Shares of Watches of Switzerland Group PLC (LON: WOSG) skyrocketed today after the company witnessed its EBITDA jumping by 13.6% to £78.1 million for a full-year ending April 26.

The maker of luxury watched posted an operating profit of £48.3 million, which is 6.2% higher compared to a year ago. This was possible due to revenues jumping by 4.8% to £810.5 million.

The group performed extremely well up to the final six weeks of its financial year when it saw its sales crash by 84.9% amid the pandemic. In the current financial year, the group’s revenue dropped by 27.6% to £151.6 million in the 13 weeks to July 26.

“We delivered a strong performance during the first 46 weeks of the year before adapting with speed and agility to the challenges presented by the Covid-19 pandemic,” Watches of Switzerland chief executive Brian Duffy said.

“Momentum accelerated in our US business adding to the positive performance in the UK and we remain confident in our strategy to drive profitable growth in both markets.”

As for the full-year guidance, Watches of Switzerland Group expects revenues to come in between £840 million and £860 million.

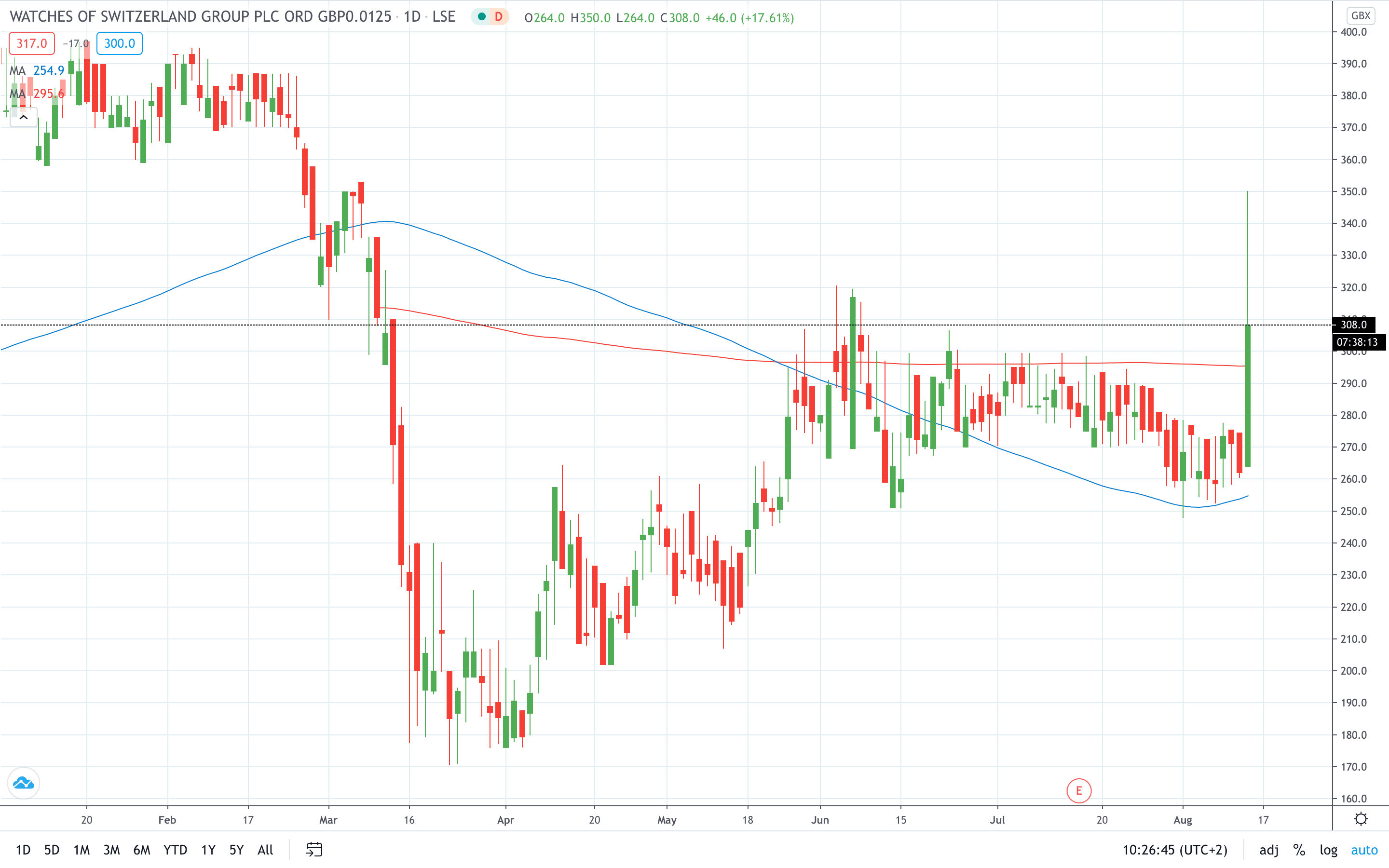

Watches of Switzerland share price skyrocketed over 30% following the results presentations, before paring back around half of earlier gains to settle at 307p or 17.18% in the green for a day. Today’s high of 350p is the highest the stock traded in five months.

- Learn stock trading strategies

- Learn from experts on risk management in trading