Key points:

- East Imperial has signed up a China distribution deal

- It's possibly an excellent market for EISB

- But just how excellent will it be over time?

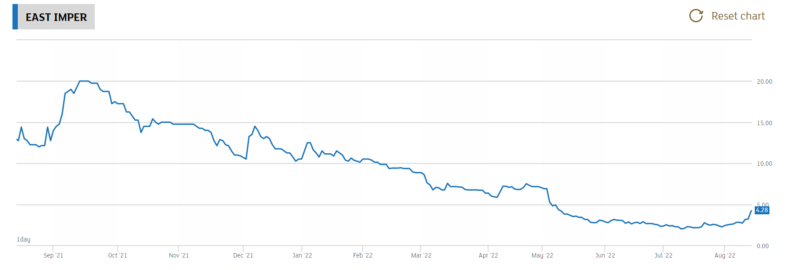

East Imperial (LON: EISB) is up 30% this morning on news that they've reached an agreement for China distribution. Given the name of the company we might think this is fairly important and so it is – and thus the EISB share price jump. The issue really being that China is – OK, probably is – the great current growth market for East Imperial‘s line of products. Therefore gaining a decent distribution agreement into that market exposes EISB to it's one grand expansion opportunity.

East Imperial is in the business of luxury – it prefers the phrase “ultra-premium” – mixers. As the experience of Fevertree shows us this is an expanding market. For which there are several reasons. The first is simply the manner in which mass manufactured products tend to down grade over time – manufacturers use lesser ingredients on cost grounds etc. Further, mass brands are always at risk of those very claims of “premium” and “ultra-premium”. There's often room at the top that is when we talk of branded items.

The second is the general decline in alcoholic consumption around the world. That can indeed lead to a move upmarket – drink less but better – and there's the example of Diageo to see there. Finally there's something specific to China and important about this specific deal.

Also Read: Five Best Recession Proof Stocks

The two China specific issues are that the place is getting richer, faster, than anywhere else has ever done. It's also hugely unequal by the standards of any other country. That does lead to a taste for premium – or ultra-premium – brands. Supplying that taste could indeed be most profitable. But there's more than that, Chinese society places more emphasis on brands and that outward appearance than many other places. Cheap and cheerful is not, really, a hallmark of the society. Which again makes a distribution agreement of top end products into the country worthwhile.

The specific agreement is also with “Wen Hua Hang Wine Spirits Company (WHI), one of the largest distributors in China.” which means that East Imperial gains maximal exposure with the just the one deal. WHI has worked with Pernod Ricard in the Chinese market, giving us a signal of their quality.

So it looks like a good deal. But of course it is only the signing of a distribution agreement. This doesn't mean that the products will actually sell in China, it's only an indication that the distributor thinks they will. At which point we have to think about the East Imperial share price rise today. Is 30% merely on the signing of an agreement enough, not enough or too much? It's obvious that if the products become widely bought in China then it's not enough – but what is the probability of that? That's what has to determine trading positions from here. Not the news that EISB has distribution in China for that's now already in the share price. It's how successful is that distribution for East Imperial in China going to be?