If you want to learn how to pick a stock, or which selection methods might be best suited to you, we are here to help. There are a few fundamental things to know first, but feel free to jump ahead if you need to.

Success in the markets ultimately comes down to the quality of your research and stock-picking. Trade management, risk management and the impact of random events on your portfolio also come into play, but in the long-run, being able to pick the right stock is likely going to be the key factor in determining your performance return.

Table of content

Basic fundamentals of stock picking

When you hold an equity position, you take on the role as an owner of that firm. If the firm makes money, you receive a return, in the form of a dividend payment. Those dividends will continue to hit your account while you still hold the stock.

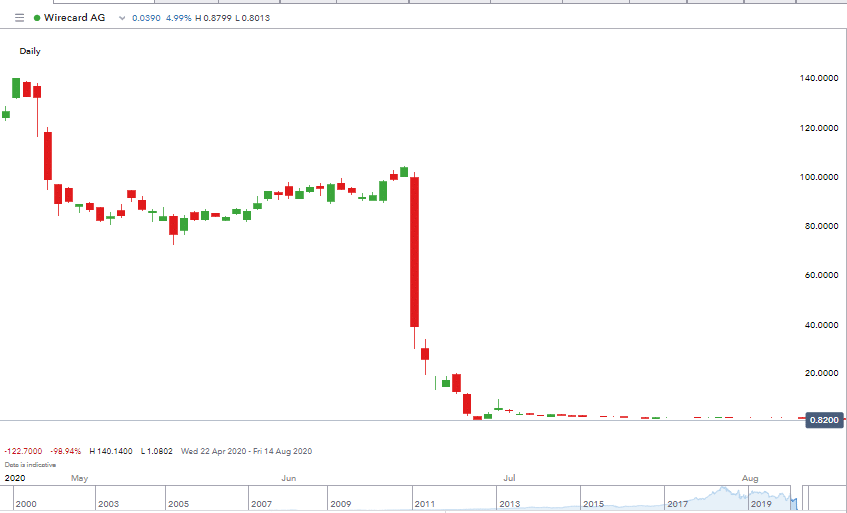

The trick to stock picking is developing ways to find a stock that looks ‘undervalued’. That is, if you buy it today and hold it, you’ll receive a return in percentage terms that offers enough reward for the risk you are taking. Stock trading isn’t risk free, countless firms, including high-profile tech firm Wirecard AG have collapsed and left investors with worthless holdings.

Source: IG

The reward you want from your investment will be some way above the savings interest rate, as holding your cash at a bank involves much less potential downside.

This approach to equity investing has a long legacy. Often referred to as value investing or fundamental analysis, it bases current share prices on predicted future returns.

Reasons to use fundamental analysis

Using a fundamental analysis approach to stock selection is logical enough. Another reason to adopt it is that you’ll be going with the flow. The equity markets are dominated by institutional investors, such as pension funds and hedge funds. If they use value-based metrics to pick stocks, then bet against them as you’ll just end up fighting a wall of cash.

What is fundamental analysis?

Fundamental analysis is based on the P/E ratio. Getting to grips with this is key to understanding where and when it might be good to buy or sell stocks.

The P/E calculation starts by taking the current valuation of a firm. As firms only infrequently change the number of shares in circulation, the value of a firm can be quickly gauged by noting the share price reported on the stock exchange. This is the ‘P’ part of the equation.

The upwards and downwards price moves in stock prices reflect buyers and sellers determining between them what the firm’s valuation should be.

Going back to the fundamental principle of holding shares to receive a dividend income brings in the ‘E’ part of the equation. ‘E’ relates to Earnings Per Share (EPS) – the revenues generated by the firm being ultimately fed back to the owners of the business, the shareholders.

If a firm has 10,000 shares in circulation and earnings of $1,000,000, then EPS is 1,000,000 / 10,000 = 100. The firm’s share price is trading at $150 which means the P/E ratio = 1.5.

Using the P/E ratio to pick stocks

Here are the P/E ratios of some well-known and headline-making stocks:

Zoom Video Communications Inc: 344.46%

Berkshire Hathaway Inc: 23.40%

HSBC Plc: 10.66%

The wide range in P/E ratio, from 10%–344% highlights how your stock picking is now reaching a fork in the road.

Zoom is a growth stock and HSBC a value stock.

