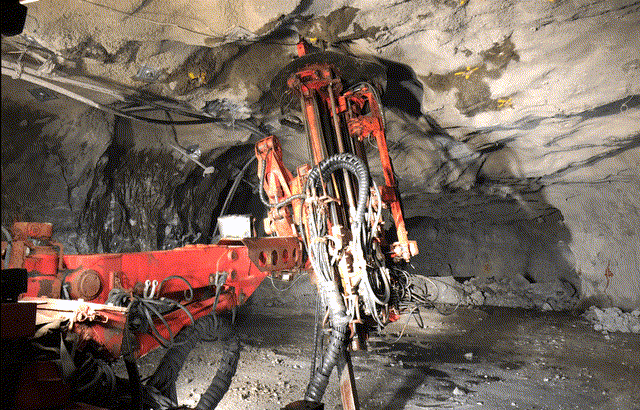

The Centamin PLC (LON: CEY) share price edged 3.39% after the company released its financial results for the twelve months ended 31 December 2023. At the Sukari Gold Mine, a commendable milestone was achieved with 9.5 million hours of labour without any lost time injuries (LTIs), showcasing an exceptional commitment to workplace safety.

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk.

The Group's lost time injury frequency rate (LTIFR) significantly reduced to 0.08, marking an 83% decrease compared to the three-year average. Furthermore, the total recordable injury frequency rate (TRIFR) improved by 24%, at 2.83, against the trailing three-year average.

Environmental sustainability efforts led to a 7% reduction in Scope 1 and 2 Greenhouse Gas Emissions (GHG) since the 2021 base year, primarily due to a substantial cutback in diesel usage by 21.5 million litres, attributable to the first full year of harnessing solar power.

Gold production for the year reached 450,058 ounces, recording a 2% increase from 2022 and aligning perfectly with the guidance set for 2023. The all-in-sustaining costs (AISC) for gold sold were reported at US$1,205 per ounce, surpassing expectations with a 14% improvement over the previous year.

Financially, adjusted EBITDA surged by 25% to US$398 million, reflecting a profit margin increase from 40% in 2022 to 45%. Annual capital expenditures were notably efficient, totalling US$204 million, which was significantly lower than the anticipated US$272 million due to cost efficiencies, reduced expense capitalisation, and adjustments in equipment overhaul timelines.

Sukari's financial contribution was robust, with US$121 million comprising US$45 million in cost recoveries and US$112 million in profit shares, after accounting for US$36 million in capital expenditures financed through corporate funds. The government's share of profits and royalties amounted to US$139 million.

The Group's free cash flow stood at US$49 million, demonstrating a positive shift from US$18 million in 2022. The balance sheet remained strong, with cash and liquid assets totalling US$153 million as of December 31, 2023, and overall liquidity reaching US$303 million, including an undrawn US$150 million from a sustainability-linked revolving credit facility.

A final dividend of 2.0 US cents per share, totalling US$23 million, has been proposed, pending approval at the annual general meeting scheduled for May 21, 2024. This brings the total dividend for the year 2023 to 4.0 US cents per share, or US$46 million, reflecting the company's robust financial health and commitment to shareholder returns.

Centamin share price.

The Centamin share price edged up 3.39% to trade at 109.850p from Wednesday’s closing price of 106.250p.

Searching for the Perfect Broker?

Discover our top-recommended brokers for trading stocks, forex, cryptos, and beyond. Dive in and test their capabilities with complimentary demo accounts today!

- BlackBull 26,000+ Shares, Options, ETFs, Bonds, and other underlying assets – Read our Review

- Admiral Markets More than 4500 stocks & over 200 ETFs available to invest in – Read our Review

- Hargreaves Lansdown The company's website is easily understandable and accessible to a wide range of customers – Read our Review

YOUR CAPITAL IS AT RISK. 76% OF RETAIL CFD ACCOUNTS LOSE MONEY

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk.