D-Wave Quantum Inc. (NYSE: QBTS) is experiencing a period of intense investor interest and significant stock price fluctuations, driven by a range of factors, including bold claims of quantum supremacy, impressive booking growth, and a bullish analyst outlook.

The Burnaby, British Columbia-based company, a pioneer in annealing quantum computing, has seen its stock soar over 215% in the past 12 months, and an impressive 18.73% in just the last 24 hours in closing at $6.91. This morning's pre-market action is following a similar trend, with a gain of 7.24% bringing D-Wave's stock price to $7.42.

The most recent catalyst for this surge is D-Wave's assertion of achieving “quantum supremacy” – a milestone where a quantum computer demonstrably outperforms classical computers on a real-world problem. Published in the prestigious journal Science, the company's research claims to have solved complex materials simulation problems using its quantum annealing technology, something CEO Dr. Alan Baratz hailed as “a first for the industry.” While this claim is subject to ongoing debate within the scientific community, with some researchers suggesting classical algorithms might still offer competitive performance in specific scenarios, the announcement has undeniably fueled investor enthusiasm.

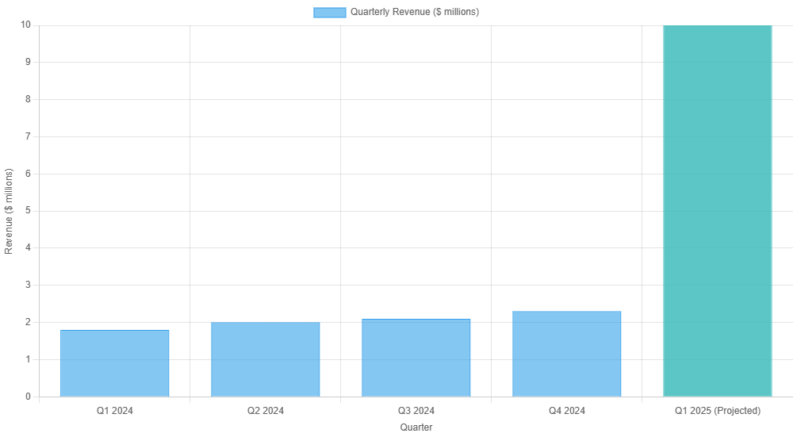

This enthusiasm is further bolstered by D-Wave's projected Q1 2025 revenue, which the company anticipates will exceed $10 million, representing a significant leap from Q4 2024's $2.3 million. This positive revenue trajectory aligns with a reported 502% year-over-year increase in Q4 bookings and a 128% increase for FY 2024, indicating growing customer adoption of D-Wave's Quantum Computing as a Service (QCaaS) platform.

Reinforcing this positive sentiment, Roth MKM analyst Sujeeva De Silva recently raised the price target for QBTS stock to $10 from $7, maintaining a Buy rating.

Dr. Baratz has been a vocal advocate for D-Wave's approach, directly challenging comments from Nvidia's CEO, Jensen Huang, who suggested quantum computing was still decades away. Baratz countered, asserting that D-Wave's annealing quantum computers are “solving real-world problems” *today*. This public disagreement highlights the competitive and rapidly evolving landscape of the quantum computing industry. While D-Wave may have the edge when it comes to its Quantum-as-a-Service, it remains to be seen how diversification into hardware will fare for the company.

D-Wave (QBTS) presents an interesting but highly volatile opportunity off the back of recent events. The company's technological advancements, strong booking growth, and bullish analyst sentiment are undeniably positive. However, the significant volatility, relatively weak current financials, and the inherent uncertainties of the nascent quantum computing market necessitate a cautious approach.

There will likely be more volatility to come, and the investment thesis hinges on the long-term realization of quantum computing's transformative potential.

Searching for the Perfect Broker?

Discover our top-recommended brokers for trading or investing in financial markets. Dive in and test their capabilities with complimentary demo accounts today!

- eToro Wide range of instruments available to trade – Read our Review

- Vantage High levels of account and deposit protection – Read our Review

- BlackBull 26,000+ Shares, Options, ETFs, Bonds, and other underlying assets – Read our Review

YOUR CAPITAL IS AT RISK. 76% OF RETAIL CFD ACCOUNTS LOSE MONEY