- Share prices in the airline industry outline what happens to the prices when everything that can go wrong does so.

- The perfect storm of issues created by the COVID-19 pandemic has carved billions off the valuations of the firms in the sector.

- Gaining a firm idea of the next price move is made harder by the number of issues in play. However, identifiable calendar events are coming up, which make it a situation worth monitoring.

Holders of airline stocks will be aware that few other sectors have been as thoroughly battered by the COVID-19 pandemic. Passengers were stopped from flying as governments grounded aircraft to stem the spread of the disease. The easing of the lockdown, which offered a glimmer of hope to some parts of the economy, has only exposed the challenges facing the air travel sector.

Individuals have had their risk-return massively skewed. Take, for example, the wealthy pensioners of the baby-boom generation. This group, with the time and money to travel abroad, now find themselves the part of the population most at risk from the virus. It's not only silver surfers who have developed a fear of flying. Corporate travellers have dwindled in numbers as firms consider the risk of being liable for encouraging/permitting their staff to travel. Both individuals and businesses are scaling back on big-ticket travel expenditure.

Crash landing

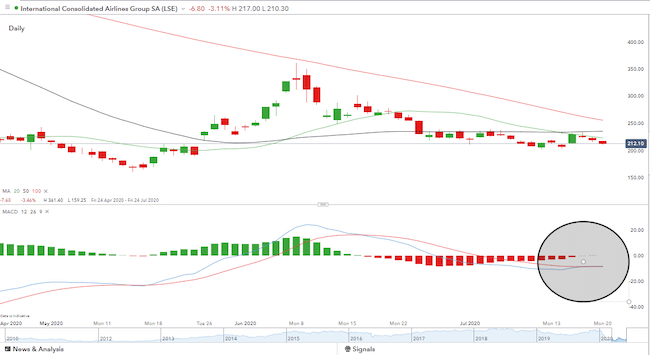

There is bad news for the UK listed companies such as EasyJet (LSE:EZJ), Ryanair (LSE:RYA) and IAG (LSE:IAG). The UK is experiencing particular hardship with passenger journey numbers recovering at a slower rate than across the rest of Europe. The IAG share price chart is reflecting this by forming an ‘L-shaped' rather than a ‘V-shaped' pattern.

IAG share price – Daily Candles – Year to date – 20th July

Aviation UK has released a report claiming that a 12 month cut in Air Passenger Duty would save 8,000 jobs. Transport infrastructure might also benefit with the reduction being suggested to save 300 of the 600 routes under threat of being cancelled by an industry which is on its knees.

The request for a tax break may materialise as it comes hot on the heels of support for other sectors of the economy. Recent Treasury policy measures have included cuts in VAT on hospitality industry goods and services and a reduction in Stamp Duty paid on property transactions. Not only has the airline industry so far missed out, but it also requires greater support. The VAT and Stamp Duty measures are being implemented for a few months, but longer-term support is needed for airlines.

This is more than pork-belly politics (politicians trading favours with constituents or interest groups in exchange for political support). The stated need for support to last for at least one year highlights the long-term nature of the challenges facing airlines.

To some extent, the sector's dynamic culture is working against it. The history of airlines is littered with charismatic captains of industry setting up disruptor companies which thrive against the incumbents. Two of the major players in the industry, Easy Jet and Ryanair, not only broke into the industry but completely reshaped it.

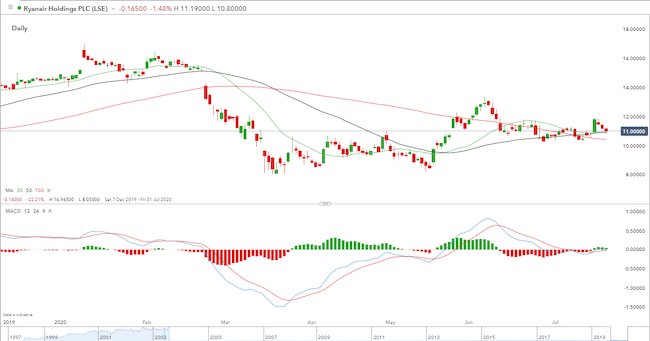

Ryanair share price – Daily candles – Year to date – 20th July

The disruptors still have supporters in the financial markets. The Ryanair share price currently trades above the daily SMA's due to investors perceiving the firm as battle-hardened. Its survival instincts sufficient to suggest it would be unlikely to go bankrupt and is possibly well positioned to pick up market share from those that do. In the 15 trading sessions following the 14th of May, the RYA share price rose by more than 57%.

Potential trades

A long-term ‘buy and hold' is tempting. These would assume that the bad news is priced in, and there are also reasons to believe that the unique aspects of the industry mean it might currently be oversold.

One potential trigger for an upturn in share prices in the sector is a proposed cut in the Air Passenger Duty tax which is applied to each flight. UK passengers typically pay £26 for a return trip and the industry is lobbying to have it suspended. Price may not be the critical factor when potential customers are considering whether or not to travel, but paying less for something never went out of fashion.

The release of the report by the industry body Aviation UK means the idea is beginning to gain traction. As outlined, it won't be the salvation of the sector but it could trigger a rise in share prices. Even traders with a longer-term investment horizon may look to bank some profit from short-term price spikes that might occur if the government announces airline-specific support in the coming days and weeks.

To date, the UK government has been playing hard-ball with the airlines. All have been instructed to exhaust every other means of private financial support before approaching the Treasury for assistance. There is also a suggestion that any bail-out would be on punitive terms. With no sign of that approach shifting, a tax-break to soften the blow may well be likely.

In it for the long haul

Longer-term trading strategies can also factor in upcoming calendar events as potential entry points for buy trades.

Winter is traditionally the quietest season in terms of passenger numbers and the government-backed furlough scheme is scheduled to wind down in October just as the airlines face their toughest quarter. As a result, job cuts are almost guaranteed. If the airlines take the approach that the first cut should be the deepest, then the high-profile nature of the sector is sure to grab news headlines.

Depending on the size and nature of cuts, this could be an opportunity to buy any aviation shares which drop in price. It's a hard-nosed approach but cutbacks in staff numbers will leave the firms with preferred staffing choices and without any ‘dead wood'. As with the financial crisis, a headline-grabbing crisis can form a handy opportunity to clear out unsatisfactory employees.

Roland Head of Motley Fool also notes that restructuring could bring about long-term benefits. Considering EasyJet specifically, he wrote:

“Staff face even bigger cuts. Up to 30% of the airline's employees could lose their jobs, due to fewer aircraft and changes to working practices. Such massive cuts would be hard to push through in more normal times. But with the airline industry on its knees, I suspect Lundgren will get an easier ride from unions representing aircrew.”

Source: Motley Fool

As the creator of value investing Benjamin Graham said: “The intelligent investor is a realist who sells to optimists and buys from pessimists.” Currently, optimism in the airline has been crushed out of existence.

In terms of airline share prices, there is also another drag on performance. The sector has traditionally attracted investors looking for dividend yield. International Consolidated Airlines (LSE: IAG), the owner of airline brands such as British Airways, have made payments to shareholders since 2016 in a range between 3.75% and 7.5%. The scrapping in April of the IAG 2019 Final Dividend signalled those days are over. EasyJet's decision to honour its Final Dividend just as the lockdown was imposed drew considerable criticism from the public. Given the public-facing nature of their operations, antagonising their client base in such a way could be counterproductive.

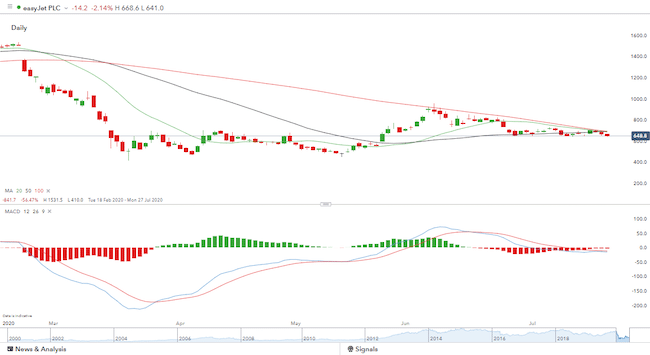

EasyJet Plc – share price – Daily candles – Year to date – 20th July

The dramatic change to the nature of the firms in the sector, away from being high-yield targets, has required stock pickers who rely on dividend income to consider their positions. Slashing dividends has been a significant trend in 2020 but some sectors, such as banking, look to be in a much better position to begin paying them. Such a rotation out of one sector into another can distort prices to the downside with institutional sellers driving down prices as they liquidate large positions with only speculators looking to take on the other side of the trade.

IAG share price – Daily Candles – 27th April – 20th July

The MACD on the daily IAG chart is showing a hint of a cross-over, so at least bottom-fishers won't be swimming against the tide. The 20, 50 and 100 SMA's have also caught up with price to offer the chance of price breaking above them.

Buying airline stocks is a risky business; the share prices in the sector are relatively volatile at the best of times. It's hard to know whether to consider Ryanair the strongest or the ‘least weak' of the firms in the sector. Even they see the glass half empty. Market Watch reports the firm as stating that:

“Ryanair now expects the recovery of passenger demand and pricing–to 2019 levels–will take at least two years, until summer 2022 at the earliest,”

Source: Market Watch

There are, however, recognisable signposts, which might indicate when the timing could be right.