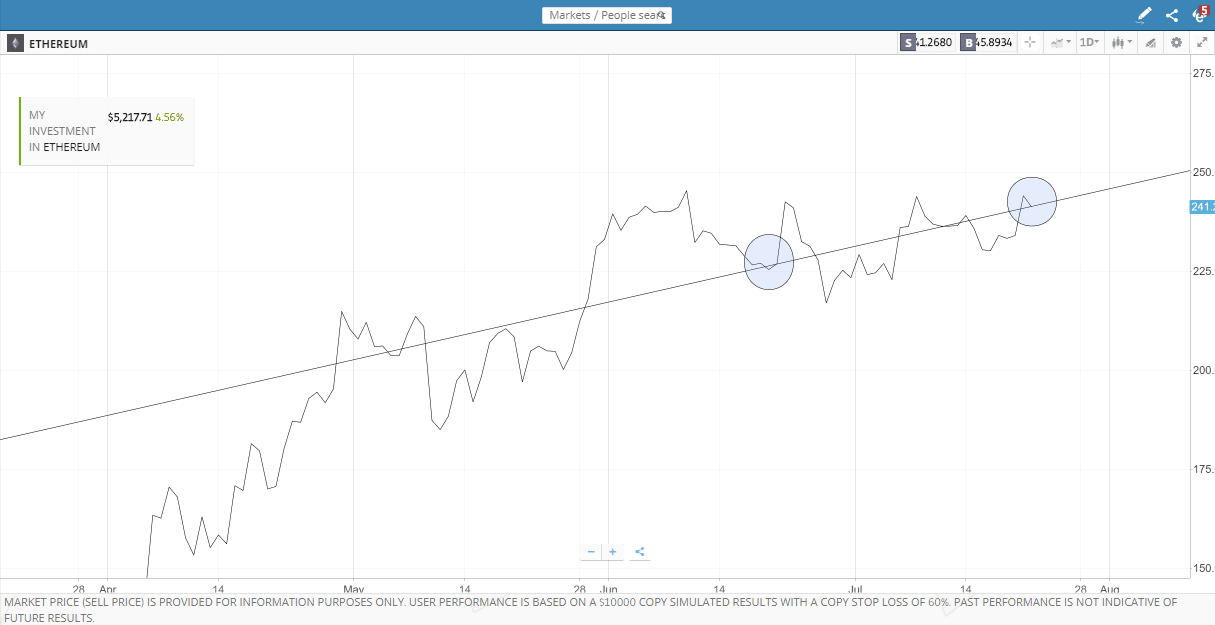

Other cryptocurrencies are also available to trade. The Virtual account at eToro has been running a new strategy in the crypto, ethereum. In little more than one month, here, the price has moved in your favour, and the position bought for $5,000 is now worth an additional $211.47.

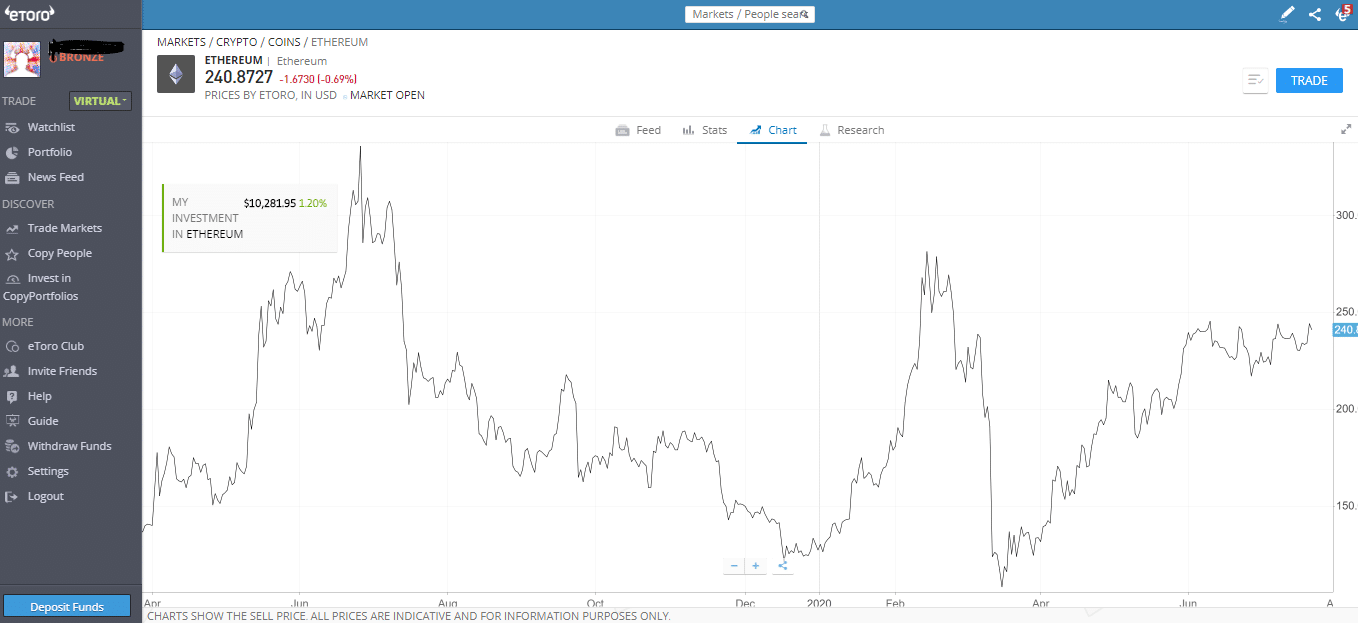

That profit of $211.47 equates to a gain of 4.44% on our trade – the price chart on the eToro site shows the course of price movements since April 2019.

