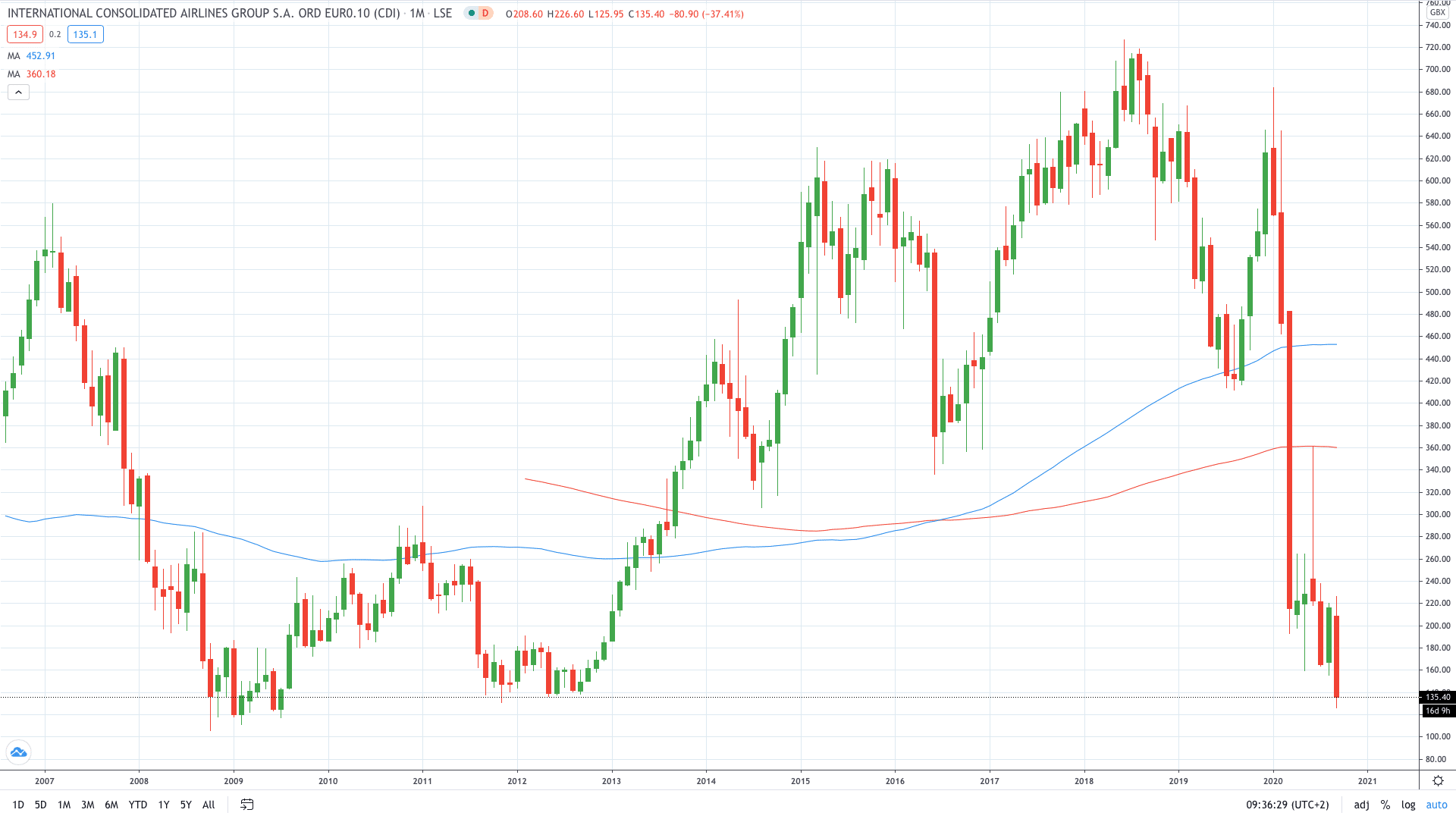

Shares of International Consolidated Airways Group S.A. (LON: IAG) crashed more than 30% on Monday as the owner of British Airways was forced to launch a heavily discounted rights issue to raise €2.74 billion to improve its liquidity.

Investors that will take part in the new rights issue will be able to do so at a price that is 35.9% lower to Thursday’s closing price. Qatar Airways, the biggest shareholder, has agreed to take part with its 25% stake.

Three days ago, British Airways announced it has to slash over 8,200 jobs to cut costs and survive the biggest crisis that the airline industry faced ever. Total job cuts are expected to reach around 13,000 figures.

The airline said that most job cuts are a result of voluntary redundancies. It expects that costs related to restructuring charges will be amount to €330 million in 2020.

The carrier has seen mixed levels of demand since the lockdown measures were lifted in May. In June, the airline witnessed an uptick in demand, similar as in August. However, holiday bookings took another hit after the British government added popular travel destination to the quarantine list.

“Where travel markets have reopened without border restrictions and quarantine requirements, IAG has been encouraged by the level of pent-up demand that exists for air travel,” new chief executive Luis Gallego said.

IAG share price plunged over 30% to hit 125.95p, which is the lowest that stock traded since 2009.

PEOPLE WHO READ THIS ALSO VIEWED:

- ASTON MARTIN SHARE PRICE UP 15% IN TWO DAYS. HERE’S WHY

- Learn more on how to open a demo account

- Master trading with Bollinger Bands