Shares of AFC Energy plc (LON: AFC) have been trading sideways since April despite participating in the Extreme E race. It is the exclusive provider of electricity charging solutions for all race cars.

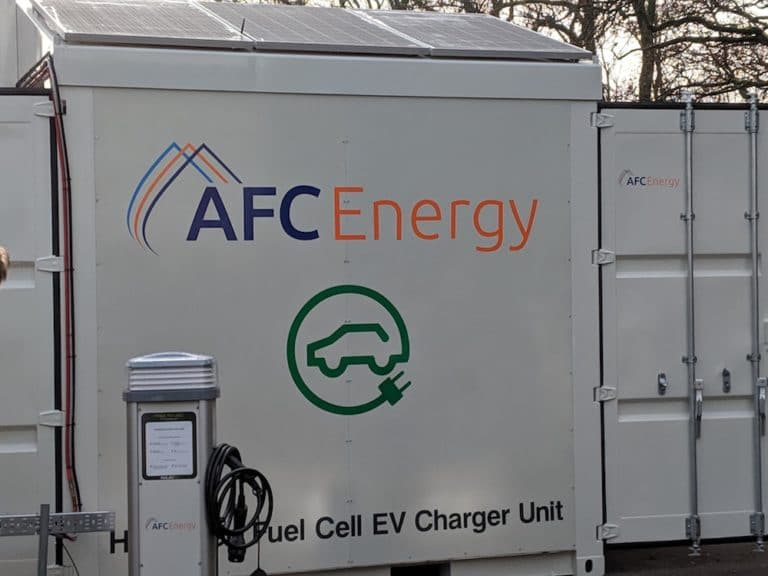

The company’s bespoke hydrogen fuel cell generator and operating system is the sole charging solution for all of the championship’s ODYSSEY 21 electric SUVs. The system has performed exceptionally well in the past two races.

AFC Energy’s proprietary hydrogen fuel cell generator is an excellent replacement for the diesel generators used in extreme off-grid locations by providing a sustainable solution with zero emissions.

The company’s unique system had not been tested before being used on the Extreme E races but had no issues in the Desert X Prix in Saudi Arabia and Ocean X Prix in Senegal. In addition, the system will be used in the Arctic X Prix in Greenland later this month.

The Extreme E races have given AFC Energy a global platform to showcase its hydrogen fuel cell technology, especially its use in extreme conditions. Yet, its share price has traded sideways for the past few months.

Could investors be missing the significant opportunity posed by AFC’s participation in the Extreme E races? Unfortunately, yes, the markets might be missing a significant opportunity here.

AFC energy’s shares have fallen in tandem with other renewable energy companies such as Ceres Power in a broad industry selloff occasioned by the shift in investor preferences to value stocks at the expense of growth stocks.

From a technical perspective, AFC Energy’s share price could surge if the current support level holds, providing an excellent trade setup for swing traders. However, a break below the level will invalidate the trade setup.

*This is not investment advice.

AFC Energy share price.

AFC Energy shares have been trading sideways since April and are down 28.7% in 2021.

Should you invest in AFC Energy shares?

AFC Energy shares are traded on the London stock exchange's AIM market (the alternative investment market), which is the submarket specifically for smaller companies. AIM stocks are attractive to investors as they have tax advantages and smaller companies have the potential to benefit from rapid growth. But are AFC Energy shares the best buy? Our stock market analysts regularly review the market and share their picks for high growth companies