Key points:

- The Avast share price jumped 42% this morning

- The CMA's provisional report says the Norton merger can go ahead

- The final price will depend upon the Norton stock price in the US

Avast (LON: AVST) shares have leapt 42% this morning as it looks like the merger with Norton (NASDAQ: NLOK) is back on. The Competition Authority has managed to extract thumb and say that it can go ahead – at least, those are the provisional conclusions. The expectation therefore is that everything can go ahead. This is not a certainty as yet because, obviously, bureaucracy, but it's looking pretty certain. And thus the bounce in the Avast share price to around where the merger is expected to be.

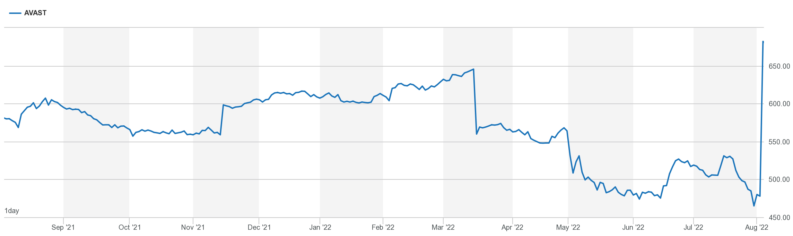

As we can see from the share price chart (it's clearer on the stock exchange version) the Avast share price has been moving along with expectations of this deal coming off. A significant boost last autumn as the deal is set up, then that fall in March when the deal was called in for consideration by the Cmompetition Authority. Varied wibbles as sentiment about how that would turn out and now today's soaring as it looks like it will go through.

One lesson we might take from this as traders is how important that bureaucracy now is to what happens in markets. This has all, or will by the time we see the final result, taken a year to sort out. The box tickers like to take their time so pouncing on merger opportunities is something that cannot really happen any more. A shame but there it is, the ever greater regulation of modern life.

Some will prefer the more normal layout of a trading chart for the Avast share price:

Also Read: 8 Best UK Tech Stocks To Buy Right Now

It should be said that this isn't, wholly and fully, a done deal as yet. What has been released so far is the provisional findings from the Phase 2 investigation. The statutory deadline for the CMA's final report is 8 Sept and so that's the date by which we can expect that final go ahead. The reason that the AVCT share price has jumped today is that this is the last legal barrier to the merger.

As to what the deal actually is, Nitro Bidco, a wholly owned subsidiary of NortonLifeLock, will make a recommended offer for the entire share capital of Avast. Given that legal deadline for the CMA the first practicable date for this to close would be 12 Sept 2022. Assuming that happens then the new NortonLifeLock shares will list on NASDAQ on 13 Sept.

Avast shareholders can elect to receive either 31% in cash, 69% in Norton stock, or 90% in cash and 10% in stock. As it happens, Norton stock is at about the same valuation (around $27 a share then, $24 now) as it was when the deal was first announced a year back so the delay hasn't changed the price much at all.

As to trading this the valuation of the deal depends upon the Norton share price, obviously, so there could be variances in the market price and the takeover price depending upon how that moves in this next couple of weeks.