Key points:

- BiomX units are up 100% premarket

- But the warrants and common stock have hardly changed

- This could be a mispricing which could be traded as an arbitrage

BiomX (NYSE: PHGE) stock is up a bit this morning, but not much. The warrants (NYSE: PHGE.WS) seem unchanged but that might just be that the market isn't open as yet. But the units – which are stock and warrant – are up 100%. That's a significant pricing anomaly. It's worth trying to work out why this is happening before deciding upon a trading strategy.

As to what BiomX is it's a spin off from the Weizmann Institute in Israel. It's a clinical stage pharma company and is working on “phages”. These are bacteria which might themselves be used to fight disease or symptoms – they're highly hopeful of having something useful for Crohn's Disease for example. The current interest is that at the back end of last week they announced that they really did have something and this current trading seems to be working off the back of that.

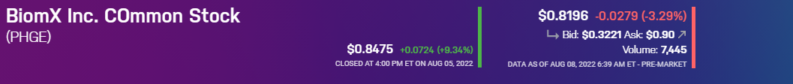

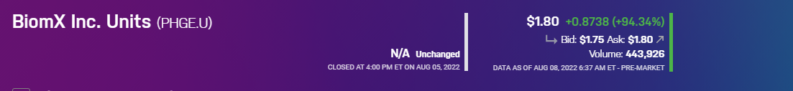

However, there's still this issue of it being the units that are jumping in price, not the stock itself nor the warrants. We can see this from the exchange itself:

And:

And:

Also Read: Five Best Pharmaceutical Stocks To Watch In 2022

As we can see the units are up that around and about 100%. But the warrants are unchanged and the stock is only different by 10% or so. Which is a puzzle that needs to be unwrapped before we can decide upon a trading strategy.

The puzzle is that the warrants should be the most geared of the three issues there. They should move in price more than the other two that is – either way, and for whatever reason. Yet they're not, so, why? Why they should move more is simply that a warrant gives the right to buy stock at a particular price. If, at exercise date, the stock price is below the warrant exercise then it expires, worthless. Clearly, that rapidly changes as the stock price moves up above the exercise price. So, the warrant should move more than the stock price. The units are stock and warrant, so their volatility should be inbetween that of the warrant and the stock. That's simply not what we're seeing here. So, why?

The simplest and most obvious explanation would be that there's no continuous market in the warrants. So, we'll need to wait until the full opening of the New York markets to see what any price move will be. It's also possible that the warrants are highly illiquid and so there's just not been any trading to register the price change.

The point here is not to say that there's any indication of why BiomX is moving – it's that there's a pricing anomaly there. Before trading that though it would be necessary to work out why it is happening. If it's simply that the units are mispriced relative to the common stock, or the warrants, then there's a trade to be done there, an arbitrage. Which way that trade goes would depend upon how the mispricing is working. It's even possible that there won't be one when the markets are fully open – but such mispricings do happen and they can be traded when they do.