Shares of BT Group PLC (LON: BT.A) soared over 8% today after the British media and telecom firm increased the lower end of its EBITDA outlook range for the full-year

BT Group said its revenue fell 8% to £10.6 billion for six months ending September 30 amid the pandemic and lower revenue from BT Sport unit.

EBITDA dropped 5% to £3.2 billion while CAPEX jumped 5% to £1.9 billion on new investment in the fixed and mobile network. Lower EBITDA also dragged reported profit before tax to £1.06 billion, which is 20% lower compared to a year ago.

The company identified £352 million in gross annualised savings at a cost of £163 million.

“Customer demand during the pandemic has shown how critical our networks have become, and our significant network investments have helped us double the number of Openreach’s FTTP orders compared to this time last year and have seen our leading 5G network expand to 112 towns and cities across the UK,” said Philip Jansen, Chief Executive.

Following today’s result, BT increased the lower end of the adjusted EBITDA outlook range for £7.3 billion with the top-end staying at £7.5 billion. Moreover, the firm now expects EBITDA outlook of at least £7.9 billion in 2022/23.

“The growth in EBITDA underpins the planned reinstatement of our dividend next year whilst ensuring that we can continue to drive value-creating investments in our networks and products,” Jansen added.

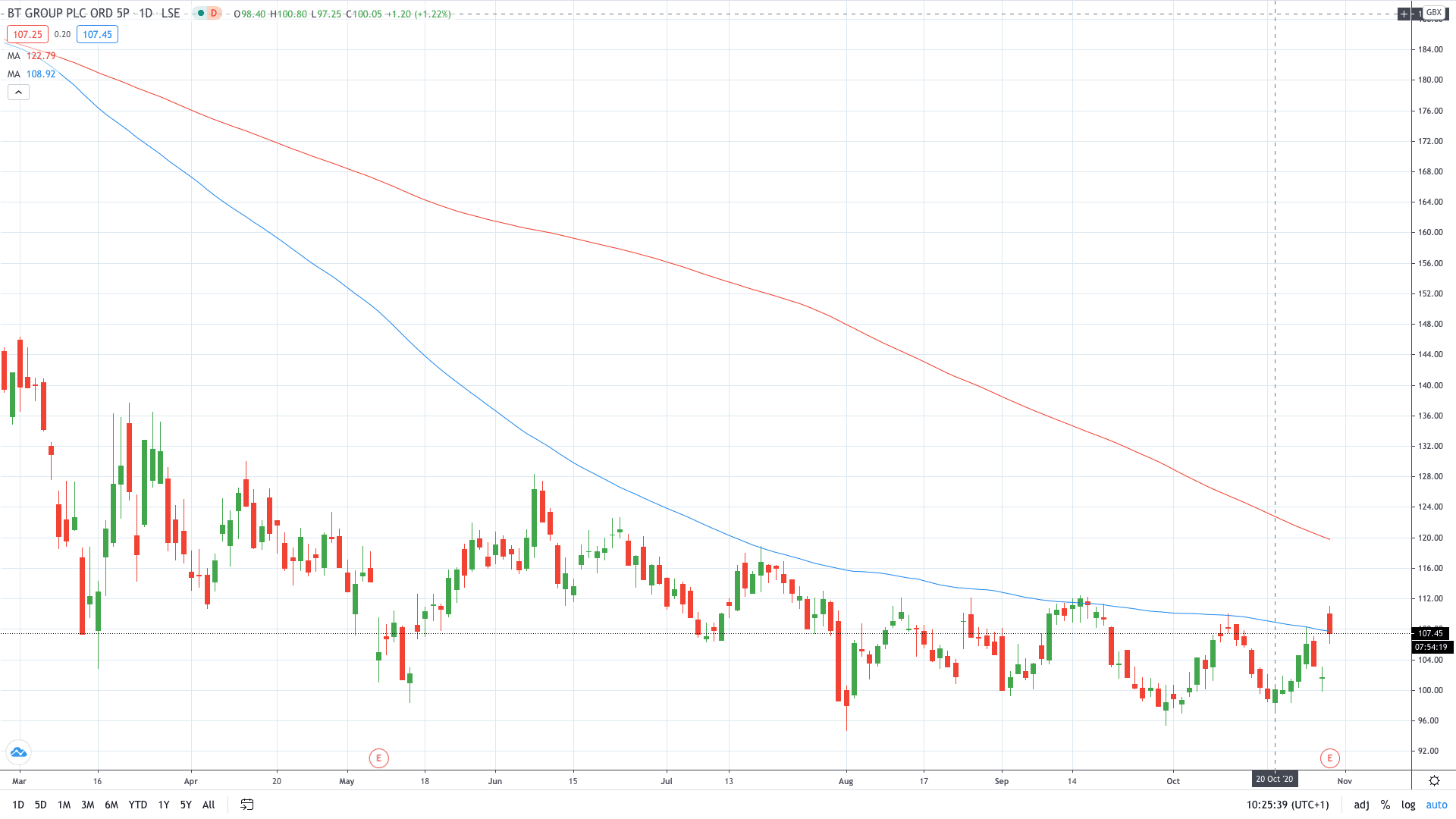

BT Group share price rose over 8% to print a new 6-week high above the 110p mark.

PEOPLE WHO READ THIS ALSO VIEWED:

- Here’s Why Just Eat Takeaway Share Price Just Soared to Fresh Record Highs

- Experience stock trading with a reliable demo account

- Implement Divergence Trading strategy in your daily trading plan