- Tech giants Amazon (NASDAQ:AMZN) and Facebook (NASDAQ:FB) have seen their stock increase in value by eye-watering amounts since March

- The natural inclination to expect a correction could be misplaced

- There are always warning signs to look out for, but the most robust indicator still points towards buying the dips

Tech stocks that led the rally from the market lows of March continue to carry a substantial and significant burden. As the leading indicators of the initial recovery, signs of their share prices falling away would be alarming for the rest of the equity market. Whereas tech behemoths have the liquidity and IP to forge a bright future, regardless of COVID, the multitude of stocks that followed them upwards appear to be riding on the coat-tails of Facebook, Amazon and others.

While keen-eyed perma-bears monitor the share prices of the FAANG companies, looking for signs of a broad market correction, they might be focusing too much on the detail and not sufficiently on the bigger picture. Yes, the big tech firms are leading indicators, but they continue to point upwards. The moments of price weakness have for several months formed opportunities to buy dips rather than signal that the market was rolling over.

Higher highs, and higher lows

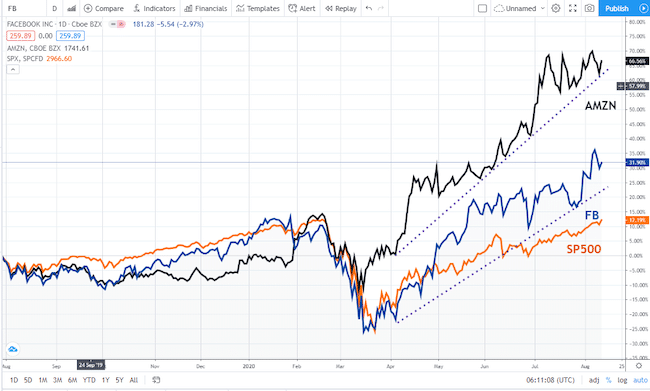

The share price chart for Amazon vs Facebook vs S&P500 highlights how the supporting trend is holding steady. Until that breaks, the dips look like an opportunity for the bulls to profit.

Amazon vs Facebook vs S&P 500 – 12-month comparative share price chart

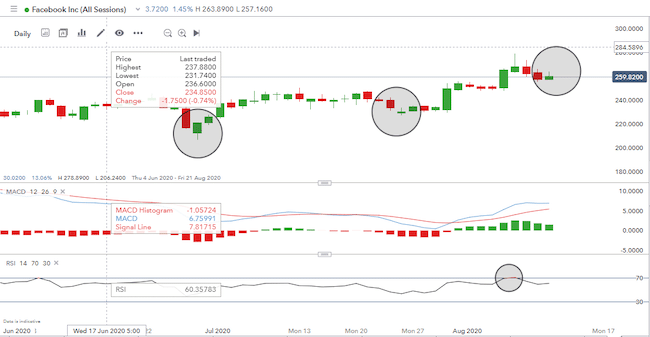

The classically bullish price action of the tech stocks comes with a much greater range of peaks and troughs than the S&P 500 index, which covers the broader equity sector. This price volatility opens the door to range trading the tech stocks to try to squeeze out extra profits. Picking the correct retracement to short can be tough, but the indicators are there. Sustained buying pressure on Facebook during the first week of August did lead to the RSI breaching the important 70 level for the first time since June. The resultant sell-off could have proved profitable for short-sellers factoring in that prices always return towards the longer-term averages.

There is, of course, some risk involved with betting against the underlying trend. The Facebook share price chart is full of instances where any sell-off has been met by renewed interest from buyers.

Any break of the supporting trend line would be the primary indicator of trouble ahead, but until that happens, the dips do look like buying opportunities.

Facebook All Sessions – Daily Candles – 4th June–12th August

Resistance and support

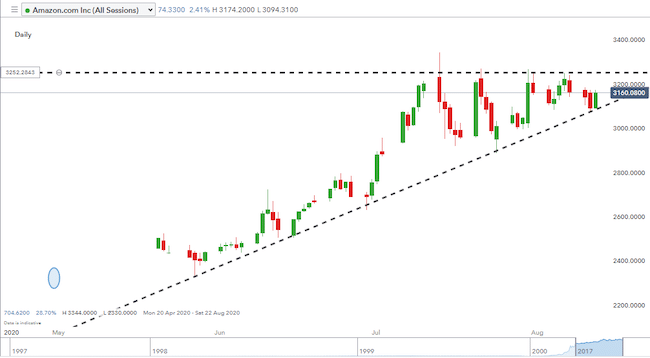

Trend following can be incredibly profitable and there are signs that fundamental and technical factors may be beginning to form resistance to further upward share price movement.

