- A 62% share price spike is quite something, and considering the sector that Dignity PLC (LON:DTY) operates in, it might surprise some investors

- This isn’t a tech stock, nor a start up pharma operation that just found a Covid-19 vaccine

- Dignity is the UK’s largest listed provider of funeral services and the share price jump follows news that regulators are moth-balling their review into market practices

- The firm has experienced extreme share price volatility before. This might put some off, but the fundamental business model actually has ‘slow and steady’ defensive aspects to it.

Thursday’s share price move in Dignity PLC shows what happens when a regulator pulls out of industry reforms that had challenged the profitability of a business. The eye-watering, one-day price hike of 62.56% signalled the lifting of a very dark cloud, which had hovered over the firm.

Dignity PLC share price — Daily candles — 1st February–14th August 2020

Source: IG

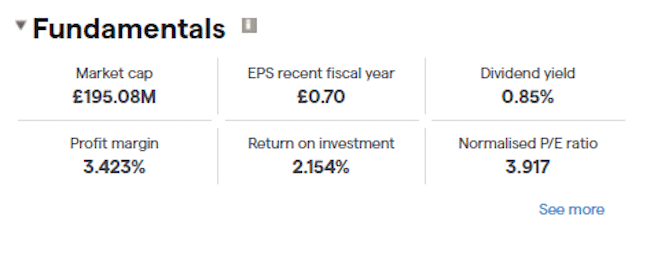

Dignity plc is one of the two main providers of funeral services and prepaid funeral plans in the United Kingdom. The firm forms an effective duopoly with unlisted Co-operative Funeral Services and so is the only means for retail investors to gain exposure to the market. Dignity is a British run company and is listed on the London Stock Exchange with a market cap of £195m and a dividend yield of 0.85%.

Source: IG

The one-day bounce followed an announcement by the Competition and Markets Authority (CMA) that it was putting on hold plans to implement price caps on the funeral industry. Regulatory concern stems from the allegation that funeral prices are excessive and that prices have risen at inflation-busting rates for a long time.

The CMA’s observations also include that pricing and product information is not consistently provided by funeral directors, making it difficult for customers to adequately compare prices.

Taking advantage of the recently bereaved is not a good look. Approached from the point of view of an investor, the claims pick out Dignity as a listed firm that is operating in a market with fat margins, little competition and inelastic demand. Economies of scale fall with the Sutton Coldfield-based company as most of its competitors are small independent operators.

A Dignity spokesperson acknowledged the CMA’s latest announcement and backed calls for greater consumer choice:

“We will take the time to fully assess the CMA's Provisional Decision Report and its recommendations and will continue to constructively engage directly with the CMA through the statutory process.”

Source: Shares

The threat of regulatory price-caps hasn’t gone away but has reduced. From a statistical perspective, disruption to ‘normal’ service due to the Covid-19 pandemic has made data collection very difficult to do.

Funeral types and funeral numbers have been distorted by the pandemic, which has made comparisons to historical practises difficult, if not meaningless. This ‘bad data’ is not going to go away. If the regulator does at some point resurrect its plans, the already inconclusive data points will include outlier numbers from the pandemic. Given the risk of ‘bad data in, bad data out’, the regulator will have to approach the situation with care. Regulators are, of course, meant to hold off from steam-rolling publicly listed companies off the back of weak analysis.

Even before the pandemic hit, Dignity was already doing a good job in challenging the CMA review. It had already pointed out that there had been sub-inflation funeral director fee growth between 2016 and 2018. It has also shared with the CMA that its own funeral director revenues fell in 2019 and 2020. There is also the simple fact that the firm has not made abnormal profits in recent years.

Those with a bearish take on the stock point to the average revenue per funeral declining in recent years. In the second quarter of 2020, the percentage of ‘full services’ dropped to less than 50% of its funeral activities. This could be customers opting for cheaper, simpler funerals or alternatively a reflection on social distancing and maximum group capacity measures introduced during the Covid lockdown.

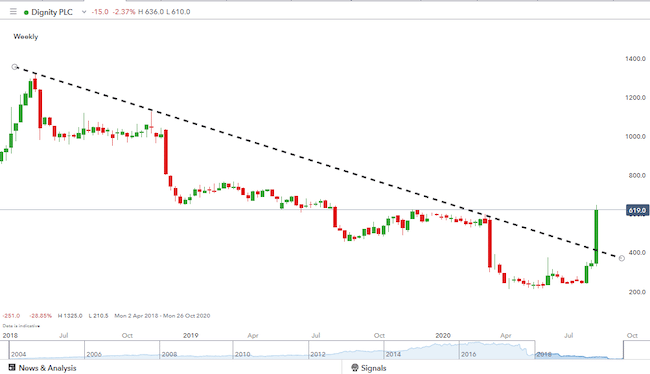

The longer-term share price chart shows the firm once printing prices close to £30. Can a firm in a relatively stable sector really be trading near the £6 mark when the major obstacle to business, the regulatory review, has now receded?

Dignity PLC share price — Weekly candles — 2010–14th August 2020

Source: IG

Technical analysis also points to Thursday’s price move as a break from a significant resistance trend line.

Dignity PLC share price — Weekly candles — 2018–14th August 2020

Source: IG

Summary

Dignity runs the UK’s only national network of funeral directors and crematoria. Only one other firm (Co-op Funeralcare) operates on anything like the same scale. Given the sector it operates in, there is little surprise that the firm’s balance sheet shows a long history of rapid and consistent revenue. Before the recent troubles affected the share performance, the firm had earnings and dividend growth, which tripled its share price between 2010 and 2017.

It’s not a stock for the faint-hearted. Yesterday’s 62% daily rise echoes the 50% daily fall in January 2018. That correction came when investors realised that growth would eventually be capped by geographical constraints. The 10-year growth rate of just over 12% attracted investors but eventually ground to a halt. The firm’s share price slump was a reflection of it being recategorised as a yield stock rather than a growth play.

Investors buying in at these levels will not be making the same unrealistic assumptions made by investors in 2017 — that Dignity’s rapid growth would go on forever. With the regulatory threat subsiding, the firm can get back to being one part of a duopoly, operating in a defensive sector and with a share price that looks like it has been heavily ‘oversold’ for some time.