In the case of the ethereum position, the strategy we are testing is relatively active. Spotting that the long-term price pattern was rising, we bought a dip, rode out the price falling away some more, but now that it has recovered, we are in profit.

One of the many cryptocurrency trading tips is that it’s never a bad idea to take a profit. As a result, we sell half of our position, crystalize that gain and leave the other half live, hoping for more price gains.

This type of trading strategy isn’t the only way to make money trading cryptocurrency. Some will trade more frequently using strategies based on ‘scalping’. This involves taking a lot of small profits on positions held for a short period.

Another strategy, possibly tailored towards cryptocurrency trading for beginners, is more ‘buy and hold’ in nature. This involves buying crypto and waiting until the price moves in your favour. If it moves against you and you start making a loss on the position, that will not be crystalized if you don’t sell out. Being patient, disciplined and sticking with your strategy would, in an ideal scenario, see the price rally and trade above your trade entry point. Such a price move provides a textbook example of how to make money by trading cryptocurrency.

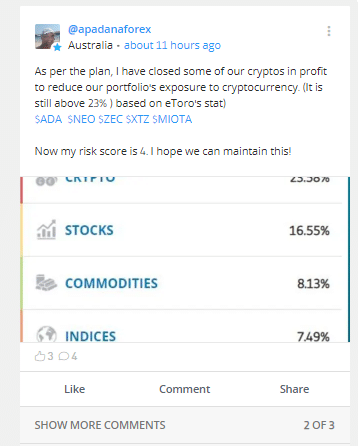

If you’re looking for other cryptocurrency trading tips, then it’s a case of sifting through the abundance of available information rather than struggling to find any. That raises the question of how to grade the quality of the advice on how to trade in cryptocurrency. One starting point might be the social trading function of the eToro site. In this area, traders share their thoughts and tips on crypto trading. A lot are actively trading in the market and are more than happy to share their views on how to make money trading cryptocurrency.

Capturing the imagination

Other cryptocurrency markets are available. At eToro there is a total of 16. Each has different ‘characteristics’. For example, some are associated with more volatile price moves. All follow the same principle that they are bought or sold using ‘traditional’ cash. When the position is closed ,the difference between the entry and exit price level determines the profit/loss on the trade.

Bitcoin is a popular first market for those wondering how to start trading cryptocurrency. Its popularity means that it might even come up in general conversation. Most people may know someone, or of someone who claims to have ‘made a fortune’ trading bitcoin. Such claims are best treated with care. Excessive returns are associated with extreme risk/return profiles. Bitcoin’s role in everyday conversation means you might hear others sharing thoughts, or indeed remarking that the price has shot up. All information has a value, so trading a market that a lot of others are also trading could be a good starting place for beginners.

The most straightforward approach to learning how to start trading crypto comes down to answering a few questions. Which of the regulated brokers to use? How long to practice trading on a demo account? Which particular crypto and crypto trading strategy best suits your approach?

Some like to mull over the options, others jump in, use a reputable and regulated broker and buy a little bit of bitcoin then let the position ride.

Finding out crypto trading tips is a continuous process. Using an unregulated broker is the biggest no-no of all.

Then there is the question of why cryptocurrencies have caught the public imagination to such an extent. Answering this point counts as trading analysis. The allure of bitcoin and other cryptos comes back to the blockchain aspect of their DNA. Some retailers already accept cryptocurrencies as payment on goods and services. If, and it’s a big ‘IF’ cryptocurrencies become widely accepted as legal tender, then the price will rise dramatically. The argument goes that if bitcoin will in the future be needed to buy things, then people will trade out of their dollars, pounds, euro and yen to buy the currency of the future. The result is that this extra demand will drive prices sky-high.

If that doesn’t happen, then they will become virtually worthless – just lines of computer code stored online.

The extreme difference between the two outcomes means that prices swing around dramatically. A report that ethereum (ETH) may become more widely accepted and take a step towards the ultimate target of being a bona fide global currency would have eye-watering effects on the price of ETH. If this move is in your favour, then that’s great news, but it can go the other way. No-one knows the direction, but historical price activity states the fact that the markets are incredibly volatile.

Blockchain is a very transparent accounting system and a societal shift to accept it is what those going long are hoping for. If that doesn’t happen then the players at the crypto card table will be showing each other their cards, but each hand will be as good as worthless.

For more insight, explore our range of our beginner’s guides that detail how to trade bitcoin, how to invest bitcoin long-term, and what to consider before investing in cryptocurrencies, amongst a wealth of resources.

PEOPLE WHO READ THIS ALSO VIEWED: