Key points:

- The ticker is showing Alleghany Corporation down 93% premarket

- There is no news, at present, to support this price change

- It could just be a fat finger mistake – but for the whole market?

- Upcoming IPOs to Look For

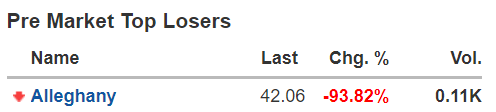

Alleghany Corporation Inc (NYSE: Y) stock is being reported by the usual tickers as being down 93.82% this morning premarket. That is an absurd price movement and there’s no news release to accompany such an event. This is just from one particular stock market tracking site, it doesn’t matter which one:

That can’t really be right. Or at least we don’t think it can be right. It is, obviously, possible for large companies to go right over the cliff in a sudden burst but we’d think it unlikely of Allegheny. A holding company for insurers? Unless there’s been the uncovering of some massive fraud or hole in the accounts we would, as we say, think such a stock price movement in Alleghany to be, well, remarkable. Along the lines of The Queen really turning out to be one of the Grey Aliens remarkable.

The Google ticker says much the same thing. The Yahoo Finance ticker does. The other usual sources all say much the same as well. There’s no announcement to the SEC so far, nothing on the company pages. Possibly more to the point, there’s nothing from any of the usual news sources either. The Alleghany market cap was $9 billion and we really would not expect to see $8.5 billion of that disappear without some of the usual suspects remarking upon it.

Obviously though, it is in fact possible that some gremlins have come out of the closet at some point.

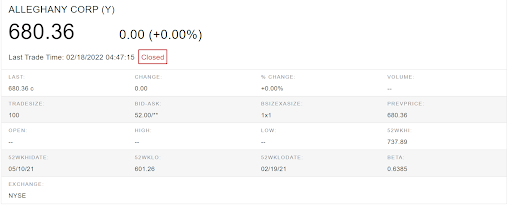

One explanation is that all of the varied feeds are working off just the one source, the NYSE itself. Which is showing the following:

The bid ask is down at around $50. That is that 90% and change from last night’s closing price.

This could all simply be a fat finger mistake at the NYSE with that then propagating through all the feeds which pick up from that one information source. Or, of course, it could be that near entire collapse of Alleghany and its stock price. We would suggest finding out which it is before trying to trade the issue.

If it is just a fat finger mistake then if it’s possible to actually buy stock at this price then there’s significant profit to be made. But if there’s some news about disaster that has leaked to the market but isn’t published yet then that’s another story of course.

Trading would require more information than currently seems to be available at pixel time.