Shares of ARC Minerals Ltd (LON: ARCM) are trading sideways after falling from their all-time highs hit in mid-March. The decline was fueled by the firm’s £1.8 million capital raise via a discounted placement of 27.7 million shares at 6.5p each.

Investors have ignored several positive announcements following the capital raise, such as ARC Minerals’ acquisition of a 75% stake in Kopore Metals’ Virgo project located in Botswana for £1.8 million in ARC shares.

The miner also recently announced that a third-party buyer was interested in buying its 99.43% stake in Casa Mining, sold to Golden Square Equity Partners Ltd for $5 million.

ARC was supposed to receive payment via a loan note, but the new buyer may be willing to pay cash for the asset.

The loan note, which was due on March 19, was extended to July 16 to give ARC Minerals time to consider the deal, which needs its approval to proceed.

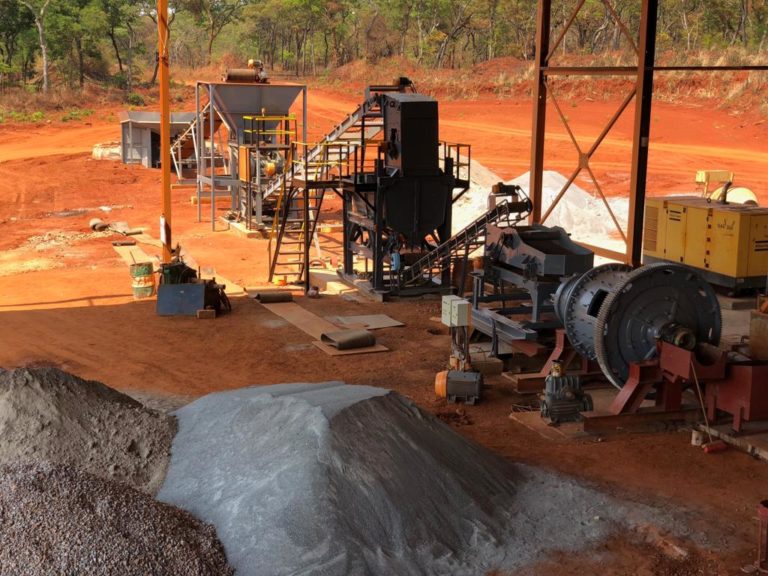

ARC Minerals is in an excellent position to profit from the rising demand for copper over the next few years via its exclusive agreement with Anglo American to exploit its copper resources.

Other players have also expressed interest in partnering with the company due to the viability of its copper resources, leaving the firm in an excellent bargaining position.

ARC’s management team also puts shareholder interests first, given that they recently surrendered their rights to 75.8 million share options and stopped any future share awards to directors to prevent the unnecessary dilution of existing shareholders.

The miner’s fundamentals are pretty bullish, while the technical picture is mixed. ARC shares are trading in a range located some distance away from a significant support area. While a bullish breakout is likely, there is a significant risk that the shares will fall to the primary support area.

Arc Minerals share price.

Arc Minerals shares have been trading sideways since falling from their all-time highs hit in mid-March.

Should you invest in Arc Minerals shares?

Arc Minerals shares are traded on the London stock exchange's AIM market (the alternative investment market), which is the submarket specifically for smaller companies. AIM stocks are attractive to investors as they have tax advantages and smaller companies have the potential to benefit from rapid growth. But are Arc Minerals shares the best buy? Our stock market analysts regularly review the market and share their picks for high growth companies