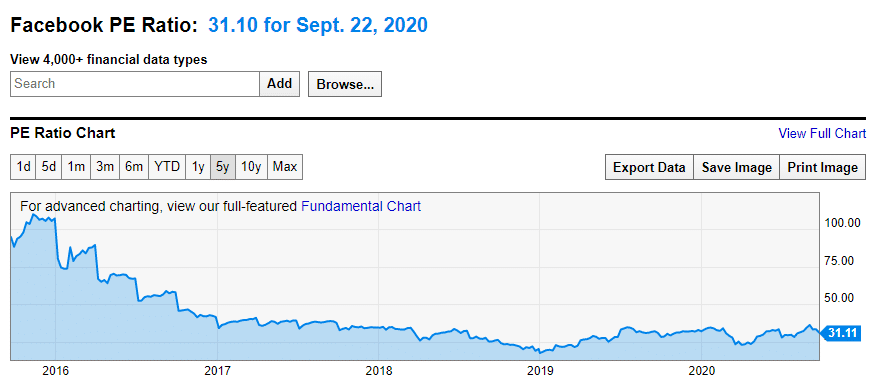

Other useful metrics include the P/E ratio of a particular stock over time

Source: ycharts

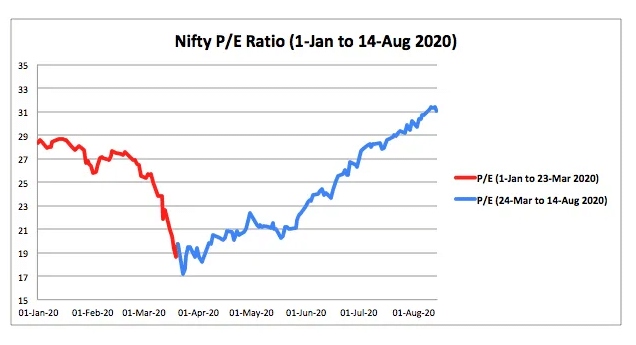

Country and sector comparisons are also insightful. The P/E ratios of markets in different geographical regions are illustrated below.

Source: Stable Investor

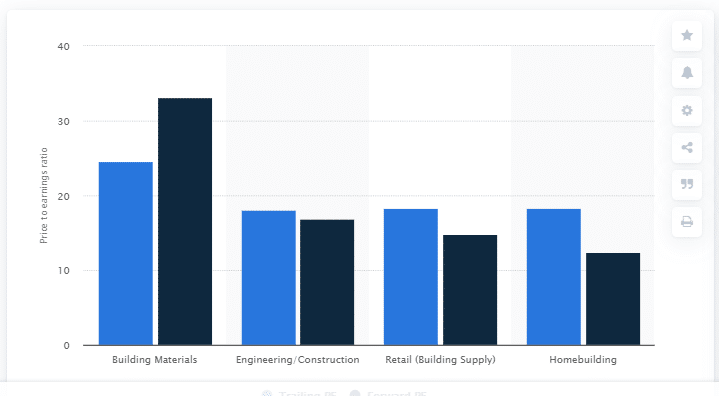

Trailing and forward price to earnings ratio (PE ratio) in the construction sector in Western Europe 2020, by industry:

Source: Statista

How to pick a stock to suit your strategy

This differentiation between growth and value stocks is an important one as investors with different objectives tend to favour one over the other. However, if you’re looking to build a diversified portfolio, then researching and picking a blend of both types would be in line with the conventional approach.

Another way in which the different ideas on the subject work hand in hand involves combining fundamental and technical analysis. While some traders take a partisan approach to the methodology, the reality is that many investors take the best of both worlds.

As outlined, the P/E Ratio is useful in its own right, but also helps you follow the broader market flow. Your exact trade entry and exit points may well be influenced by technical analysis.

