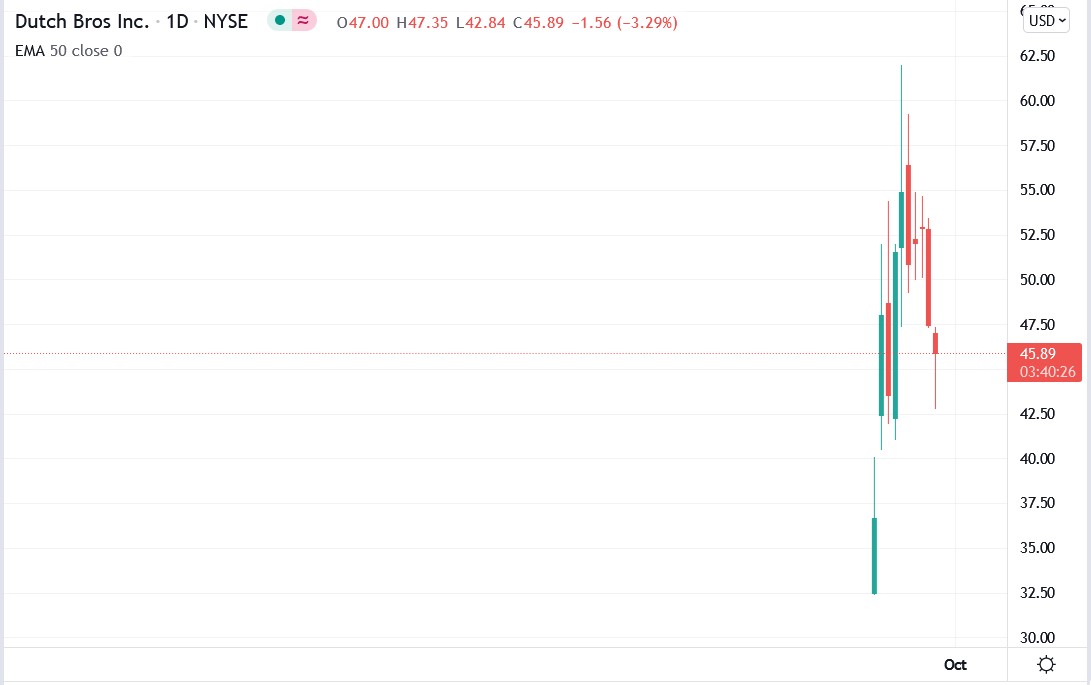

Shares of Dutch Bros Inc (NYSE: BROS) have fallen over the past five days giving investors who missed out during the IPO and the few days after a chance to get in at a lower price.

However, you might be wondering whether to wait a little longer before making your view in hopes that the stock will fall much further?

There is no simple answer to this question, but you can use a few methods to determine the best entry position to get in.

One of the factors we could look at is just how much of the gains made in the previous rally has been eroded.

Typically, the selloff that follows a parabolic rally usually retraced two-thirds of the previous rally. The Dutch Bros stock case almost retraced two-thirds of the rally, which started at $36 given the stock traded at $42 today, just six dollars off its IPO day closing price.

Based on the above criteria, now might be a good time for investors who want to get in now to do the same.

Another measure we use is to wait for the lockup period to end, at which point investors who did not cash out during the IPO sell their shares and pocket some profits.

However, the lockup period usually lasts a couple of months, with the most common length being six months. Investors who have a longer investing timeframe may choose to wait a few months till the lockup period expires.

Other points at which we could see further declines include when the company reports its earnings results with negative figures leading to selloffs that could present excellent entry opportunities.

*This is not investment advice. Always do your due diligence before making investment decisions.

Dutch Bros stock price.

Dutch Bros stock price has fallen 25.95% from its September 21 high of $61.98 to its current $45.89.