Key points:

- ATXI stock is up 1,700% premarket

- There was also a 105% rise yesterday

- How much of this is purely nominal, how much is a real price change?

Avenue Therapeutics (NASDAQ: ATXI) stock has soared 1,743% premarket this morning. Or, alternatively, we could say that ATXI is up more like 115% or so – which is still impressive. The real news here is that the NASDAQ quotation has been saved – or, if we prefer to think of it this way, the tactic used to do that has really worked this time. The difference between the two figures is that difference we must always make between a nominal price change and a real one. Nominal changes make us no money – real ones can.

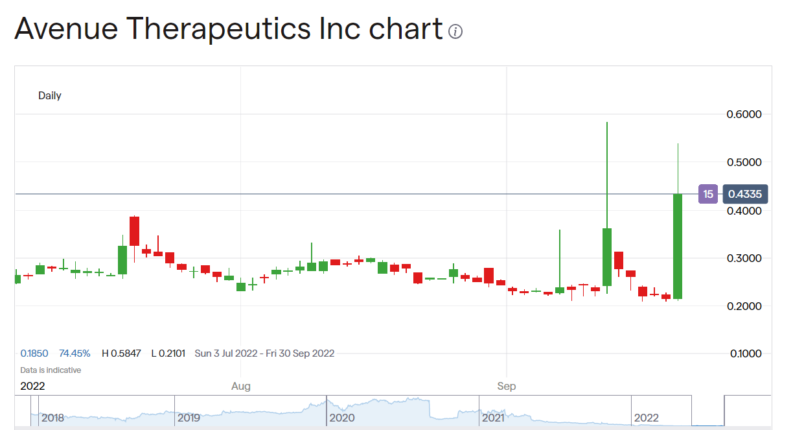

ATXI stock is down 71% over the past 12 months, not a good result for those who have held during this period. Avenue Thera as a company is a specially pharmaceutical company working on materials for the acute/intensive care market. The major candidate they have is intravenous Tramadol, a synthetic optiate. This is in Phase III trials currently.

The importance of noting the field ATXI is in is that this level of drug development is high risk – so, it's near always funded by stockholders. Such trials just eat capital. This then means that access to a market in which capital can be raised is extremely important. It's maintenance of this access – that retention of the NASDAQ quotation – which is driving the price change here.

Also Read: How To Buy AstraZeneca Shares

Avenue stock has fallen 71% over the past 12 months and has thus fallen below the NASDAQ $1 minimum bid level. This means the loss of the NASDAQ listing in time. The traditional solution to this is a reverse stock split – a consolidation to Brits. Here it's 15 for 1. 15 of the old shares are now one of the new – that should mean a 1,500% rise in ATXI stock. For the value of the corporation hasn't changed, the value of any stockholding hasn't, just the number of pieces of stock in existence.

This is not, in fact, what has happened. We've that 1,700% ATXI premarket price rise (or, as it's fallen to in the time to type a few paragraphs, 1,618%). So, that's 200% over the 15 x price rise we would expect on a theoretic basis. Or, about a 7.5% real price rise, over and above that 15 x purely nominal price rise.

Except that doesn't quite tell the whole truth either. For Avenue Thera rose 105% yesterday, after the announcement of the reverse stock split but before it took place. So, we should probably take the 105%, plus the 7.5%, price rise as being the real price change here. Which is a very impressive indeed price movement from what is usually a purely nominal movement.

The answer here is probably that opinions on Tramadol successfully completing testing are strongly pro- it happening. So, being able to maintain the NASDAQ listing and so retain access to further capital is good news. It's also possibly to wonder more than a little though. A 100% and more real price rise from just that one factor is really a very strong reaction. It's entirely possible that the effect will fade during the day.