In our Internet Age of nearly everything being digitized and searchable online-real-time, the analyst community, especially that portion that follows all things crypto, has learned that there could be unknown correlations that could provide that perfect “Holy Grail” of all indicators and pave the golden path to immediate riches. Searching for these “nuggets”, however, can be time consuming, fruitless, and often called a “fool’s folly” by those that report back from “rabbit hole” investigations. In the Bitcoin world, however, there are aficionados that swear by the perturbations of Google searches.

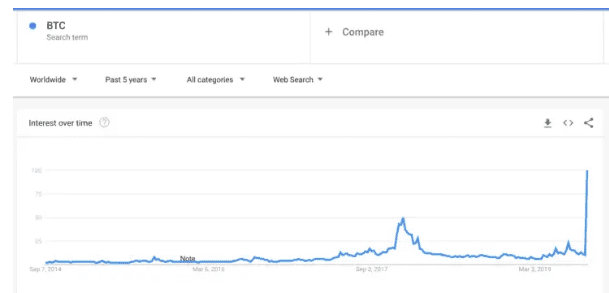

If you search through the normal Bitcoin media channels, then you might have found one or two articles on this topic, as arcane as it is in analyst circles. The chart below, however, did generate quite a bit of interest, provided courtesy of the folks over at Trustnodes.com:

Can you say the work “spike”? Yes, Bitcoin, or should I add “BTC”, search trends have gone through the proverbial roof in a big way, the highest recorded value for both the United States and for worldwide statistics, if that latter figure factors into any demand equation. If you comb through the data, as a few analysts are accustomed in doing, you would find that “BTC” outpaced “Bitcoin”, which incidentally outpaced “Brexit”, as if words or phrase that begin with the letter “B” are somehow significant in today’s public discourse. By the way, these terms drew more than “Boris”, as in the UK’s new PM.

As a matter of fact, Brexit protesters have taken to the streets in London, Liverpool, Manchester, and Belfast, angered over whatever Boris Johnson, the new Prime Minister, is trying to achieve with his pro-Brexit-No-Deal agenda. Dissatisfaction is running high, and the level of Google searches would logically follow that “Boris” and “Brexit” would be key search terms. The advent of “BTC” and “Bitcoin” throws another dynamic into the debate of what is the public thinking and where do their concerns lie.

Several observers had pontificated that these Google searches meant nothing related to Bitcoin’s price, since there had been very little movement over he past few days, but over the last 24 hours, BTC has accelerated, blasting through $10,000 and almost overtaking $10,500 to the amazement of any onlookers, trying to determine the reasons for such an immediate move. Analysts are now claiming that the “safe haven” aspect of Bitcoin, a reputation it has gradually garnered over the past few months, is at play.

There is certainly enough chaos in the form of geopolitical tensions to support this theory. Chinese trade wars have weakened the Yuan, causing capital flight to Bitcoin. The correlations here are quite strong. Then we have Europe, where a no-deal Brexit reigns, Italy is in turmoil, and Turkey remains a mess. Yes, many concerned individuals in these locales look to Gold as a “safe haven”, but a new sub-set of these folks have found that Bitcoin is “digital Gold” and offers as an extra a potential for appreciation.

Simon Peters, a UK analyst for eToro, has spoken on behalf of this notion to reporters at CryptoGlobe: “Gold has long been considered the go-to ‘Safe Haven’ asset in periods of economic or political instability… Bitcoin by comparison shares similar characteristics to Gold in that there will only be a finite amount in existence (18 million now with a future cap of 21 million), it’s decentralized, its price is not affected by inflation, and it has the added benefit over Gold of lower storage costs.”

Whatever the case might be, Google searches for BTC have spiked. BTC is trending at $10,395, as I write, and within one week, Bitcoin has righted its supposedly sinking ship and posted a 12% return. Gold cannot do that. Equities cannot do that, nor can bonds, and institutional investors are not ignorant. Many of these “Big Players” are already in the market, but the “rails” have been built so that many more may follow. The Bakkt exchange is ready to offer a fully regulated, custody secure solution later this month. Suddenly, Bitcoin went from being boring to being something much more exciting.