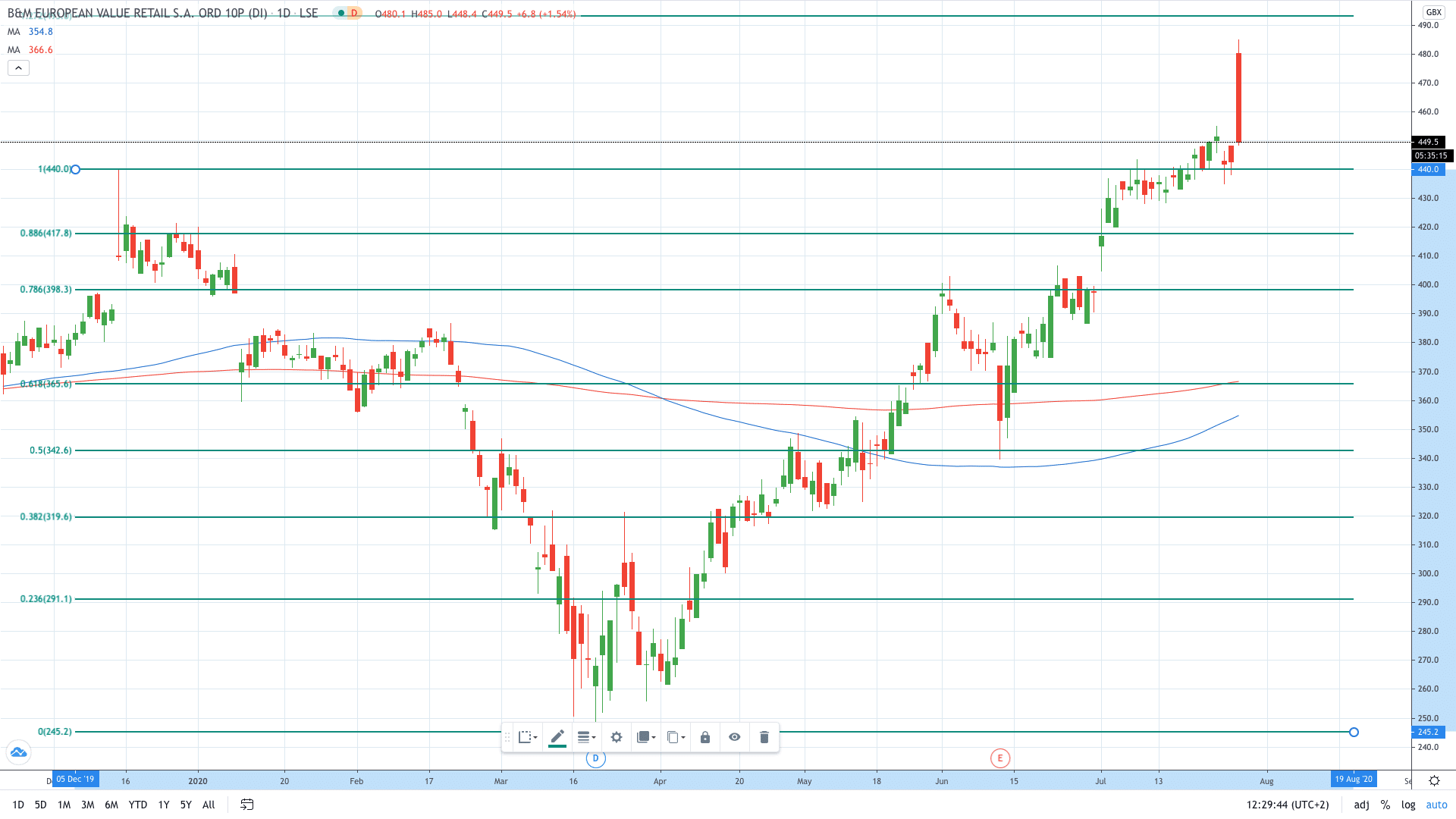

B&M European Value Retail (LON: BME) share price gapped 9% higher this morning after the retailer raised earnings forecasts.

The convenience retailer forecasts EBITDA to come in the region between £250 million – £270 million for the six months ending September 26, 2020. This is comfortably higher compared to the market forecast of £208 million.

“Today’s trading update highlights the potential pull forward on first-half earnings and whilst there is earnings upgrade pressure on FY2021 forecasts given the H1 performance,” analysts at Shore Capital commented.

The upgraded forecast is a result of positive performance in the quarter ending June 27 as revenue rose 8% to £1.1 billion. The retailer saw a surge in demand for gardening and DIY products and tools as people were confined to their homes.

Earlier this month, B&M announced revenue of £1.15 billion for the March 29 to June 27 quarter. This is nearly 28% higher compared to the same period a year ago.

“The group has made a strong start to the financial year, with a particularly strong performance in our UK businesses, and progress now resumed in France after an eight-week closure period,” B&M chief executive Simon Arora said at the time.

Today’s high of 485 marks the new all-time high for B&M share price. Shares have rotated lower in the meantime on profit-taking to trade at 451p, around 2% in the green.

- Read more about a sharp selloff in B&M share price last week

- Start trading B&M stock

- Or check out some other stock brokers