- The market sell-off that formed the immediate reaction to the coronavirus outbreak is trimming back year-to-date gains in a range of assets.

- A lot of uncertainty remains, but historical precedent suggests that the next five to 10 days could be when there appear some signs of how the outbreak may pan out.

- The situation is finely poised. A sell-off based on more detailed and considered analysis could gain momentum.

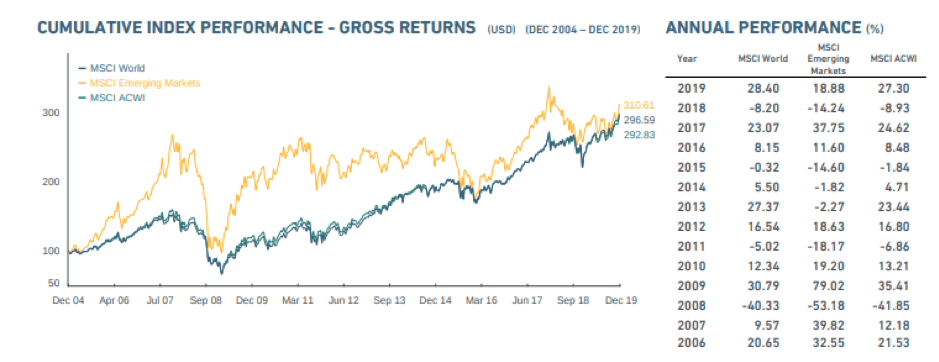

Trade disputes, Brexit and tensions in the Middle East may have been important influences on the markets in 2019, but the real driver was the loosening of global monetary policy. The decision by central banks to pump out ever-cheaper money meant that assets rocketed in price. Even asset classes that are not typically correlated, such as higher-risk equities and defensive gold, rallied simultaneously as cheap money flushed through the financial system looking for a home, any home. Those holding gold through the year saw a return of over 23% on their position, and the MSCI World Index was up 28.4% on the year, the greatest percentage return since 2009.

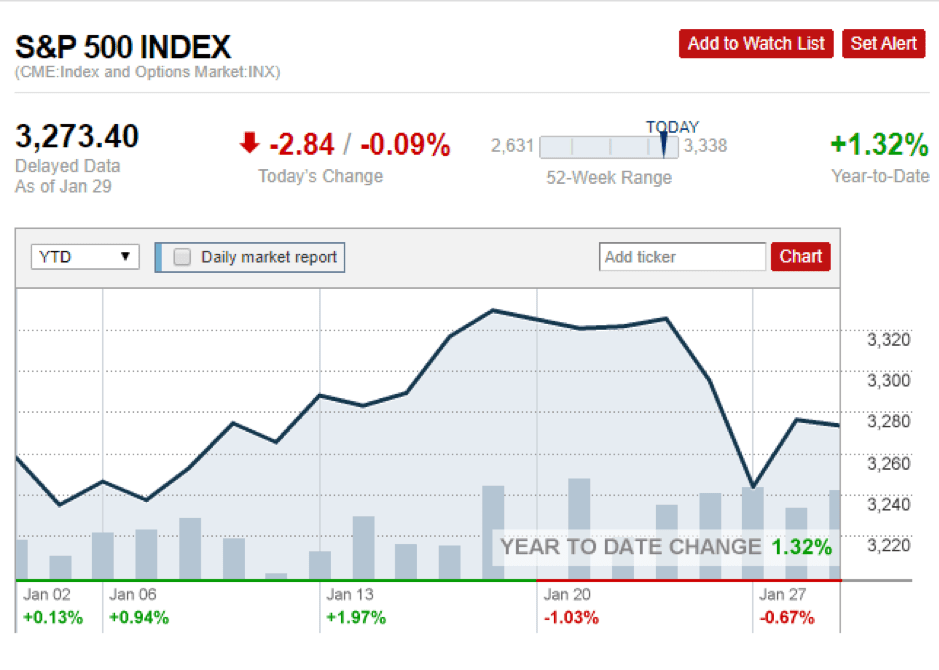

2020 was predicted by many to offer more of the same. Instead, with the first month of the year coming to a close, the S&P 500, which was up over 3% YTD on 17th January, is giving up its gains. The index, which was only up 1.32% YTD on Wednesday’s close, could well show further weakness if it follows European markets lower during Thursday’s session. The German DAX Index gave up as much as 1% intraday.