Using technical analysis

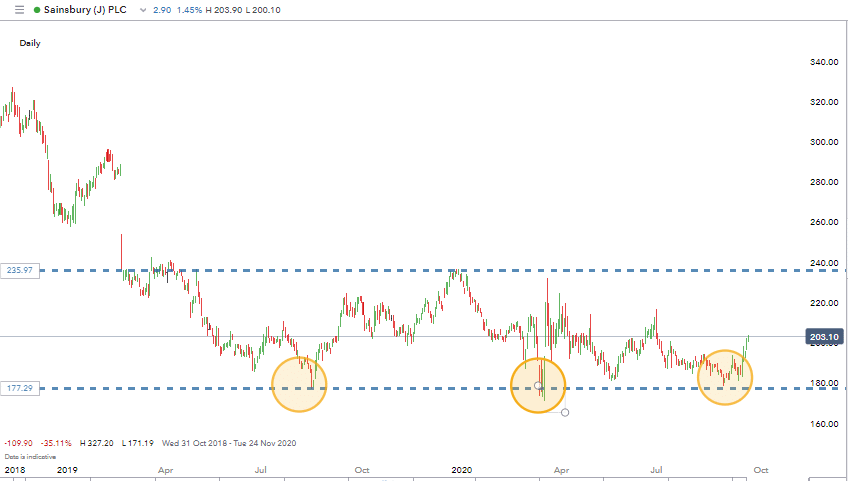

If UK grocery retailer Sainsbury PLC (P/E Ratio 9.47%) appears a good long-term home for your spare cash, then some patience could allow you to enter the trade at one of the points marked out below.

Source: IG

If your target stock is a value-based play with a long-term holding period, you may still finesse your entry into that trade. If it’s trading in a price range, then the justifiable temptation would be to time your purchase to coincide with a moment when it is trading at lower levels.

Day trading stocks

Day-trading and other short-term strategies require higher levels of price volatility. The trading return needs to be large enough to cover the frictional costs such as commissions and bid-offer spreads.

Fortunately, there is a list of high-volume stocks that have more marked price moves. The tech sector is a good place to start. This is because future earnings in ground-breaking industries are harder to predict. The suggestion that future profits are being miscalculated will lead to a change in the share price now.

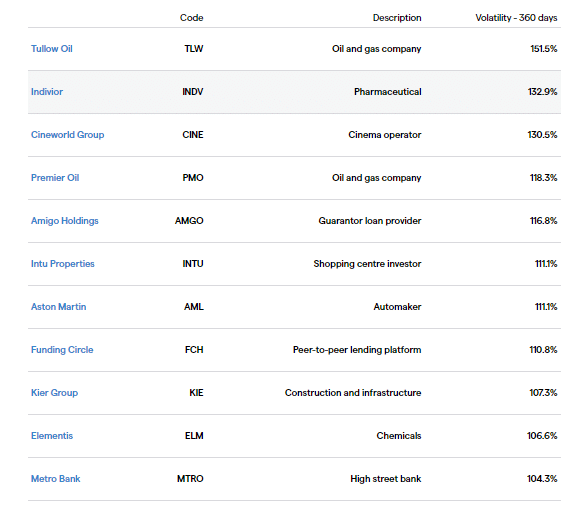

Most volatile UK stocks: FTSE All-Share

Source: IG

Volatile stocks are risky – if you are not ready for the risk, you should not be trading these stocks. Trading in small size is also recommended.

The above chart of UK FTSE 350’s most volatile stocks (mid-way through 2020) records the standard deviation of the share price for the previous 360 days. Some of the names such as the mid-cap oil explorers being perennial favourites of traders looking for equity names with a bit of spice thrown in.

Good research tools for stock-picking

Turning your research into trading ideas is obviously the main aim. The question remains how to source the raw data which can be converted into trading decisions.

Most of the online brokers offer extensive research materials as part of their package. Look for:

