The price of gold has plummeted on Monday after failing to break the $1960 level as the US dollar gains strength with the DXY looking to break above the 93.00 level…

But why?

Well, the flight to the safety of the US dollar has come as the risk of another lockdown in Europe grows, resulting in stock markets plummeting and traders flocking to the safe haven of the US dollar. At the time of writing the FTSE 100 is down 3.44% and the DAX is down 3.25%.

US yields, which have a strong correlation with gold, have also fallen as US government bond prices rise.

But, let's take a look at some of the technical aspects surrounding golds price drop…

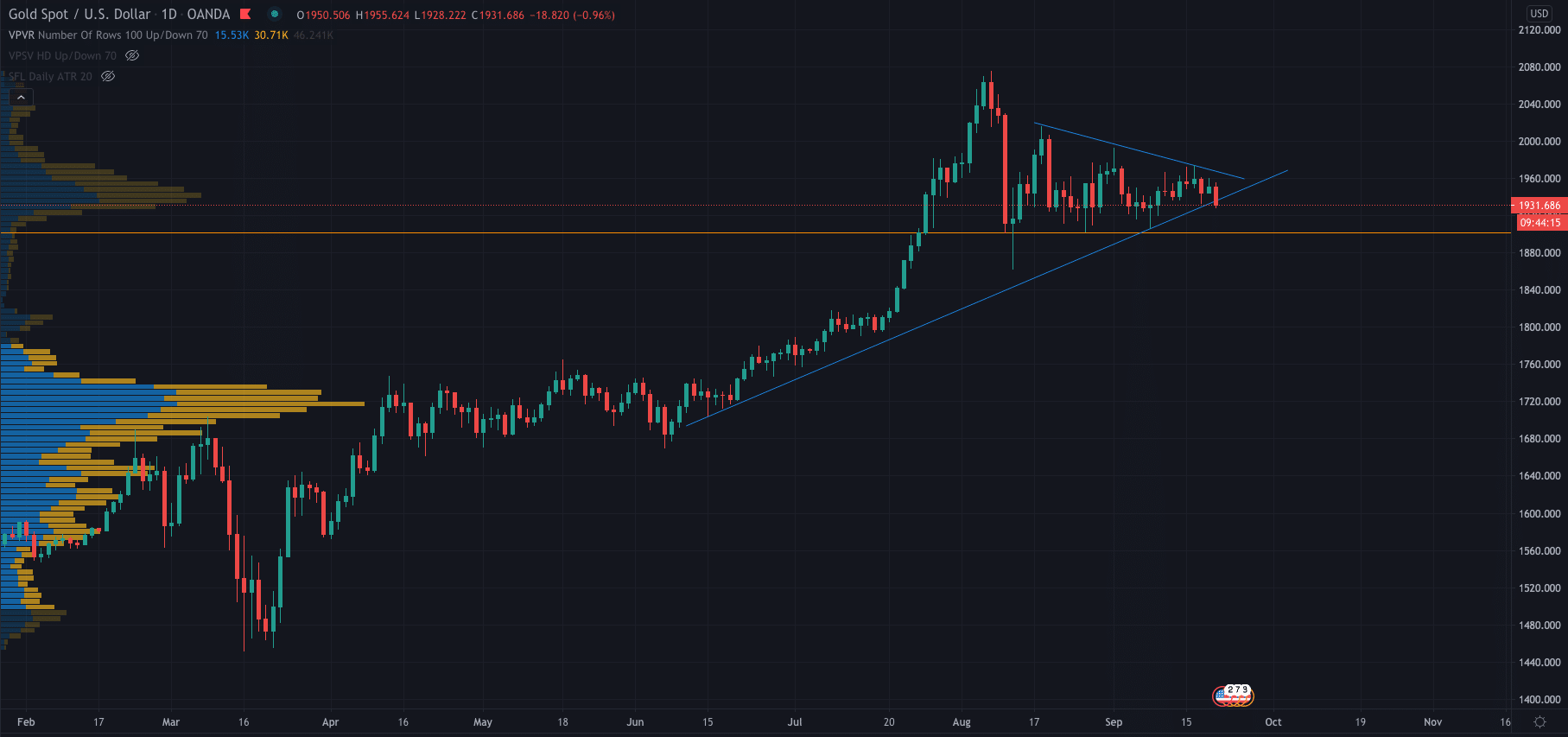

The yellow metal has tried and failed on a few occasions to break above the $2,000 level, slowly creating lower highs, while also forming higher lows at the same time, resulting in a triangle pattern, although there is a case that it is actually a descending triangle with the support level at $1,924.

However, it has now broken below the triangle pattern, currently trading at $1,931, and is approaching the key level at $1,924. With US futures indicating a lower open this may trigger more US dollar buying and, in turn, a further fall in gold and a break below $1,924.

At that point, we could see a test of the $1,900 level with a close below potentially triggering a broader sell-off in the precious metal.

PEOPLE WHO READ THIS ALSO VIEWED:

- Gold Trading Guide

- Trade stocks with eToro

- Learn stock trading strategies