Amazon's share price has over the last month made several attempts to break through the $3,250 resistance level. The result is an ascending wedge price pattern. While such patterns are statistically speaking, bullish, there is an understandable focus on whether it might, in this instance, signal a break to the downside.

Amazon All Sessions – Daily Candles – 25th May–12th August

The Amazon share price rally is also surprising those who study the fundamentals of the firm. Bloomberg highlighted one particular disconnect in July when Catherine Larkin wrote:

“Despite the growing optimism, Amazon's rally has left most Wall Street analysts in the dust. Fewer than a quarter of the 50 or so analysts tracked by Bloomberg have a target above $3,000, and the average target is about $2,810. While that is up from the $2,179 average at the end of 2019, it still implies a downside of about 7% from current levels.”

Source: Bloomberg

It takes courage and deep pockets to bet against Amazon while the supporting trend line holds. Only days after Larkin's article, the Amazon share price, which had just broken the £3,000 level, printed over 10% higher at $3,344.

The fact that analysts continue to play catch up on the share price targets might be unsurprising. There are two critical features to the Amazon success story, which are potentially hard to value.

Amazon's main competitive advantage is Prime's free and fast delivery of everything anyone might want to buy. The COVID lockdown saw the range of products supplied increase to include bulky and costly items, such as tins of paint. Whether that particular consumer trend holds as the lockdown eases is a valid question. If it does prove to be the case, then Amazon is set to benefit. The firm's extensive network of highly efficient and massive fulfilment centres is realistically impossible to replicate. It mirrors the way that IKEA built a business model, which allowed for only one player.

Duplicating the Amazon infrastructure would require massive investment and so much time that it provides a very effective barrier to entry. Even if attempted, it would probably take many years for any company to achieve Amazon's level of efficiency.

The second advantage that Amazon enjoys is its massive cash pile and a willingness to invest in new business lines. The Amazon Web Services (AWS) might sound like a natural progression for a big tech firm, but is a very different beast to the low margin e-retailing business. In Q1 of this year, the market-leading cloud platform generated $10.2bn in net sales, up 33% from last year.

It's also a sector with fatter margins. In the previous quarter, AWS accounted for just over 11% of total revenue, yet 67% of total operating profits.

Over at Facebook, it's a similar story. Negative press relating to an advertiser ‘boycott' has instead highlighted how demand for ad space on the social media site is pretty inelastic. As big-ticket firms such as Coca-Cola, J.M. Smucker Company, Diageo, Mars, HP and CVS Health put a hold on advertising with Facebook, other firms have stepped up to take their place. The situation may have hurt Facebook reputation-wise, but there doesn't appear to have been much of an impact on revenue. While this was a test that Facebook management would not have taken voluntarily, the outcome is pleasing for them and for the shareholders. Demonstrating that the firm is not beholden to one particular area of its client base is part of the reason that the share price continues to trade above its support line.

Online marketing analyst Gary Vaynerchuk explained that not only has FB built stronger relationships with smaller clients but that the more prominent players will ultimately return to the space:

“Their media product or ad product is incredible and has the broadest collective reach. So if you're a big company within the small business space, that's always going to be a place you're going to want to be.

“Facebook is too important to the big businesses … some of the (advertising) prices went down … because a lot of brands pulled out dollars and so I see hyper-under-priced opportunity on Facebook and Instagram.”

Source: CNBC

There's also the chance that the ‘Stop Hate for Profit' campaign, which led to the boycott, might be successfully addressed or at least blow over. Facebook continues to release statements on the subject and is at least demonstrating a willingness to resolve the matter. Speaking with CNBC, a Facebook spokeswoman said:

“We've invested billions of dollars to keep hate off of our platform, and we have a clear plan of action with the Global Alliance for Responsible Media and the industry to continue this fight.”

Source: CNBC

These are interesting times for Facebook and Amazon. Both firms are continuing to develop and expand their business models, and the COVID-19 pandemic has opened the door to new opportunities for them. All good things come to an end, but the fundamentals do support continued dip-buying, for as long as the supporting trend lines hold.