- Economic calendars – to help you anticipate market moves

- Live broadcasts – such as IG’s morning call video streaming

- Crowdsourcing of ideas – trader forums, for example

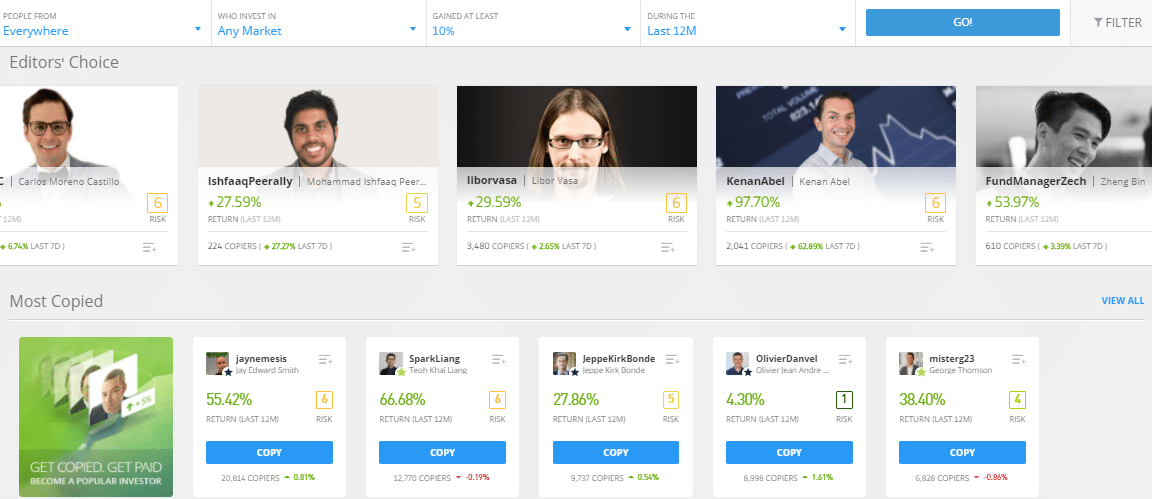

- Copy trading – sites such as eToro feature traders who are more than willing to share their ideas

- In-depth analysis on stock fundamentals – the IG coverage is hard to beat and covers thousands of stocks

- Sentiment indicators

- Charting tools, indicators and oscillators – specialist tools associated with technical analysis

- Management dealings

Source: eToro

The final item, ‘management dealing’ hammers home that there is no information like inside information. This doesn’t mean anyone is being encouraged to break the law and engage in ‘insider trading’. It just highlights that being intimately aware of how a business is doing gives you a competitive advantage.

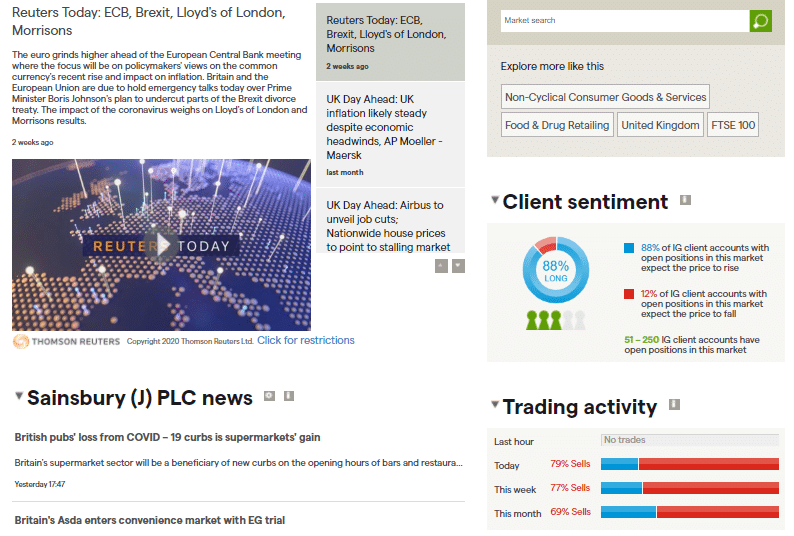

Source: IG

Don’t dismiss ground-level research, including getting a better understanding of firms your use or even work for.

Third-party research

There are third-party research sites. Some charge, some don’t, but pretty much all at least offer a free trial. Popular names include:

- Alexandria Social Sentiment

- Market Realist

- Zacks

- Think or Swim

- Market Realist

- TipRanks

- ValuEngine

- MSCI

- Business Wire

- Seeking Alpha

- Trade Station

- Morning Star

- Dow Jones

- ESG from Thomson Reuters

In addition, some broker platforms offer their clients free access to a third-party research site for which they would otherwise have to pay to access.

How do I improve my stock selection?

Sticking with your strategy is a key element of successful trading. It also helps you run an effective post-trade analysis. You can’t judge if your research and stock-picking is effective if you keep bailing out of trades earlier than the strategy dictated.

Do also be aware of ‘paradigm shift’. Using historical data to predict future events is an approach that is full of holes. It’s just a case of trying to make it work for you.

Until then, follow the news on positions you have. Research is ongoing, particularly if you have a position on. Items such as earnings releases follow a predictable schedule. Your broker might also have a filter on their ‘news flow’ monitor, which allows you to select you receive news items relating to specific stocks.

Next steps

If you don’t get your stock picking right, you are stacking the odds massively against you. They are still only part of the entire trading process. Other skills also need to be developed.

The good news is that stock picking doesn’t involve any ‘secret sauce’. If you commit to improving your research methods, this will feed through as better stock selection. The more you put in, the more you’ll get out.

A lot of the research material you might need is freely available, and demo accounts cost nothing to set up. This means testing ideas in a risk-free setting is easy to do and once done could be scaled up into live trading and real profits.

People who read this also viewed: