Shares of Dunelm Group PLC (LON: DNLM) tumbled more than 3% on Thursday after the homewares retailer posted a 13.3% fall in profits for a full-year ending June 27.

The pandemic hit Dunelm’s business hard as the retailer notes a plunge in demand after stores were closed amid the pandemic. A full-year profit came in at £109.1 million, while revenue is reported at £1.06 billion, down 3.9% from the previous year.

For instance, Dunelm saw its revenue surge 6.8% until February when the outbreak moved from China to Western Europe. A hit from stores closure was partially offset by the growth of 50.5% in online sales.

Moreover, the retailer saw a strong uptick in trading activity in July and August.

“Our customers have adapted quickly to shopping safely in our mainly out-of-town superstores and we continue to see strong growth in our home delivery offer,” said Chief executive officer Nick Wilkinson.

“Whilst the year to date performance has been materially ahead of our initial expectations, it is very difficult to provide any meaningful guidance on the future outlook given the uncertainty in the wider economy and the potential impact of further regional or national lockdowns”.

Dunelm did not declare a final dividend for the year ending June 27, although it seeks to declare an interim dividend in February next year.

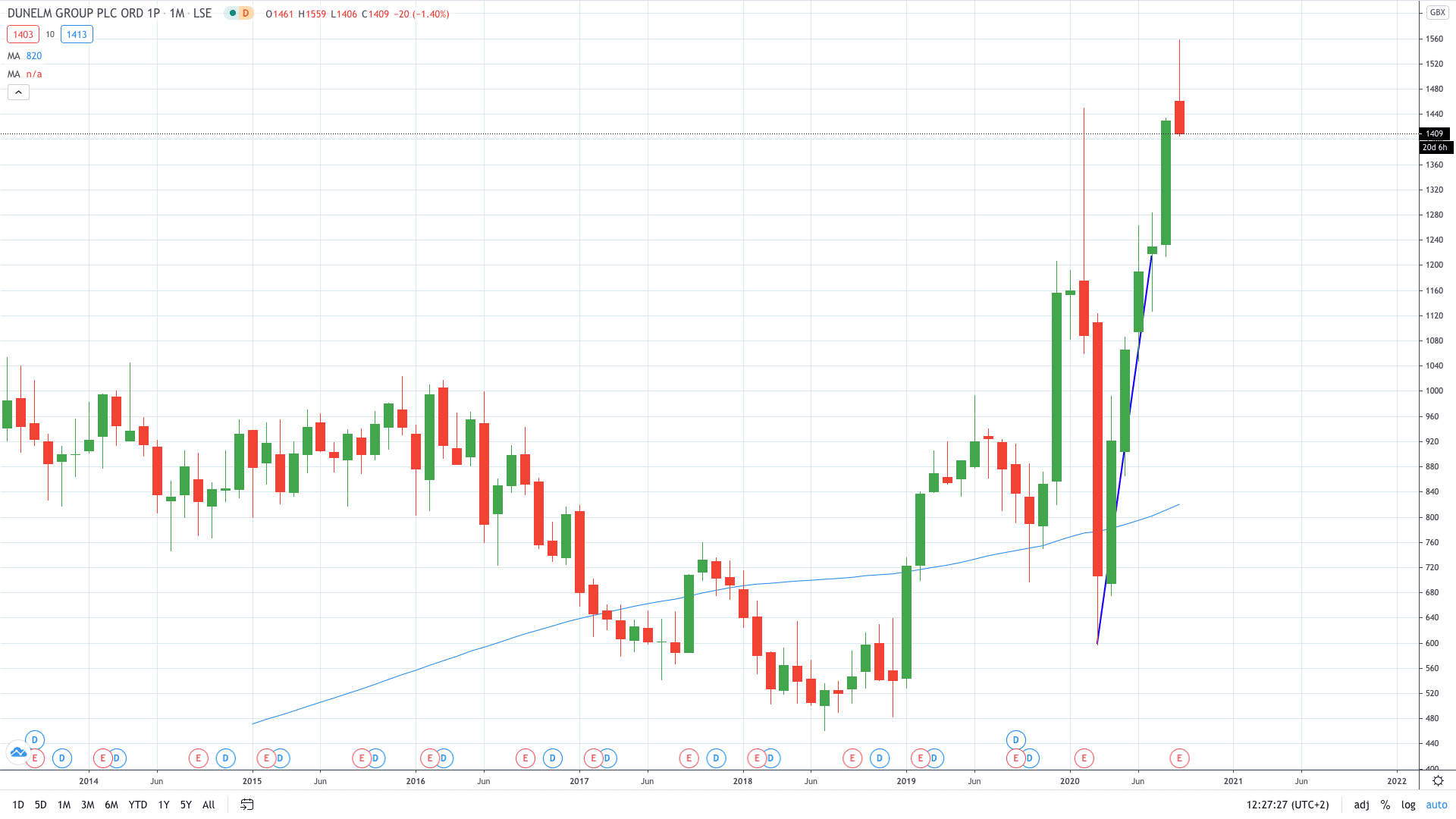

Dunelm share price fell over 3% to trade at 1410p. Last week, the share price hit a record high at 1559p.

- PEOPLE WHO READ THIS ALSO VIEWED: ASTON MARTIN SHARE PRICE UP 15% IN TWO DAYS. HERE’S WHY

- Learn more on how to open a demo account

- Master trading with Bollinger Bands