Shares of BT Group PLC (LON: BT.A) slipped 1.5% on rumours that the group is contemplating selling a multibillion-pound stake in Openreach, its infrastructure arm.

BT has moved to deny rumours. The group’s Chairman, Jan du Plessis, said that the group “remains an important part of the BT group”.

According to media reports, BT has held talks with multiple investment funds about selling its stake in Openreach.

The firm is in an interesting situation as its stake in Openreach is bigger than the value of the firm itself. Openreach, which maintains the telephone cables, ducts, cabinets and exchanges, is estimated to be worth around £20 billion.

This is almost double BT’s market value, currently standing at £11.3 billion.

Openreach also denied such rumours as CEO Clive Selley noting that the mobile infrastructure giant is “staying in the BT group”.

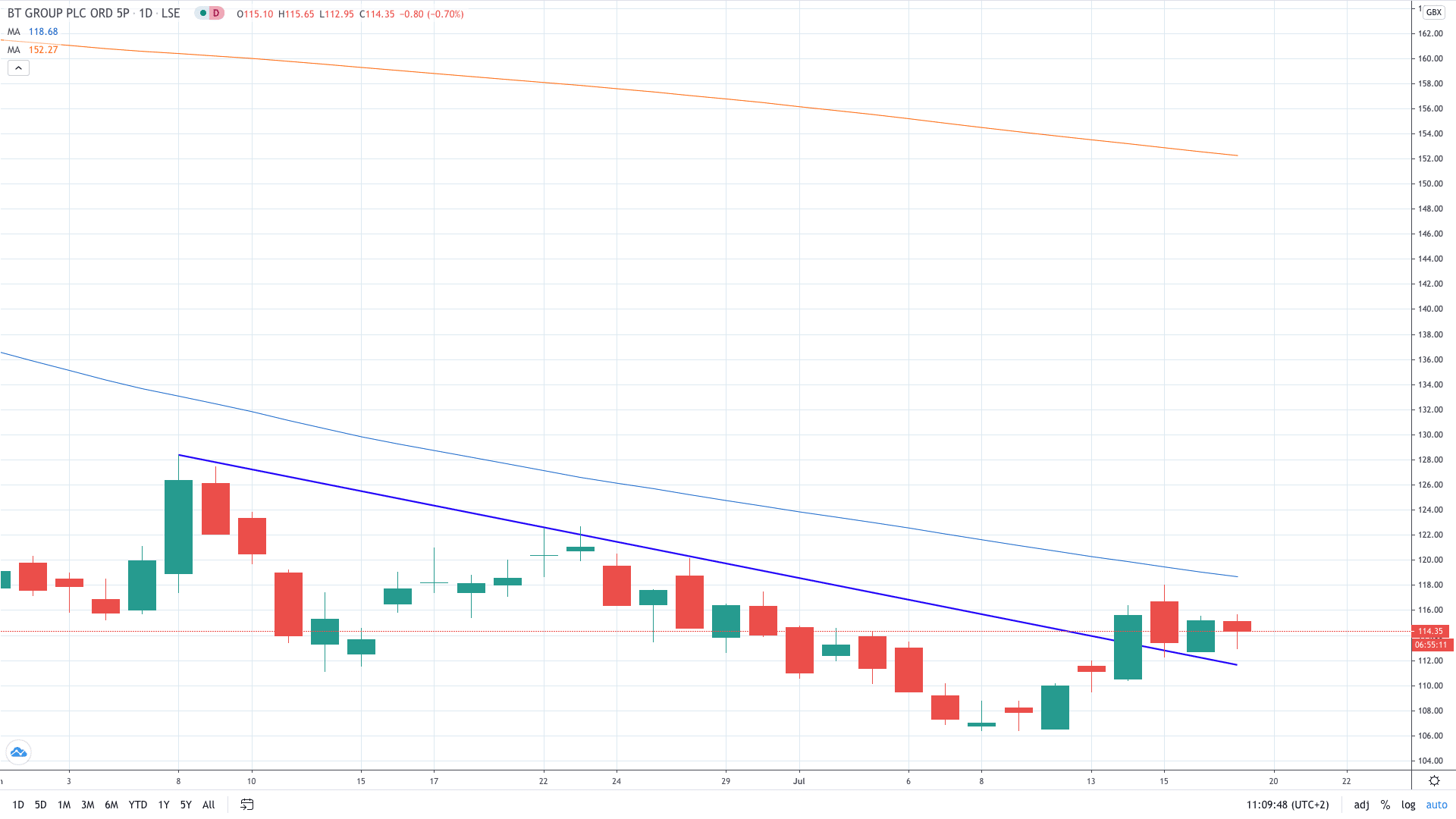

BT share price has moved more than 1% lower today after the firm denied Openreach rumours. Still, shares of BT are 3.5% up on the week as the buyers continue to work on the first bullish close in four weeks.

- Test BT stock trading with a reliable demo account

- Start learning more about strategies for online stock trading