Key points:

- Assure Holdings has soared 285% this morning, after 100% yesterday

- There's no obvious news or information to justify this

- If it's just a momentum trade when will it reverse?

Assure Holdings (NASDAQ: IONM) is by some tickers trading up 285% premarket this morning. This is after a 107% rise yesterday and the price move seems to be continuing. There is no specific news for this price change either. Of course, 400% and change up in 24 hours is nice, but it still doesn't make up for the 72% fall in the IONM stock price since the IPO back last fall. It assuages those losses but needs to go a little further before it recaptures all of them.

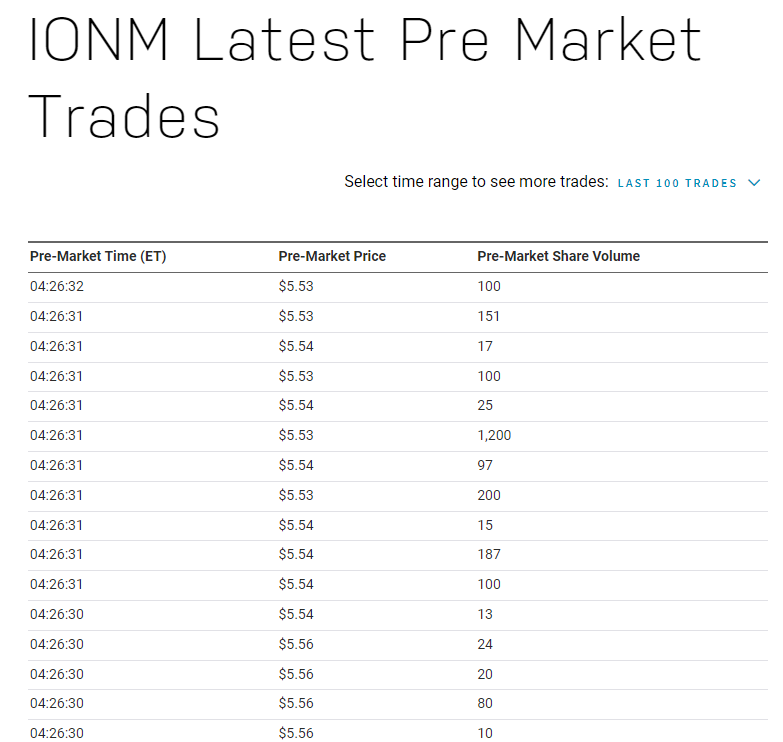

As ever, our first port of call when seeing price movements like this is to the NASDAQ market itself, to check that we've got real trade going on. It can happen – indeed we've detailed it happening – that in the very thin overnight markets a trade of a few shares only at some outrageous price can move the tiocker. This is not what is happening at Assure. Instead, we're seeing real trade, in volume, at these significantly elevated prices:

A reasonable start to trying to work out what is happening here is simply that this is momentum trade. Folk have seen the stock price moving and are piling in behind it. The corporate capitalisation is only – well, before all this – $13 million, so it's a pretty easy stock price to move. It doesn't take all that much buying to move it around that is. If it is just a momentum trade then our decision has to be whether to join it, leave it or, even, short it if we think it's peaking. Given what's been happening at AMTD Digital shorting an irrational price movement looks like a very dangerous thing to do at present. Even if it's something that will obviously come right in the end. As Keynes said, markets can stay irrational longer than you can stay solvent.

Also Read: Five Best Pharmaceutical Stocks to Watch in 2022

As to what Assure actually does with the current stock price moves that's almost irrelevant. As it happens it's in the neuromonitoring business. It's part of that complicated American healthcare system and it provides services to those dealing with spine and head injuries. It's also not done well since that IPO and just a few weeks back decided to rationalise its operations. It's difficult to think that a change of management strategy weeks back will cause an explosion in the stock price today.

Just for confirmation's sake, this is also not the result of a stock consolidation – or a reverse stock split. This is a real movement in the Assure stock price, not just some nominal one.

Which leaves us with the problem of, well, why? It doesn't look like r/wallstreetbets has climbed aboard but then who knows what they might do over there? As we've pointed out before soaring stock prices can indeed be great things to climb aboard. But many such soars are followed by plunges – momentum can reverse very quickly indeed. So, unless one is to merely gamble it's necessary to work out why a price is soaring as it is. With Assure Holding that's the key issue. If it is just momentum then the question becomes will it reverse and if it will, when?