The cause of the correction is the coronavirus and particularly the uncertainty over how bad the situation might get. In a worst-case scenario, the viral outbreak would do what geopolitical factors failed to do in 2019 – and that is override ‘cheap money’ as the base determinant of asset prices. The oil markets have seen a particularly significant sell-off. The more dramatic price moves occur, however, when prices fall, then stabilise at a particular support level, and then fall again. While markets have a long-term upward bias, strong short-term momentum to the downside can clear out stop-losses and cause a major sell-off. Systematic hedge fund BlueCrest made a 41% return on £5bn of assets in 2009 when the algorithms of its trading models, such as BlueTrend, resisted the temptation to buy the dips but instead scaled up on its short positions. After a long period of upward-trending markets, the risk of the markets experiencing a significant downturn is one that needs to be considered.

Crude Oil (NYMEX:CL1!) – Five-day price chart

Communication breakdown – market meltdown?

Historical price data marks 24th January as a trigger date for a sell-off. This date was when the markets finally got a clearer understanding of what had until that point been clouded by standard Chinese state policy of suppressing bad news. Referring to previous such epidemics, it’s possible that the total scope of the outbreak might not be known for another 20 to 30 days. Information should become more freely available as the disease spreads across the globe. Thursday’s confirmation of infection in India, for example, will be keenly monitored. It will still take weeks to form a better understanding of the effectiveness of public health measures in containing its spread. Medical treatments such as vaccinations against the disease are months away from being approved, so time will tell how willing nations are to impose lockdowns on their citizens and how effective the measures are.

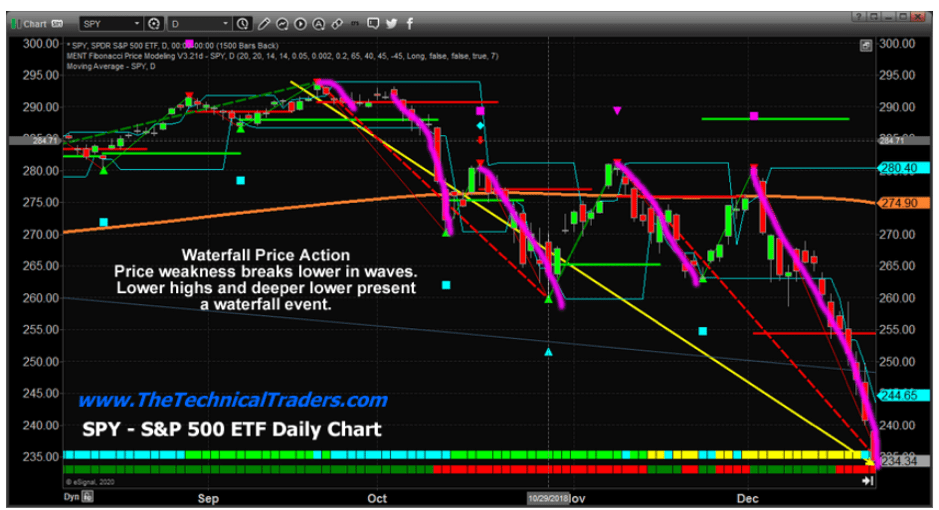

Market reaction to the situation may well come sooner than the 20 to 30-day figure. Profits are to be found from extrapolating out incomplete information and taking early positions. Industry site Technical Traders thinks that the likelihood of a further price breakdown might be known within days, not weeks. Chris Vermeulen published a research note on Wednesday in which he said:

“We believe any further downside risk to the global markets will be known within another 5 to 10+ trading days – as more information related to the spread and containment capabilities of the virus are known.”

