Shares of Tui AG (LON: TUI) fell more than 7% on Wednesday after the travel giant reported a mouth-watering earnings loss of €1.4 billion, compared to a €60 million profit last year.

Revenue is down 98% this summer compared to a year ago as bookings crashed 81%. As a result, Tui is working to cut costs by 30% across the Group.

The restructuring process will cost around €240 million in the current fiscal year and an additional €40 million in 2021 and €10 million in 2022.

“We are targeting a permanent annual saving of more than €300 million with the first benefits expected to be delivered from FY21 and full benefits to be delivered by FY23. In two years' time, TUI Group will emerge stronger, leaner, more digitalised and more agile, in what is likely to be a much more consolidated market,” TUI said in a statement.

In order to survive, Tui received €1.2 billion in state aid from the German government. The aid will help liquidity as the company shifts its focus to 2021. The travel giant has already seen its holiday bookings for 2021 erupt by 145%.

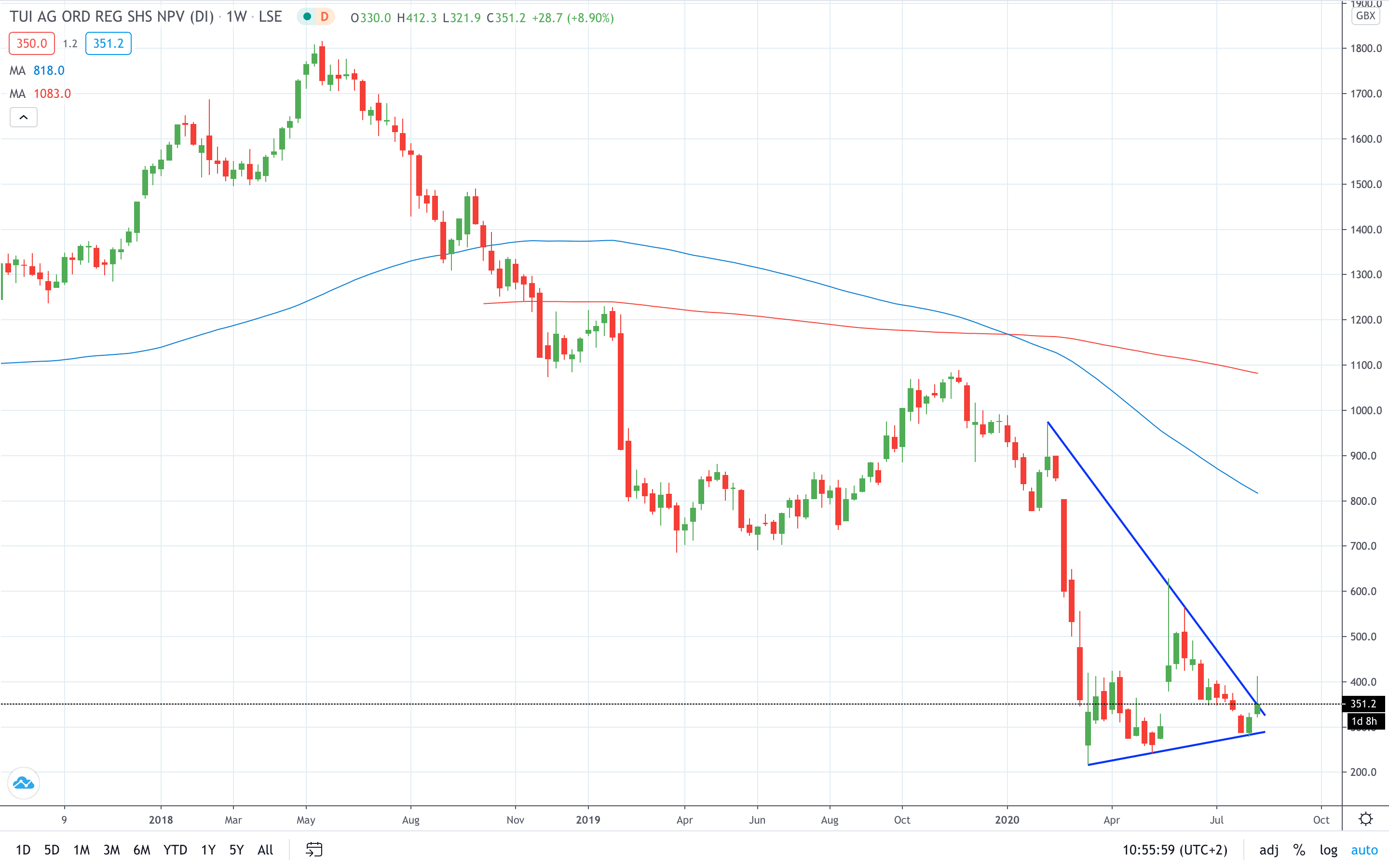

Tui share price fell nearly 8% today to erase most of the gains from the last two days.

- Learn stock trading strategies

- Learn from experts on risk management in trading