Shares of hydrogen energy company Ceres Power Holdings plc (LON: CWR) have formed an ascending triangle pattern after bottoming in March following the selloff that begun in January as sustainable energy stocks lost momentum.

Many analysts have pointed out that the selloff in Ceres Power stock could also be driven by the realisation that the company is not growing as fast as expected. It has to make significant investments to advance its current hydrogen energy technology.

However, analysts at Berenberg hold a different opinion. They recently upgraded the company’s price target to 1,560p, saying that initial estimates that Ceres shall achieve revenues of £400 million by 2035 have missed the mark.

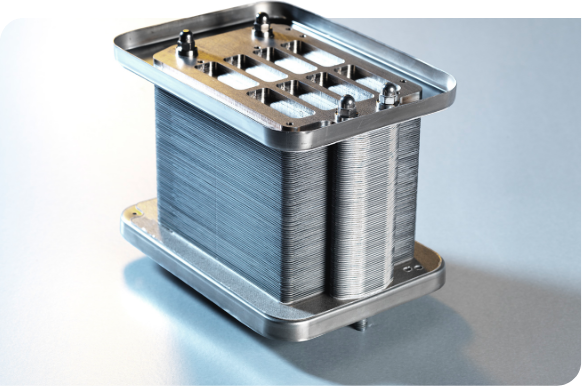

Berenberg analysts said that they believe Ceres Power could generate £750 -1,200 million by 2035 from its solid oxide fuel cells business without factoring in the £150-20mln that its electrolysis division could generate.

A significant concern for the firm is that Proton-exchange membrane fuel cells (PEMFC), also known as polymer electrolyte membrane (PEM) fuel cells, are regarded as a better alternative to solid oxide fuel cells.

PEM cells operate at much lower temperatures, making them ideal for transportation purposes. Investors are worried that the company might lag its competitors if it does not start making PEM fuel cells, given the massive demand for them as a power source for the transportation sector.

Regardless of whether the company shifts to designing PEM fuel cells or not, its current business model is still quite profitable, as evidenced by the estimates issued by the Berenberg analysts.

Ceres Power shares have formed an ascending triangle over the past few weeks, a bullish pattern putting the odds of a bullish breakout much higher than those of a bearish breakout.

However, triangle patterns are usually volatile, and traders should wait for the actual breakout before opening new positions to confirm the next move’s direction.*

*This is not investment advice.

Ceres Power share price.

Ceres Power shares have formed an ascending triangle pattern after bottoming in March. What’s next for the company?

Should you invest in Ceres Power shares?

Ceres Power shares are traded on the London stock exchange's AIM market (the alternative investment market), which is the submarket specifically for smaller companies. AIM stocks are attractive to investors as they have tax advantages and smaller companies have the potential to benefit from rapid growth. But are Ceres Power shares the best buy? Our stock market analysts regularly review the market and share their picks for high growth companies