Source: Technical Traders

Technical Traders has picked out the possibility of prices forming a Waterfall Pattern. Despite the connotations of its name, the Waterfall Pattern can be applied to markets moving upwards as well as downwards. The coronavirus outbreak may have taken that optionality out of the hands of analysts for the moment, but the theory, based on Elliott Wave methodology, might help those analysing the situation predict entry and exit points.

The statistics relating to the spread of the disease there show that as of Thursday, China’s National Health Commission had confirmed an additional 38 deaths and 1,737 new cases. Official figures show a total of 170 deaths and 7,711 cases. An identical number of people (170) were reported to have contracted the disease but have since been cured and discharged. This supports the statements made earlier in the week that the virus is more contagious but less likely to cause fatalities than the SARS strain of 2003.

Trigger points of future moves may well come from sources outside of China. Multinational corporations are scaling back their business activities. To what extent is still unclear, but the statement from Amazon implies that there could be a considerable slowdown in business activity:

“Out of an abundance of caution, we are restricting business travel to and from China.”

Source: CNBC

At the same time, Starbucks and McDonald’s are mothballing a large percentage of their China stores.

Jerome Powell, chair of the US Federal Reserve, has said:

“It’s a very serious issue … it’s too early to speculate on how it might impact the global economy. There is likely to be some disruption to activity in China and possibly globally based on the spread of the virus to date and the travel restrictions and business closures that have already been imposed.”

Source: CNBC

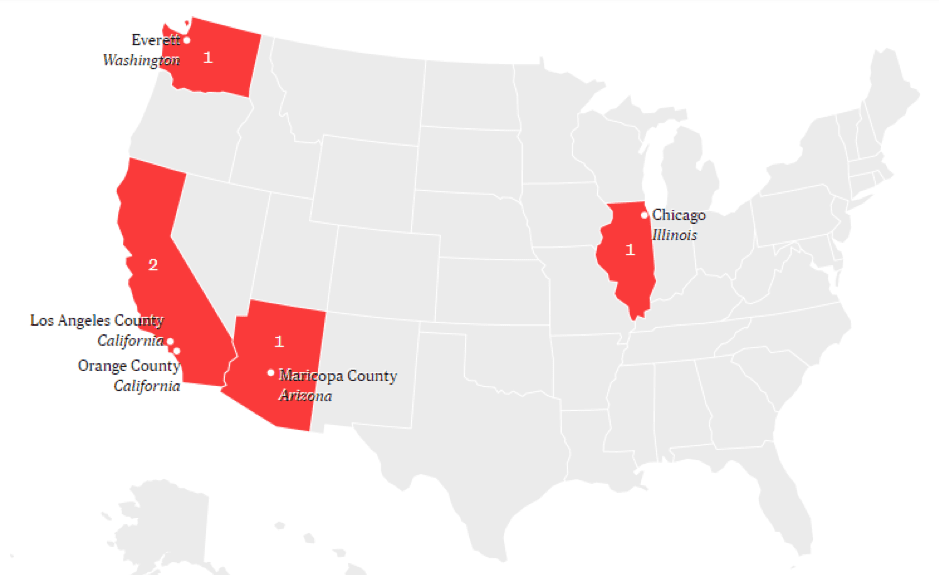

Traders will have to factor in extensive research. For example, Thursday saw France confirm its fifth case of infection and Russia has closed its 2,600-mile-long border with China. Unsurprisingly, it will be the case that most eyes will be on the US, the world’s most important economy. As of Wednesday, there had been five cases of the disease, which are spread across the country.

Confirmed cases of coronavirus in US

Those looking to take an early position on the consequences to the financial markets will be studying this chart closely.