Key points:

- ASOS will report final results Wednesday, October 19

- ASOS shares are down 78% in 2022

- ASOS shares are one of the top 5 most shorted London-listed stocks

Update: ASOS released a trading statement on September 9 stating full year results will be released on October 12 (today). However, ASOS has today confirmed to AskTraders that the release will, in fact, be on October 19 (listed on its financial calendar). We have updated the dates in this article to reflect the confirmed release date

ASOS will report its full-year results on Wednesday, October 19, and due to the current macroeconomic and overall investment climate, expectations aren’t exactly positive.

The company is the latest high-profile fashion brand to report results following Boohoo and Next in recent months. Both Boohoo and Next provided bleak outlooks, with BOO cutting guidance, stating that due to the macroeconomic and consumer backdrop, it expected a similar rate of revenue declines to persist over the remainder of the financial year if the conditions continued. Meanwhile, Next cut its guidance due to inflation and the cost of living crisis.

Surging costs have clearly had a significant impact on retailers, and ASOS revealed in its September trading statement that full-year profit is expected to be at the bottom end of guidance, while full-year sales “are anticipated to be in the range of market expectations.”

However, what’s more concerning is that it said after seeing good growth in June and July, sales in August were weaker than anticipated due to inflationary pressures and a soft start to Autumn/winter shopping. As a result, ASOS cut constant currency sales growth to around 2% from the previous expectation of between 4% to 7%, while it expects net debt to be about £150 million. It previously forecast net debt in the range of £75 million to £125 million.

Also Read: The Top Defense Stocks To Buy in 2022

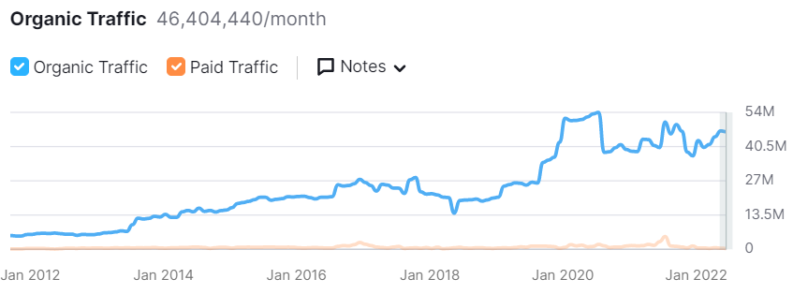

However, according to Semrush, web traffic has picked up recently despite the significant dip since late 2021/early 2022. After a low of 36.9 million in April, organic traffic in September hit 47.7 million.

Even so, ASOS shares are down a substantial 78% in 2022 and 81% in the last 12 months, while last week, they declined over 10%.

In addition, the company is among the top five most shorted London-listed stocks. According to Short Tracker, six different funds are cumulatively short 6.83% of ASOS’ total share issuance.

In late September, RBC Capital analyst Sherri Malek downgraded shares of ASOS to Sector Perform from Outperform in a note to clients, lowering the firm’s price target to 1,000p from 2,000p. The analyst stated that ASOS’ competitive advantage on service “has narrowed as omnichannel retailers have closed the gap,” undermining the stock’s ability to outperform. Furthermore, Malek stated near-term growth would likely be challenged by soft consumer spending.

Bottom Line

Overall, the bear case for ASOS is clear, and the current negative sentiment and macroeconomic environment remain obstacles. Nevertheless, the downside move is significantly stretched.

That does not mean it won’t continue its rapid decline, but investors should be aware that any hint of a change in sentiment could result in a jump.